Gerresheimer AG – A Conflicted Acquisition, Flailing Divestiture & Accounting Games Coming To Roost As Key Weight-Loss Driver At Risk

Introduction

- Gerresheimer AG (GXI.DE) is an €857 million ($996 million) Germany-based, international packaging company focused on the pharmaceutical and cosmetics industries that was founded in 1864.

- After peaking in September 2023, Gerresheimer’s shares have plummeted ~80% due to unsustainable debt levels, downward financial guidance, the failed sale of the company, the announcement of a formal investigation into accounting matters by the German regulator BaFin, and delays in finalizing a plan to divest the molded glass division into 2026.

- Trading at a significant discount to peers, Gerresheimer has attracted several activist investors betting on a potential turnaround driven by a successful sale of the molded glass business and growth in sales through exposure to blockbuster weight loss drugs, called “GLP-1s.”

- Our 2-month investigation, involving interviews with 28 former employees, customers, and competitors, uncovered serious risks to growth with Gerresheimer’s flagship CagriSema contract, conflicts and undisclosed business issues relating to the Bormioli acquisition, a flailing attempt to divest molded glass, a series of aggressive accounting tactics propping up the company’s already-deteriorating financial performance and impairments likely in its struggling Advanced Technology division.

Risks To Gerresheimer’s Key Growth Driver: CagriSema

- Market analysts believe that Gerresheimer’s contract to supply a specialty dual-chamber syringe for Novo Nordisk’s weight loss drug CagriSema, once hailed as a “more potent successor” to blockbuster drug Wegovy, could drive a "sizable part" of its weight loss (GLP-1) sales and up to €250 million in 2027 revenue.

- The challenge in mixing the two active molecules of CagriSema initially required the use of a dual-chamber syringe, rather than the standard single-chamber syringe used for many injectable drugs.

- In December 2024, Novo reported disappointing trial data for the drug. In February 2025, Novo Nordisk delayed filing for CagriSema regulatory approval due to “supply chain readiness.”

- We interviewed current and former Novo Nordisk employees who explained that there are quality issues related to “the fitment of the primary packaging,” specifically the dual-chamber syringe related to Gerresheimer, that could result in further delays due to Novo possibly running a “very late stage design change project” that could “delay approvals.”

- In addition to packaging challenges, one of the experts said that Novo Nordisk has “very serious hurdles” relating to the dual-chamber syringe, including: “One, the internal manufacturing capacity is delayed and two their output is not going to be comparable to the output of a single-chamber line.”

- With dual-chamber CagriSema already behind schedule and at risk of further delays, a new wave of next generation GLP-1s, including single-chamber applications of CagriSema, are rapidly being developed that utilize commoditized, single-chamber syringes that can be sourced from many different vendors, of which Gerresheimer is just one.

- For example, in December 2024, Novo launched a new trial for a single-chamber formulation of CagriSema. It has also publicly reported results for a new GLP-1 called Amycretin, which has demonstrated excellent results and no “weight loss plateau,” while only requiring a single-chamber syringe.

- As one Novo Nordisk employee told us: “If you secure the single-chamber device and you’re confident that it can supply within the shelf-life requirements with the single chamber, there is no reason to stay with the dual chamber. That would be a very simple word – stupidity – to keep supply from the single chamber."

- Another Novo Nordisk employee explained: “For 3rd generation GLP-1s, we are back to using our standard titratable pens … that we procure from 3 vendors, Gerresheimer being one of them.” Meanwhile, a former Gerresheimer executive confirmed that the company would have no exclusivity with single-chamber syringes.

- Even if Novo opts for the dual-chamber syringe, Gerresheimer’s lack of intellectual property (“IP”) means that Novo can source it from other suppliers or even manufacture it in-house in the future, per a Novo employee who said: "The contract that we have with [Ypsomed] allows us to in-source their device … Gerresheimer does not have the IP on the, on the syringe, right? Meaning that we can actually produce the same syringe in-house.”

- Gerresheimer’s former CEO said that he did not see oral GLP-1s (pills) “disrupting or cannibalizing” the demand for injectables. Multiple Novo employees, however, said they see orals taking 40% - 60% market share over the next 3-5 years.

- Eli Lilly has already manufactured “billions” of pills in anticipation of approval, per Bloomberg. Meanwhile, Novo has manufactured “more than enough [Wegovy] pills” for an aggressive launch expected before the end of the year as it goes “all in” on pills, per Reuters.

- In short, the dual-chamber syringe for CagriSema has duration risk and is likely to be superseded by oral pills and single-chamber products, both lower margin and with competition risk for Gerresheimer.

The Conflicted Bormioli Acquisition & A Flailing Attempt To Divest The Molded Glass Business

- In December 2024, Gerresheimer acquired Italian packaging company Bormioli Pharma for ~€800 million, representing a 10x multiple of Bormioli’s 2024 Adjusted EBITDA, according to Gerresheimer. A former Bormioli employee told us the price represented the “highest multiple applied in the pharmaceutical packaging industry” in recent times.

- The deal was financed through a credit facility that has resulted in Gerresheimer’s net debt to adjusted EBITDA leverage ratio climbing to 4.15x, just below its previous 4.25x debt covenant.

- A former Bormioli employee told us that it was a “good deal” for Bormioli shareholders, namely, Bormioli’s former private equity owner Triton Partners. An industry consultant close to the deal told us Gerresheimer paid a “rich price” and that Triton was “very happy.”

- Gerresheimer justified the price by pointing to Bormioli’s “profitable growth track record, attractive margins, and cash generation,” and by claiming “substantial synergies” between the two companies.

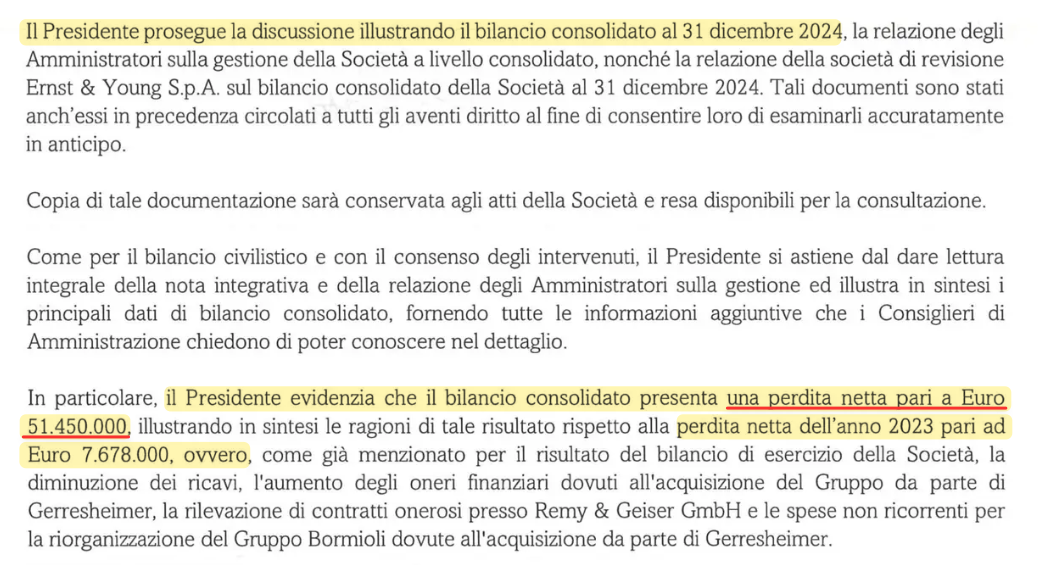

- Despite Gerresheimer’s claims, Bormioli generated a net loss of ~€8 million in 2023, accelerating to ~€51.4 million in 2024, according to the minutes of its shareholder meeting. Revenue was flat at best and potentially on the decline based on 1H 2025 sales of €166.952 million, which would require a 22% increase in the second half of the year just to maintain 2024 estimated sales.

- A former Gerresheimer executive described the acquisition as a diligence failure, saying that Bormioli was “window dressed,” specifically mentioning aggressive sales to distributors. “I mean, I wouldn't call it a big window dress. It was like massively window dress … the due diligence exercise that was done at that time, in my view, was not done properly from, from our end … they have a lot of distributors. They kind of push them, all the material to their throat.”

- Two former Bormioli employees described channel-stuffing at Bormioli, specifically through its relationship with a distributor called Punto Pack, with one estimating an extra €10 - 15 million in end of year revenue from the practice.

- In addition to potential channel-stuffing and deteriorating financial performance, Bormioli appears to be plagued by aging assets, loss-making business units, and deferred CapEx. A former Gerresheimer employee estimated the deferred CapEx to be in the “tens of millions.”

- In August 2025, Gerresheimer announced closure of one of Bormioli’s plants in Germany with a former Bormioli employee telling us it was a “hint” of how things are going.

- A former Gerresheimer executive told us: “The furnaces and the assets that Bormioli had were old assets, old machines … But they [Gerresheimer] didn't consider that. And now, and now the problem is that if they want to sell now, and now they're selling, anybody with enough knowledge of the technicalities of the business, they would go and do a due diligence into those plants and evaluate the age of the assets and how much more CapEx it would need to be invested in order to keep the business running. So they’re trapped. They’re trapped.”

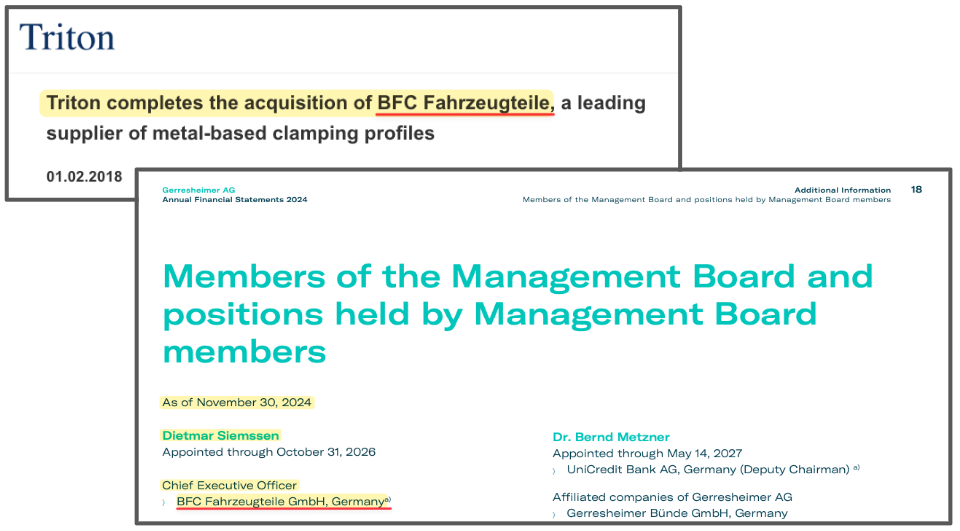

- Gerresheimer’s former CEO Dietmar Siemssen, who presided over the acquisition and negotiation with Bormioli’s owner Triton Partners, was simultaneously moonlighting as CEO at a portfolio company of Triton Partners. A former Gerresheimer executive told us this represented a “compliance question” due to his connections to Triton.

- We believe his connection to Triton warrants more scrutiny from shareholders and Gerresheimer’s board given the seemingly excessive price that was paid for Bormioli, and the concerns related to the health and trajectory of its business.

- Gerresheimer has now combined Bormioli’s molded glass factories with its legacy molded glass business to form a “powerhouse” that it hopes to divest, allowing for material deleveraging. We believe, however, that negative growth, deferred CapEx, and operational challenges will severely limit Gerresheimer’s ability to divest the molded glass business at sufficiently favorable terms.

- A former Gerresheimer senior employee told us: “You have this molded glass area, and honestly that’s also where they bought Bormioli, and I believe that the synergy effects that were expected here didn’t come through. So, what I have heard, that the molded glass plants are not 100% occupied.”

- Another former Gerresheimer executive told us: “The molded business is declining … you have furnaces, you have high energy consumption, you have production in Germany and so on, yeah. It’s a low growth asset … it’s not like people are lining up.”

- Another senior leader explained that the molded business is unattractive due to having a significant portion of its assets in Germany where energy costs are among the highest in Europe. “And then the question is, also, for example, the molded glass business. What is the strategic rationale to operate the majority of the sites in Germany where everybody knows that Germany has the highest energy costs, in Europe at least. So, they need to find answers on this … there are no answers yet.”

- Gerresheimer’s “powerhouse” molded glass division includes its Chicago Heights factory, which an industry expert described as a “complete f*cking dog,” saying that, “at some point, when a plant is like a human being or an animal or a horse. When it’s too late, it’s too late.”

- A former Gerresheimer executive said that Chicago Heights is “struggling” and that it has not been consistently profitable since 2015 and its flagship customer Pfizer had to come in with “a number of large teams” to “control and support” the plant’s operations.

- In 2024, OSHA fined Gerresheimer $145,000 for safety violations at the Chicago Heights location, and employee reviews from as recently as October 2025 mention excessive heat that has led to employees passing out, in addition to “many OSHA violations.”

Gerresheimer’s Use Of Aggressive Accounting To Prop Up Key Metrics

- We have identified several accounting practices that we believe are aggressive and potentially inflate key metrics like Adjusted EBITDA, operating income, and cashflow. We do not believe the market is fully aware of these issues.

- Aggressive Accounting Practice #1: Gerresheimer has capitalized an increasing amount of “development costs” in recent years, providing immediate boosts to EBITDA & operating income. While it claims it “usually” amortizes these costs over “three to ten years,” actual charges show it is stretching these costs as far out as 34 years. This boosted 2024 operating income by ~7%.

- Aggressive Accounting Practice #2: In 2020, Gerresheimer also extended the useful life of technologies in its Advanced Technologies division by 10 years to 25 years, further boosting near term earnings. It did not specifically detail the impact of this change in its reporting.

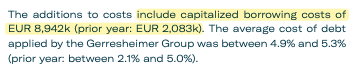

- Aggressive Accounting Practice #3: After not doing so for 15 years, Gerresheimer suddenly started capitalizing certain borrowing costs in 2023, providing an immediate boost to net income in 2024, while stretching the recognition of these costs over 3 to 10 years. In 2024, the capitalized borrowing costs were equivalent to ~8% of net income. A former employee told us: “Mr. Metzner [the former CFO] … he was only trying to find topics to do financial engineering on … and one of the things that he identified was then, we can just lower the interest cost by capitalize them.”

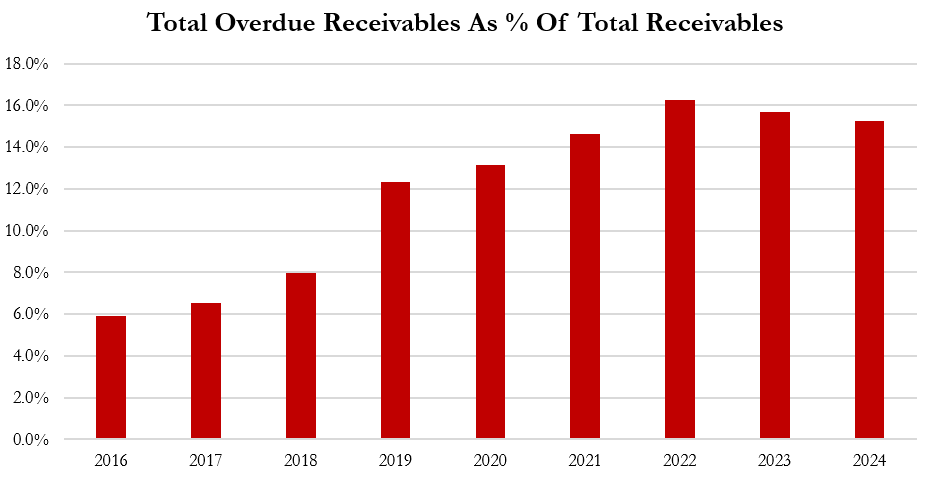

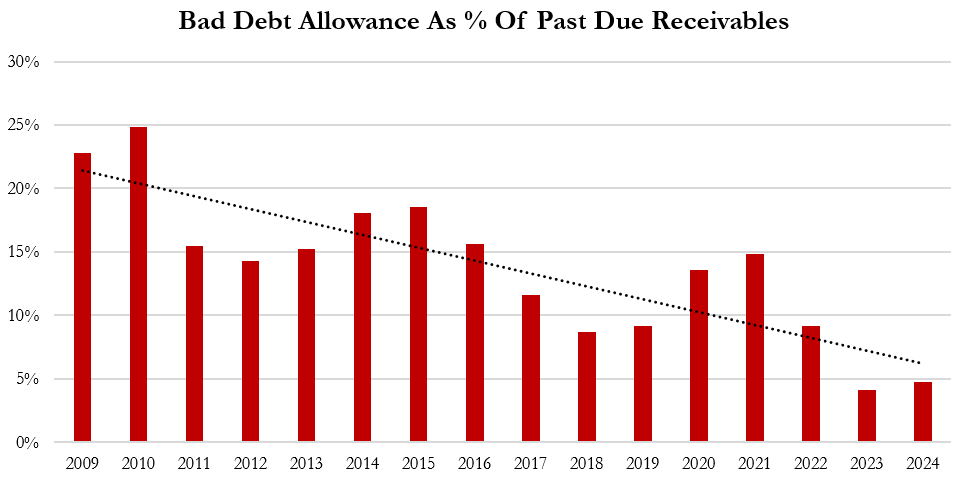

- Aggressive Accounting Practice #4: Despite record levels of overdue receivables, Gerresheimer’s provisions for bad debts are at a 15-year low, boosting operating income by an estimated ~2.5% in 2024 relative to historical provisions.

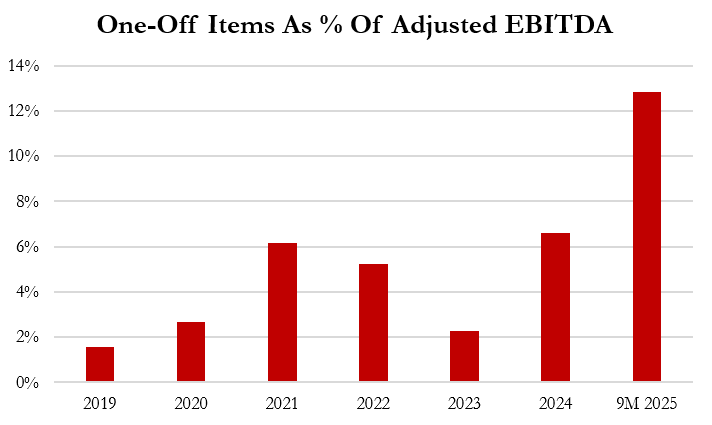

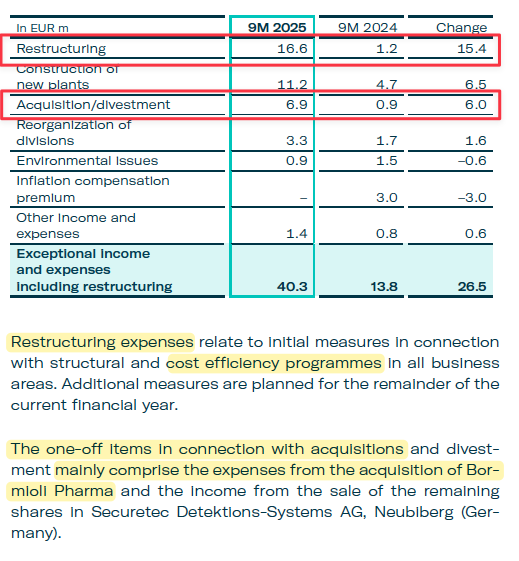

- Aggressive Accounting Practice #5: Gerresheimer increasingly relies on the removal of “one-off” expenses in its calculation of adjusted EBITDA, with these expenses more than doubling from 6.6% in 2024 to 12.8% of EBITDA in 9M 2025, including €16.6 million of opaque “restructuring costs” unrelated to the Bormioli acquisition.

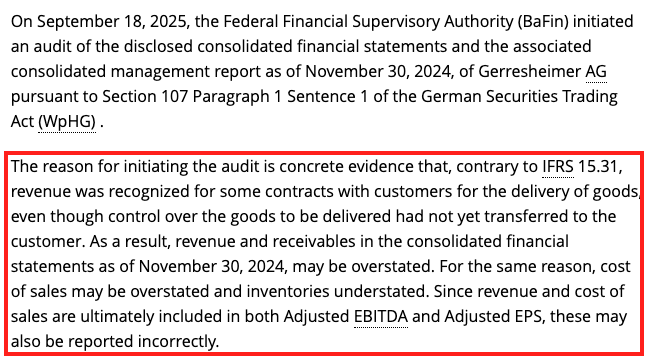

- Aggressive Accounting Practice #6: In September 2025, German regulator BaFin disclosed an investigation into Gerresheimer’s “bill-and-hold” practices, which management has claimed amounted to €28 million in 2024 with €3 million potentially being booked inappropriately in just the last quarter of 2024.

- A former Gerresheimer employee told us the company circulated “templates” that could be used to ensure bill-and-hold agreements were technically compliant with IFRS-15, even if those requirements were not actually met. They stated: “Because templates were shared where a customer could just agree on a certain PO that these are the requirements. So, they signed, at least, all the IFRS-15 requirements, which are needed to fulfill the bill-and-hold agreements, they signed it.”

- We believe this practice may have been more problematic than management has let on, with a former senior employee telling us bill-and-hold was a “common practice all across the business … and what they wanted to do was mask their top line.”

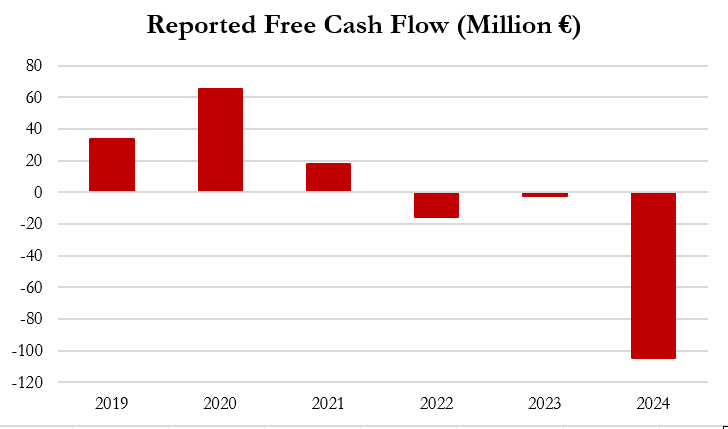

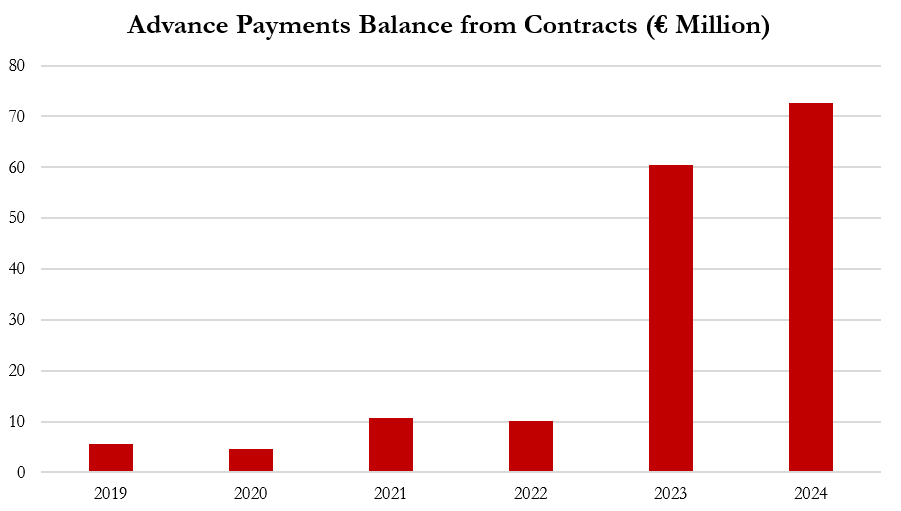

- Gerresheimer has stated that it is “laser-focused” on cash management, but it has already pulled nearly every lever to manage cashflow, including receivables factoring, reverse factoring of payables, and taking advanced payments from customers – all of which prop up an already deteriorating cash flow situation.

- Since 2020, balances related to advanced payments from customers have grown 15x from €4.6 million in 2020 to €72.6 million in 2024, providing significant boosts to cash flow. For example, for the 2-year period of 2023 and 2024, Gerresheimer reported negative cash flow of €107.3 million, which would have been 58% lower at €169.8 million in the absence of these advanced payments.

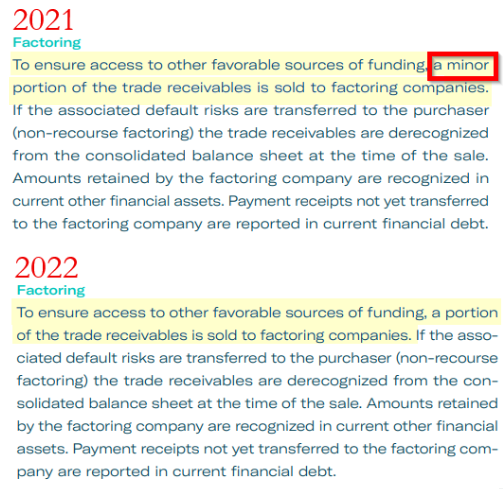

- Gerresheimer disclosed a “minor” receivables factoring program in 2021. The word “minor,” however, was removed from its disclosure in 2022, indicating an increased use of this practice. Meanwhile, a former Gerresheimer executive told us factoring happened "constantly" throughout the year.

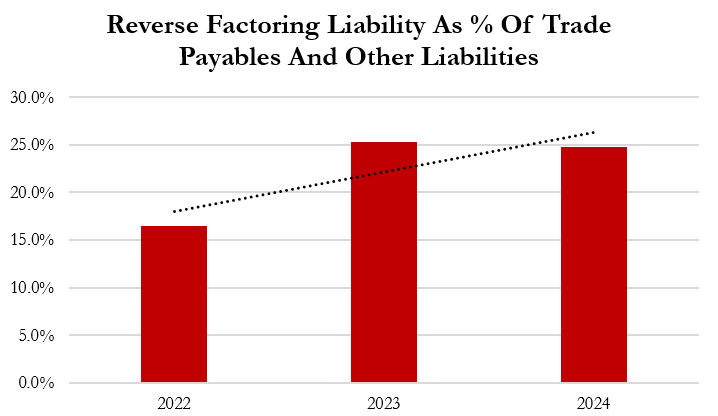

- Gerresheimer discloses that liabilities from its reverse factoring program, or supply chain finance, expanded from 16.5% of trade payables in 2022 to 24.7% in 2024.

- Factoring and reverse factoring come at a cost, per Gerresheimer’s disclosures stating that declining profitability in 2024 was partially attributable to “higher expenses from factoring and reverse factoring agreements.”

- A former Gerresheimer executive told us: “They did factoring. They did reverse factoring. They did leasing. All these things to be able to finance this growth story. And serious payback is coming.”

Impairments Risks In Advanced Technologies & A Major Customer Loss In North Macedonia

- In 2018, Gerresheimer acquired a medical pump business called Sensile Medical to serve as the genesis of its “Advanced Technologies” division, which Gerresheimer said would be an “innovation umbrella.”

- Less than 2 years into the acquisition, Sensile lost a flagship contract with Sanofi to develop a diabetes treatment device, according to Gerresheimer. Undisclosed by Gerresheimer, Sensile also lost its development deal with scPharmaceuticals in March 2019, according to scPharmaceuticals' regulatory filings, which mention “device preparation” and “design flaw” issues.

- Since acquiring Sensile, “Advanced Technologies” has racked up a total of €105 in EBITDA losses and spent over €87.5 million in CapEx. While one might expect headcount growth at this “innovation umbrella,” a former Sensile employee told us that Gerresheimer has already instituted two rounds of lay-offs, and its disclosures confirm a ~25% reduction in headcount.

- A former Gerreshesimer executive told us: “We sent a couple of general managers there in, Olten [Switzerland]. You know, they had a couple of projects. None of them were actually materialized. It was a mess. And still today." Another former executive noted: “... there was not a realistic chance to survive on the market or to gain market share for the products.”

- In June 2025, Sensile’s partner (Ever Pharma GMBH) for a Parkinson's disease treatment pump device called “D-Mine” issued an Urgent Field Safety Notice in the UK related to problems with the device.

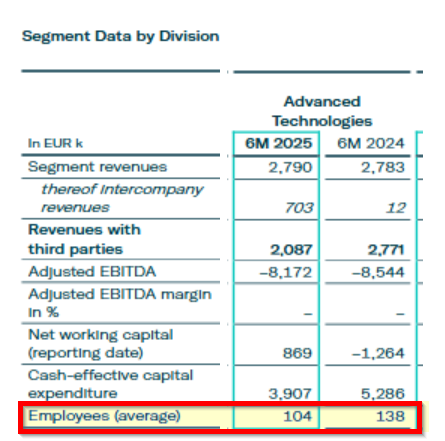

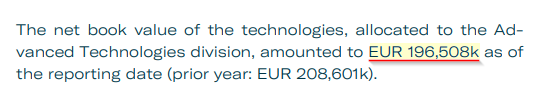

- While Gerresheimer has already taken a €116.7 million impairment on Sensile, given the performance and outlook for the business, the remaining €196 million of reported net book value of technologies within the division looks susceptible to further impairments.

- Added to impairment risks, Gerresheimer’s new North Macedonia plant is facing customer challenges, which comes after Gerresheimer announced a €100 million investment in the factory there in 2024.

- Our checks with multiple former employees uncovered that Gerresheimer has recently lost its highest volume syringe customer for the North Macedonian plant. “It was the biggest customer in volumes, not turnover, that changed to a competitor … that was a big loss,” per a former Gerresheimer employee.

Conclusion

- Gerresheimer has spent years trying to convince investors it can move upmarket as part of its “formula G” strategy, specifically betting on the weight loss megatrend. Its key growth driver CagriSema, however, faces a litany of risks, while its supposedly synergistic acquisition of Bormioli appears to be flailing, and the debt situation remains unaddressed as former executives tell us buyers for molded glass are not exactly “lining up.”

- While management downplays the BaFin investigation, our interviews indicate the issue could be more prevalent, while years of other aggressive accounting practices seem to be propping up an already bleak financial picture. We see no easy way out.

Initial Disclosure: After extensive research, we believe the evidence justifies a short position in shares of Gerresheimer AG (XETRA: GXI). Morpheus Research holds a short position in GXI around but not exceeding 0.5% of issued share capital. This report represents our opinion, and we encourage all readers to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Background: A 161-Year Old Packaging Business With 40+ Factories Globally And More Than €2 Billion In Annual Revenue, Supplying Weight Loss Drug Makers

Gerresheimer AG is a packaging manufacturer that was founded in 1864 in Gerresheim, Germany, as a small glass factory. Today, it operates 40+ facilities in 16 countries and generated more than €2 billion in annual revenue in 2024.[1]

Gerresheimer’s fiscal year ends on November 30. ↩︎

Gerresheimer has 2 main verticals, “plastics & devices” and “primary packaging glass,” making up 56% and 44% of sales, respectively. It also has an “Advanced Technologies” division with minimal revenue contribution. [Pgs. 9-10]

Gerrsheimer’s long-term strategy has so far revolved around its “formula G” strategy which was first established in 2019 and focuses on higher value, more complex products for the pharmaceutical industry. [Pg. 5]

After riding the tailwinds of the COVID-19 pandemic, Gerresheimer’s shares peaked in September 2023, further buoyed by the growing potential to benefit from the weight loss drug megatrend by supplying syringes and components for well known drugs like Ozempic and WeGovy, referred to collectively as “GLP-1s.”

Since 2023, Gerresheimer’s Shares Have Plummeted ~80% After Multiple Profit Warnings, CEO & CFO Departures, An Investigation By The German Regulator, Mounting Debt, And Failed Buy-Out Negotiations

Since September 2023, Gerresheimer’s shares have plummeted by ~80% due to multiple profit warnings, a BaFin accounting investigation, the departures of its CEO and CFO, and halted negotiations with potential private equity acquirors.

Further, Gerresheimer became “over-levered” after acquiring Bormioli Pharma, a specialty glass and plastic packaging business that was purchased in December 2024 for ~€800 million.[1]

Berenberg Research said the company has an “over-levered balance sheet” in a note dated October 27th, 2025. ↩︎

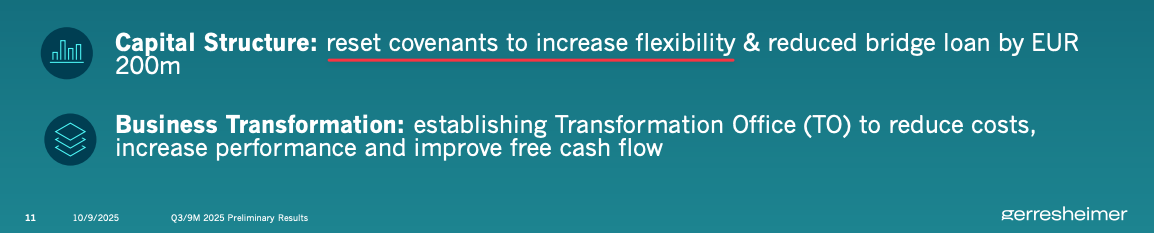

While Gerresheimer stated in an October 2022 presentation that it would consider 2.5x - 3x net financial debt to adjusted EBITDA as “appropriate,” the Bormioli acquisition required the business to stretch itself to 4.15x, just below the previous 4.25x debt covenant threshold it disclosed in May 2024.[1]

When the company announced the Bormioli acquisition it guided a "temporarily higher - mid to high 3s x adj EBITDA on closing,” according to a company presentation. ↩︎

In its Q3 2025 earnings presentation, Gerresheimer stated that it had “reset covenants” to “increase flexibility” but failed to provide details around the terms of the new covenants. [Pg. 16]

In its subsequent earnings call, a JPMorgan analyst asked a direct question about the new covenants, but management again failed to provide any clarity except to say that the company has “sufficient headroom.”

Analyst: “Yes, coming back to the balance sheet again … I think, on our math, you're close to 4.5x with the new guidance. Maybe just in terms of -- you mentioned in the presentation that the reset covenants you're happy with. Maybe you could just disclose what those covenants are?”

[…]

Gerresheimer CFO: “So I can only repeat again, yes, you're right, 4.15x is the current leverage ratio based on third quarter results. And with that, we're fully compliant with our debt covenants. We haven't disclosed yet all the details around the latest covenants. But yes, due to the covenant reset, we have sufficient headroom, and we're comfortable with that.”

As of now, investors have little visibility into whether Gerresheimer is compliant with its debt covenants, and are left having to trust management at its word.

Bull Case: Since October 2024, Several Activist Firms Have Taken Stakes In Gerresheimer, Betting On A Turnaround Driven By The Divestiture Of The Molded Glass Division And Exposure To New Blockbuster Weight Loss Drugs That Will Prevent A Dilutive Capital Raise

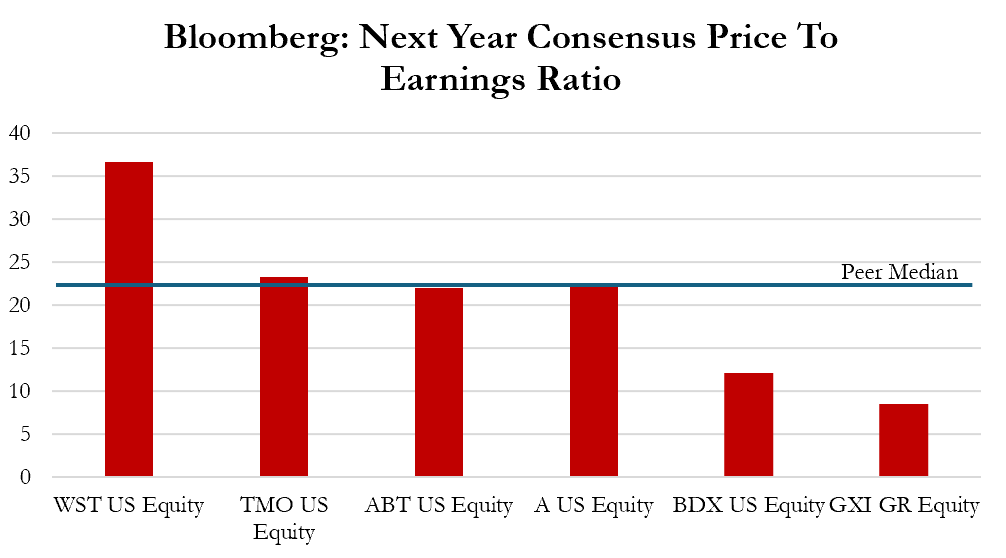

As Gerresheimer’s share price has crumbled, it now trades at a significant discount to peers, attracting the investment of several activists betting on a turnaround, despite the increasingly opaque financial situation.[1]

The peer set is the same one used in a MWB Research report, dated September 24, 2025. ↩︎

Activist investors have called for new financial leadership and the rapid divestiture of Gerresheimer’s molded glass division to reduce the excessive leverage incurred by the Bormioli acquisition, per Reuters.

In August, Gerresheimer’s shares responded positively when it officially announced a plan to sell the molded glass division, which it described as a “powerhouse” that would have the “best growth opportunities” outside of the Gerresheimer group.[1]

Bulls believe the sale of the business will “significantly reduce debt” and make a capital raise “very unlikely,” per Reuters.

With the sale of the molded glass business potentially stabilizing Gerresheimer’s financial situation, bulls believe the company will be better positioned to continue to focus on the higher value pharma and biotech industries, a sentiment that has been confirmed by management on the Q3 earnings call.

“As you know, we have a wide portfolio of GLP-1, which goes in plastic containment, syringes, devices of various forms, pens, autoinjectors. That's actually the areas that are strongly growing. And thus coming back to the question of do we believe that we can reach the EUR 200 million in GLP-1 in 2025? The answer is yes.” — Dietmar Siemssen, Former Gerresheimer CEO, October 9, 2025

With new management and the planned divestiture of the molded glass business, Gerresheimer is viewed as a potential turnaround story for several activists and analysts, with JPMorgan noting that the discounted valuation “now reflects an asymmetric risk to the upside.” [1]

JP Morgan research note, October 13, 2025. ↩︎

We believe the core business faces unknown or underappreciated challenges that risk its ability to divest the molded glass business at favorable terms. Further, key customer and product issues, competitive threats, aggressive accounting, unsustainable debt, and potential looming impairments represent material downside risks that seem to be unacknowledged by the market.

Part I: Gerresheimer’s Key Future Growth Driver, Supplying Packaging For Novo Nordisk’s Weight Loss Drug CagriSema, Is In Peril

CagriSema Faces Delays, Packaging Quality Issues, Competitive Threats, And Cannibalization Risks

Background: Analysts Believe That Gerresheimer’s Contract To Supply A Specialty Dual-Chamber Syringe For Novo Nordisk’s CagriSema Drug Could Drive Up To €250 Million In 2027 Revenue, Representing A “Sizable Part” Of The Company’s Growth In GLP-1

During Gerresheimer’s Q3 2025 earnings call, management said it believed it would reach €200 million in revenue from exposure to GLP-1s in 2025. This market could grow to €350 million over the long-term, according to management.

A key element of Gerresheimer’s GLP-1-themed growth story is CagriSema, a new still to be launched drug from Novo Nordisk that was being hailed as a “more potent successor” to Wegovy, Novo’s blockbuster weight loss drug.

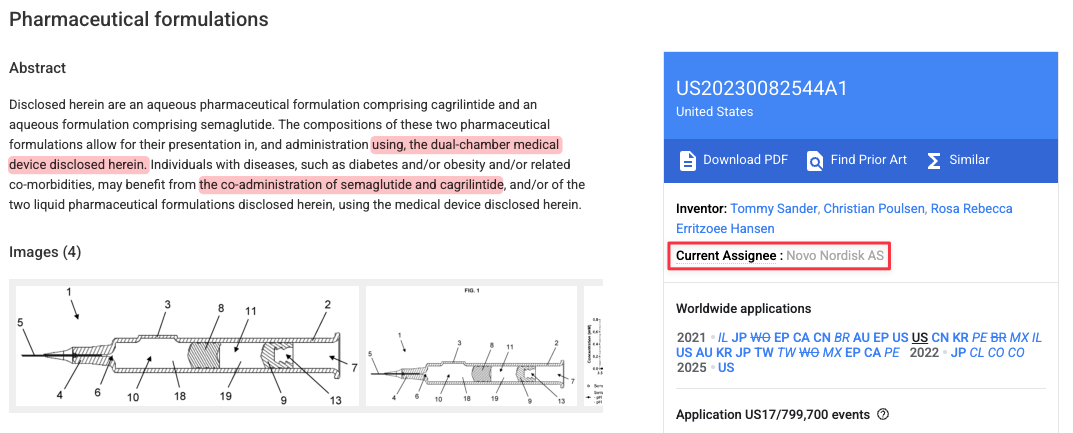

In 2024, an analyst reported that Gerresheimer would be providing a novel dual-chamber syringe for CagriSema, per Reuters. The dual-chamber syringe was believed to be necessary because of the way the drug is formulated from two distinct compounds, per BioPharma Dive, an industry publication.

The announcement was met with optimism from analysts. Jefferies Research noted CagriSema could contribute a “sizable part” of the €350 million GLP-1 sales target. UBS stated that CagriSema alone could drive up to €250 million of revenue for Gerresheimer by 2027, representing as much as ~8% of total revenue and the lion’s share of the company’s growth.[1]

Jefferies research note, December 20, 2024. UBS research note, February 11, 2025. ↩︎

In our view, CagriSema-driven revenue is not a foregone conclusion, and we see significant short term and long-term risks to Gerresheimer’s ability to fully capture the projected CagriSema-driven revenue.

CagriSema Has Faced Delays Due To Supply Chain Challenges, Pushing Out High-Margin Revenue For Gerresheimer

Novo Nordisk Employees Told Us That The CagriSema Dual-Chamber Device Packaging Has Quality Issues That Could Result In Further Delays

“We Came To A Conclusion That Some Of These Issues Were Basically Due To The Fitment Of The Primary Packaging” – Current Novo Nordisk Employee

In December 2024, Novo reported disappointing trial data for CagriSema.

As one former Gerresheimer executive stated plainly:

“The problem with CagriSema is that it has not been effective in the last stages of the clinical studies.”

In February 2025, Novo Nordisk delayed filings required for regulatory approval of CagriSema “in order to secure supply chain readiness,” according to Reuters.

As mentioned, CagriSema’s supply chain is dependent on components from external manufacturers, such as Gerresheimer for its dual-chamber syringe. These components have been experiencing quality concerns, risking further delays, according to a Novo Nordisk employee we interviewed.

The Novo Nordisk employee told us that due to manufacturing issues specific to the rigid needle shield (RNS) used with the syringe (supplied by Gerresheimer) that there were delays in trial outcomes and certain quality thresholds were exceeded:

“As part of my, kind of, assessment of the issues that we are having right now with the primary packaging from Gerresheimer on the CagriSema project, basically, the complaints that we are receiving from the customers … when they’re trying to remove the cap, this rigid needle shield sometimes gets stuck in the cap … so there is some interference between the interface of the rigid needle shield and the cap and the primary packaging, which is the device itself, I mean the dual-chamber syringe.”

“So these are, these are complaints that we have received, and these are not one-off cases. We have received complaints … And in our investigations, we came to a conclusion that some of these issues were basically due to the fitment of the primary packaging.”

The executive told us that Novo is engaged in a “very late stage design change” discussion that could result in further delays.

“We are in the process of basically running a kind of a very late stage design change project, which we don't want in the CagriSema program, because then it delays some of our approvals and so on.”

In addition to packaging component challenges, a former senior employee at Novo explained that CagriSema faced additional “very serious hurdles” related to Novo’s dual-chamber capacity.

“I'm cautiously optimistic that they will be able to have the launch that they want, but there are very serious hurdles that are still, that they will have to address. One, the internal manufacturing capacity is delayed and two their output is not going to be comparable to the output of a single-chamber line.”

We believe that Novo’s challenges with primary packaging for CagriSema could lead to further delays and its internal capacity issues with the dual chamber could result in it prioritizing a single-chamber solution.

In December 2024, Novo Launched A New Trial For A Single-Chamber Formulation Of CagriSema, Presenting Additional Risk To Gerresheimer’s Opportunity To Sell Its Higher Margin Dual-Chamber Product Over The Long-Term

“If You Secure The Single-Chamber Device And You’re Confident That It Can Supply Within The Shelf-Life Requirements … There Is No Reason To Stay With The Dual Chamber.” – Novo Nordisk Employee

In December 2024, Novo launched a new trial for a novel formulation of CagriSema that does not require a dual-chamber syringe. Instead, it utilizes a formulation of CagriSema that can be administered in a single-chamber syringe. The trial was completed in May this year.

We interviewed a current Novo Nordisk employee who told us that if the single-chamber formulation works, it would likely replace the dual-chamber option.

“But if you, if you secure the single-chamber device and you’re confident that it can supply within the shelf-life requirements with the single chamber, there is no reason to stay with the dual chamber. That would be a very simple word – stupidity – to keep supply from the single chamber."

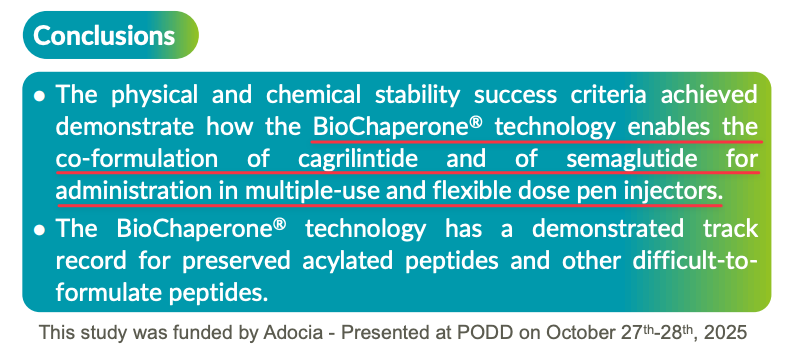

Further, demonstrating the viability of a single-chamber application for CagriSema, in October 2024, French biopharmaceutical company Adocia SA (EURONEXT: ADOC) announced a patent for a stable formulations that can administer CagriSema’s molecules using “standard injection devices … and also standard vials with syringes.”

“Adocia has patented, among other examples, a stable combination of cagrilintide and semaglutide (“CagriSema”, amylin analog and GLP-1 receptor agonist respectively, Novo Nordisk) with BioChaperone®, which could be administered in standard single- and multiple-use auto-injectors or pens, representing an improvement over a dual-chamber device.”

In October 2025, Adocia, which had been collaborating with 2 unnamed “large pharmaceutical companies,” presented their own trial results from a preclinical study, concluding that its technology enables the co-formulation of the two CagriSema’s molecules “for administration in multiple-use and flexible dose pen injectors.”

All said, we see material risk to the long-term viability of CagriSema’s dual-chamber solution and by extension, Gerresheimer’s key growth driver.

Gerresheimer’s Ability To Capitalize On Dual-Chamber Syringes For CagriSema Is Further Threatened By Novo’s New GLP-1, Amycretin, Which Has Demonstrated Excellent Results With A Single-Chamber Syringe

In January 2025, Novo Nordisk stated its new GLP-1, Amycretin, had resulted in a 22% body weight loss over 36 weeks. These results were achieved by affecting the same two body systems (called “targets”) as CagriSema, per reporting in BioPharma Dive.

Critically, Amycretin is a single molecule drug, which means it would not need a dual-chamber syringe.

In June 2025, news site Fierce Biotech reported that Amycretin data showed no “weight loss plateau,” suggesting it could be a “Zepbound-beating” innovation, referencing Eli Lilly’s blockbuster weight loss drug.

Further, Novo is developing an orally-administered version of Amycretin that has shown promising results, per studies published in the Lancet.

"To date, no other oral drug has shown the same level of effectiveness in reducing body weight as observed with amycretin in individuals with overweight or obesity over a 12-week timeframe … Importantly, there were no apparent signs of weight loss plateauing in our study."

If approved, Amycretin could cannibalize significant volumes of CagriSema.

Gerresheimer could still capture some of the single-chamber syringe business associated with newer, so-called “3rd generation” GLP-1s, such as Amycretin and Adocia’s single-formulation CagriSema.

Yet, it would face far more competition for the more commoditized syringe than it would have for the specialty, dual-chamber option that is expected to drive the bulk of the company’s revenue growth over the near future, according to our interviews.

Researcher: “How does Gerresheimer fit into this 3rd generation?”

Novo Nordisk Employee: “For 3rd generation GLP-1s, we are back to using our standard titratable pens where its a 3ml cartridge inside and it’s a pretty standard 3ml cartridge that we procure from 3 vendors, Gerresheimer being one of them … and just, Gerresheimer, kind of got the CagriSema bit because the molecule was, it’s two mono components that are not fused together, they have to go through a dual-chamber syringe … so that’s unique to CagriSema, from a syringe delivery standpoint.”

We asked a former Gerresheimer executive about this, who confirmed that Gerresheimer would not have the same type of exclusive opportunity with a single-chamber syringe.

Researcher: “You know, Gerresheimer might not have the same exclusivity or the same kind of opportunity that it does with the dual-chamber syringe. Is that, is that fair?

Gerresheimer Former Executive: “Absolutely. Yeah, absolutely.”

Even If Novo Opts For The Dual-Chamber Syringe, Gerresheimer’s Lack Of Intellectual Property Means Novo Nordisk Could In-Source Production Of The Primary Packaging

“The Contract That We Have With [Ypsomed] Allows Us To In-Source Their Device … Gerresheimer Does Not Have IP On The, On The Syringe, Right? Meaning That We Can Actually Produce That Same Syringe In-House” – Novo Nordisk Employee

Regardless of whether Novo Nordisk ultimately opts for a single-chamber syringe or a dual-chamber option, it is not a foregone conclusion that Novo will continue to source dual-chamber syringes from Gerresheimer.

In September 2023, Novo signed an autoinjector supply deal with Ypsomed, and in November 2024, Reuters reported that Ypsomed would make injectors specifically for CagriSema.[1]

Ypsomed (SWX: YPSN) is a Swiss company that manufactures auto-injectors and which recently invested $248 million in a North Carolina facility to service the GLP-1 market, according to Fierce Pharma. ↩︎

Our understanding, based on our interviews, is that under the current CagriSema agreement, Ypsomed would supply the injector device for CagriSema while Gerresheimer would supply the primary packaging, i.e. the dual-chamber syringe.[1]

As a Novo employe explained: "So for CagriSema, we have from a primary packaging standpoint, we have Gerresheimer as the one that's providing the syringes, and we have Ypsomed that is doing the device.” ↩︎

Our interview with a senior leader from Novo Nordisk indicates that Novo has the ability to manufacture the dual-chamber syringe in-house if it needs to, due to Novo’s access to Ypsomed’s design and Gerresheimer’s lack of intellectual property (“IP”) on the device.

“The contract that we have with [Ypsomed] allows us to in-source their device … Gerresheimer does not have the IP on the, on the syringe, right? Meaning that we can actually produce the same syringe in-house.”

Supporting the risk of in-sourcing or shifting production to another supplier, Novo appears to own the key patent related to the dual-chamber delivery system for CagriSema – rather than Gerresheimer.

Adding to the risks to future CagriSema dual-chamber syringe revenue, in May 2025, Novo announced an investment into Gerresheimer’s competitor Schott Pharma’s Indian joint venture (JV), called Schott Poonawalla. The company has its own line of dual chamber syringes in its “Safepac” line. “Safepac” products are marketed for GLP-1 use.

Overall, we feel Gerresheimer bulls have pinned their hopes on the revenue potential of dual-chamber syringes for CagriSema. We see risks of approval delays, packaging quality concerns, and the possibility that Novo will prioritize single-chamber solutions that will significantly impact Gerresheimer’s revenue opportunity.

Even if CagriSema launches on time and with Gerresheimer’s dual-syringe, we believe the volumes are highly likely to be cannibalized by the wave of next generation GLP-1s in development, many of which have highly promising clinical results but utilize single-chamber syringes, which are a commoditized product with far less revenue and margin potential for Gerresheimer.

Gerresheimer’s Former CEO Said He Did Not See Oral GLP-1’s “Disrupting Or Cannibalizing” The Demand For Injectables

Reality Check: A Novo Nordisk Executive Told Us They See Pills Taking 40% to 60% Of Overall Weight Loss Market Share Over The Next 3-5 Years, While Eli Lilly Has Already Manufactured “Billions” Of Pills In Anticipation Of Approval

During the Q4 2023 earnings call, Gerresheimer’s former CEO told shareholders that he did not believe orally-administered GLP-1s would disrupt or cannibalize the volumes of injectables.[1]

During the call, CEO Siemssen said that Gerresheimer was “serving the oral solution and are growing” with their lower-margin plastic packaging solutions. ↩︎

Recent news and interviews we conducted suggests orals are poised to take more market share than Gerresheimer has indicated to shareholders.

For example, in September 2025, Novo’s share price spiked 5% after reporting successful results for its new orally-administered version of Wegovy, which is expected to be approved by year-end 2025, per Reuters.

Novo Nordisk announced 2 weeks ago that it has manufactured “more than enough [Wegovy] pills” and is going “all in” on pills, per Reuters.

Meanwhile, Eli Lilly is reportedly manufacturing “billions” of weight-loss pills in anticipation of US approval, per recent Bloomberg reports in October 2025.

Eli Lilly has described its weight loss pill as a “strong candidate for a significantly accelerated approval review,” per Reuters.

Market share of oral GLP-1s will have an impact on the demand for Gerresheimer’s GLP-1 products, per an interview with a former Gerresheimer executive, who told us that Gerresheimer expected pills to take just 15% - 20% market share.

Interviewer: Does it make a difference if market share is 20 [percent] for these pills or 40 [percent]?”

Former Executive: “Oh for sure. Yeah. For sure. I mean, there's a, you know, a lot of investment that’s already been put in place in anticipation of what 80% of the market end up being pens would be. So if that’s reduced to 60%, then you're going to likely have some excess capacity in the marketplace. So, you know, it’s going to take away opportunity for those that are serving that product. And it's going to put some competitiveness in that place faster than necessarily it would have been otherwise.”

In an expert interview featured on a leading expert network platform, a Novo Nordisk strategy lead opined that 40% market share for pills may be more likely.[1]

A leading platform for interviews with industry experts published a transcript of an interview with a Novo Nordisk strategy lead in September 2025. ↩︎

“I think [20%] is probably a conservative number. My gut tells me it could be even be as high as 40%/60%, so 40% oral, 60% injectable. Especially knowing some of the signaling of the manufacturing that Lilly has signaled and having an abundance of orals, I think we could start to see the oral market account for a big proportion of the overall market.”

A current Novo Nordisk executive told us that GLP-1 oral drug share could be higher and even take up to 60% share of the total weight loss market.

“Short term, I think we'll be probably looking at potentially 40 to 60% … [in] 3 to 5 years max. Anything afterwards, then the share will explode to mainly being driven by orals.”

Over the long-term, another Novo Nordisk executive agreed that a pill with equal efficacy was the preferred delivery mechanism.[1]

The expert confirmed that, in their view, GLP-1 pills still “aren’t as efficacious as injectables” and come with their own manufacturing challenges. ↩︎

Interviewer: “All things equal, If a pill had the same kind of efficacy, it would generally be a preferred delivery mechanism?”

Novo Nordisk Executive: “That's right. That's for sure.”

In short, despite Gerresheimer’s claim, the dual-chamber syringe for CagriSema has duration risk and is likely to be superseded by oral pills and single-chamber products, both of which are lower margin solutions in markets where Gerresheimer would just be just one of many suppliers.

Part II: Bormioli – How A Conflicted CEO Overpaid For A Zero Growth Business And Gerresheimer’s Flailing Attempt To Divest Its Distressed Molded Glass Division

In May 2024, Gerresheimer Announced The Acquisition Of Italian Packaging Company Bormioli For ~€800 Million, Or 10x Adjusted EBITDA, Which One Former Bormioli Employee Described As The “Highest Multiple” In The Pharma Packaging Industry

Gerresheimer Claimed Bormioli Had A “Profitable Growth Track Record, Attractive Margins And Cash Generation” And Would Have “Substantial Synergies”

Reality Check: Bormioli Is A Zero-Growth Business With Rapidly Accelerating Losses

In December 2024, Gerresheimer acquired Bormioli Pharma — an Italian glass and plastic packaging company — for ~€800 million from private equity seller, Triton Partners. The purchase price represented a 10x multiple of Bormioli’s 2024 adjusted EBITDA, according to Gerresheimer. [Pg. 4]

The deal was financed through a credit facility that resulted in Gerresheimer’s net debt to adjusted EBITDA leverage ratio climbing to 4.15x, just shy of its 4.25x debt covenant threshold, which, as mentioned, management says has now been “reset” to “increase flexibility.” [Pg. 13] [Pg. 16]

A former Bormioli employee told us that the price was among the richest valuations in recent transactions.

“[The deal] translated into a multiplier that was over ten … in 2025, the highest multiple applied in the pharmaceutical packaging industry because anybody else was below ten [Adjusted EBITDA multiple]. So it was a good price. So I think that for Bormioli shareholder[s] that was a good deal.”

Despite the apparent premium paid and Gerresheimer’s pre-acquisition claims of a “profitable growth track record,” Bormioli reported a “net loss of around €8 million” in 2023, per Gerresheimer’s reports. [Pg. 83]

In 2023 and 2024, Bormioli lost €7.6 million and €51.4 million respectively, according to the minutes of the Bormioli Pharma SpA shareholders meeting held on June 27, 2025, which discussed Bormioli Pharma’s consolidated financials.[1]

Gerresheimer acquired BlitzLuxCo Sarl whose only asset is 100% of the shares of Bormioli Pharma SpA, according to BlitzLuxCo financial statements. Bormioli Pharma SpA owns 100% of 4 subsidiaries: Bormioli Pharma France SAS, Bormioli Pharma (Shanghai) Trading Company Co., Ltd, Bormioli Pharma United States Inc and Remy & Geiser GmbH, according to Bormioli Pharma SpA accounts. ↩︎

Beyond the lack of profitability, Bormioli’s revenues were flat year-over-year from 2023 to 2024, and now appear likely to decline materially based on Gerresheimer’s disclosures.

In H1 2025, Gerresheimer reported Bormioli sales of just €166.952 million, requiring a 22% increase in 2H 2025 just to maintain 2024 estimated figures – which we see as highly unlikely.[1]

At the time of the Bormioli acquisition, Gerresheimer predicted €370 million revenue for Bormioli during 2024. (Pg .4) That figure is lower than the €371 million of revenue generated by Bormioli during 2023, according to Gerresheimer’s financial statements. In H1 2025, Bormioli achieved €166.952 million in revenue, per its Half-year Financial Report. (Pg. 15) ↩︎

Gerresheimer has seemingly paid a rich multiple for a loss-making, no-growth business, leading to a windfall for private equity firm, Triton.

Former CEO Siemssen, Who Presided Over The Deal, Worked For Bormioli's Seller Prior To And During His Time At Gerresheimer, Including At The Time Of The Bormioli Acquisition

Former Gerresheimer Executive: “For Me, This Is Kind Of, It's A Compliance Question”

Glass Packaging Industry Expert: “They Indeed Have Paid A Rich Price For Bormioli … I Can Tell You That Triton Was Very Happy”

Gerresheimer’s former CEO Dietmar Siemssen has over a decade-long relationship with Bormioli’s seller, Triton Partners.

In 2010, Triton acquired Stabilus, a gas struts and hydraulic vibration dampener manufacturer. From 2011 to 2018, Siemssen acted as CEO of Stabilus. In 2014, Stabilus went public and Siemssen publicly praised Triton for their “business-minded” ownership approach.[1]

Since at least 2021, during his tenure as head of Gerresheimer, Siemssen moonlighted as CEO of a Triton portfolio company called BFC Fahrzeugteile GmbH, a “leading supplier of metal-based clamping profiles,” according to Gerresheimer’s annual reports. [1, 2, 3]

In other words, when Gerresheimer acquired Bormioli, its CEO literally worked for Bormioli’s seller, which one former Gerresheimer executive referred to as a “compliance question.”[1]

“I think that, for me, this is kind of, it's a compliance question … he also still had during the time of being at Gerresheimer, that he still had also some advisory assignments at portfolio companies of Triton.”

We interviewed a senior glass packaging industry expert who was involved in the Bormioli deal. They explained that Gerresheimer “paid a lot” for the acquisition, and that the former owner of Bormioli, Triton, was “very happy” with the “rich price.”

Further, Karin Dorrepaal was a director at Gerresheimer when the Bormioli acquisition was signed in May 2024. She had served as a member of Triton’s Industry Board for over 16 years, until March 2024, per her Linkedin.

Former Bormioli Employees Described Channel-Stuffing At The Company

In One Example, A Former Bormioli Employee Told Us That Ahead Of The Gerresheimer Acquisition, Bormioli Used Its Largest Italian Distributor, Called Punto Pack, To Inflate Revenue To The Tune Of €10-15 Million At Year End

“Even My Management Said That [Bormioli] Were Kind Of … How Do I Say, Embellishing The Bride? So, Making The Bride Nice” – Former Gerresheimer Senior Leader

Apart from the seemingly excessive multiples paid for Bormioli, former senior leaders from Gerresheimer explained to us that the acquisition happened at Bormioli’s “peak” and that Bormioli had significant “window dressing.”

Part of this may have been related to potential channel-stuffing at Bormioli, something that one sell side analyst touched upon in a research note shared with investors.[1]

On July 4th, 2025, JP Morgan wrote in a note on quarterly results expectations “we’ll be looking for more colour on the areas of weakness and in particular any confirmation that Bormioli channel loading might be to blame.” ↩︎

A former Bormioli employee told us that Bormioli would sometimes use “techniques” to close the year with “a little bit higher result,” including the practice of billing customers for products that they were “maybe” not asking for.

"I remember also, for example, techniques, techniques to closing the year with a little bit higher result. So, for example, you were invoicing, you had goods in stock, and you were sending to customer like on the 30th of December, stuff like this, so that the invoice would come into, into the year before to get the result. Even if maybe the customer was not asking for that. And then you were, say, basically, apologies to the customer, but yeah, some of these techniques were used.”

A second former Bormioli told us about end-of-year channel-stuffing with an Italian distributor called Punto Pack that amounted to an estimated €10 - 15 million – bizarrely characterizing the practice as irrelevant.

“And usually and usually there were just few of those distributors that get consignment stock or ship. And then we bill later or we bill and then we ship later at the end of the year, because Punto was one of that, but the other one were not big enough to manage that. So in terms of volumes, I would say that might represent the next that extra, extra revenues might be in the range of 10 to 15 million over a almost €400 million total revenue. So I would say not relevant.”

A former Gerresheimer executive described the Bormioli acquisition as a diligence failure by Gerresheimer’s M&A team, stating that Bormioli had massive “window dressing” and explicitly mentioning Bormioli’s aggressive sales to distributors.

“Yes. I mean you're putting it very gently here. I mean, I wouldn't call it a big window dress. It was like massively window dress … the due diligence exercise that was done at that time, in my view, was not done properly from, from our end … they have a lot of distributors. They kind of push them, all the material to their throat.”

Another former senior leader from Gerresheimer conflated the Bormioli acquisition with “embellishing the bride.”

“But the issue with Bormioli was that the company was actually sold at its peak performance. ‘22, ‘23 were good years, and they were benefiting from that Covid impact and so on. And in a way, Gerresheimer paid too much, if you will … Remember, the acquisition was done in May. So, the forecast was maybe not already reflecting that downturn. And ‘25 was even going down further.

[...]

Even Gerresheimer management said that they were kind of, yeah, how do I say that, embellishing the bride? So, making the bride nice … so there is a certain impact you can generate, yeah, by moving sales forward.”

Bormioli Appears To Be Plagued By Loss-Making Business Units, Plant Closures, And Significant Deferred CapEx That Former Employees Estimated Was In The “Tens Of Millions”

A former senior leader from Gerresheimer explained that Bormioli’s “old assets” were not considered by Gerresheimer, and that the CapEx needs could present a challenge in running and/or divesting of these assets.

“The furnaces and the assets that Bormioli had were old assets, old machines … But they [Gerresheimer] didn't consider that. And now and now the problem is that if they want to sell now, and now they're selling, anybody with enough knowledge of the technicalities of the business, they would go and do a due diligence into those plants and evaluate the age of the assets and how much more CapEx it would need to be invested in order to keep the business running. So they’re trapped. They’re trapped.”

We asked a former Gerresheimer employee the type of additional capex requirement here:

“So if you want to get everything to a comparable level [of Automation], you need to put a lot of CapEx in … Directionally not hundreds, but for sure double digit millions.”

Overall, Gerresheimer appears to have dangerously leveraged itself to acquire a declining business facing distress and with material deferred CapEx.

Distressed Example: Bormioli’s German Subsidiary, Operating 3 Plants, Had “Onerous Contracts” That Contributed To Bormioli’s Consolidated Losses

It Was Fully Written Down During 2024 After Gerresheimer’s Acquisition

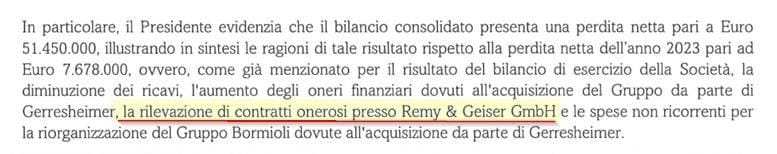

In addition to potential accounting issues, the Bormioli acquisition appears to be plagued by challenged subsidiaries, including Remy & Geiser GmbH, which contributed to Bormioli’s reported €51.4 million net loss in 2024 due to “onerous contracts,” according to the minutes of the Bormioli Pharma SpA shareholder meeting.

Gerresheimer has not publicly discussed what these onerous contracts were at the second-tier subsidiary: Remy & Geiser. The subsidiary revenues decreased from €34.1 million in 2023 to €28.5 million in 2024, while its losses increased from €3.5 million in 2023 to €9.9 million in 2024. [Pg. 49]

As of December 31, 2024, the company had written down its full investment in Remy & Geiser, per Bormioli’s annual report, evoking questions about future revenue generation and further losses from the business. [Pg. 49]

Remy & Geiser, operated 3 plants in Germany, according to Bormioli’s website.

A former Bormioli executive told us that the three Remy & Geiser plants were “kind of old” despite investments and had limitations.

“A lot of investments were made, but still the buildings themselves were kind of old and with some limits. For, Remy Geiser, there were two plants, two big plants and a third one … closed, a few months ago.”

A former Gerresheimer executive confirmed that one of Bormioli’s Remy & Geiser plants has already shut down and said that a second one is also likely to shut down.

“But the tubular business is not profitable and some are just shut down, one plant in Germany, Bad Königshofen, and sooner or later the other one will also go out.”

In August 2025, an industry magazine, Glass International, covered the intended closure and loss of 90 jobs at one Remy and Geiser plant at Bad Königshofen, eventually confirmed by management on its Q3 2025 call.

A former Bormioli employee said the closure is a “hint” of how things are going at Bormioli.

“See a signal of this by the fact that there were three plants of Remy & Geiser and the one in which they invested the most which is Bad Königshofen, closed a few months ago. So it’s, I would say it’s a huge hint of how things are going.”

The former Bormioli employee also described another of Remy and Geiser’s plants at Altenfield, which appears to be challenged due to its location and outdated equipment.

“It’s located exactly in the middle of the village. And that means that you have no room for expansion. So I remember … seeing pallets everywhere because basically the warehouse was full. And in this case, it's hard to build in a modern economy with a small plant in the middle of a village.”

“It's called Altenfield. And, I would say logistically, it's an awful spot because it's far away to the main highways and communication route. You have this plant close to a forest, and I would say, I saw really old, both old machinery and old ways of working.”

Gerresheimer Is Attempting To Divest Its Molded Glass “Powerhouse” Which Consists Of Both Bormioli Facilities And Legacy Gerresheimer Facilities

We Believe Negative Growth, Deferred CapEx, And Operational Challenges Will Severely Limit Gerresheimer’s Ability To Divest Its Molded Glass Business At Favorable Terms

“The Molded Business Is Declining … You Have Furnaces, You Have High Energy Consumption, You Have Production In Germany And So On, Yeah. It’s A Low Growth Asset … It’s Not Like People Are Lining Up” - Former Gerresheimer Senior Executive

When Gerresheimer acquired Bormioli in 2024, approximately 45% of Bormioli’s revenue was generated from its molded glass division. By combining these facilities with Gerresheimer’s legacy molded glass operation, the company claims to have formed a “molded glass powerhouse” that reportedly generated €735 million in 2024 revenue with ~20% adjusted EBITDA margins, according to Gerresheimer.

Analysts believe the molded glass division could yield a sale price of anywhere from €780 million to €1.18 billion, allowing Gerresheimer to significantly pay down debt, reduce overall leverage, and stabilize the company’s financial situation.[1]

Hauck Aufhauser & MWB Research Notes, August 5, 2025. MWB research notes that “limited post-acquisition performance improvements” and the “absence of growth momentum” could challenge the multiple applied to a potential sale. ↩︎

We believe, however, that the molded glass division is more distressed than analysts realize and that Gerresheimer will struggle to divest these assets at favorable terms.

At the time of the acquisition, Gerresheimer said there would be “substantial synergies” with Bormioli, but a former senior employee from Gerresheimer told us that those synergies have not materialized.

“You have this molded glass area, and honestly that’s also where they bought Bormioli, and I believe that the synergy effects that were expected here didn’t come through. So, what I have heard, that the molded glass plants are not 100% occupied. And, also, the cost position is not very well there. So, therefore, that I think is the main issues currently in the cashflow.”

Another former senior employee from Gerresheimer told us buyers are not exactly “lining up” to buy the molded glass business, which they described as “declining,” noting high fixed asset costs, high energy costs, and weak demand.

“At the end of the day, the molded business is declining, it’s declining. And when you have a molded glass plant, you have very high fixed costs. You have the furnace, which runs 24 hours, and then when you lose sales, you lose a lot of margin, and that is really impacting a lot. And I think management has underestimated the duration of the, let’s say, weakness in demand.”

“You need to find a buyer for molded, which is not that easy … You have furnaces, you have high energy consumption, you have production in Germany, and so on, yeah. It’s a low growth asset … it’s not like people are lining up.”

The senior executive’s reference to energy costs were echoed in another interview with a third former senior leader from Gerresheimer, who told us that operating glass furnaces in Germany is challenging due to the “highest energy costs in Europe.”

“And then the question is, also, for example, the molded glass business. What is the strategic rationale to operate the majority of the sites in Germany where everybody knows that Germany has the highest energy costs, in Europe at least. So, they need to find answers on this … there are no answers yet.”

Gerresheimer’s Chicago Heights Glass Production Facility Appears To Be Unprofitable & Distressed, Per Former Employees And Competitors We Interviewed

Competitor: It’s A “Complete F*cking Dog.. At Some Point, When A Plant Is Like A Human Being Or An Animal Or A Horse. When It’s Too Late, It’s Too Late”

As one of its molded glass facilities in the US, Gerresheimer’s Chicago Heights factory is likely to be sold as part of the molded division. According to former employees and industry experts, the facility is highly distressed and has significantly underperformed for years.

A former executive from competitor SGD Pharma explained to us that Gerresheimer’s Chicago facility is known to be a toxic asset, describing it as a “complete f*cking dog.”

“At some point when a plant is like a human being or an animal or a horse. When it's too late, it's too late. It’s not the age. You can reinvest and change the machine. This is a dynamic, a particular managerial dynamics … Nobody wants to go there. You can Google, indeed, Chicago Heights Gerresheimer and you will see all the very bad comments of everyone who just left this factory. And when you enter this bad logic, you are blamed by the client, you have accidents, blah blah blah. And it's honestly difficult to reverse the dynamics.”

A former Gerresheimer executive corroborated this perspective, referring to Chicago as a “struggling” facility that has not run well since 2015. The executive explained that Chicago’s flagship customer, Pfizer, had “deployed teams” to assist with running the plant efficiently.

“Since [2015] Chicago Heights is struggling. They never learned how to run a type 1 glass furnace … The customer who took, let’s say, most of the volume from Chicago is Pfizer. Because of the mess in Chicago, and creating out-of-stock situation at Pfizer, Pfizer deployed a number of large teams basically to control and support on improving the efficiency, that stabilized a little bit the situation. But until today, Chicago never really recovered and became profitable again.”

In 2024, OSHA fined Gerresheimer ~$145,000 for safety violations, according to industry publication, Glass International.

Employee reviews from as recent as October 2025 cite excessive heat causing workers to pass out and “many OSHA violations.”

Part III: How Gerresheimer Utilizes Aggressive Accounting To Boost Adjusted EBITDA, Operating Income, And “Mask” Its Top Line

We have identified several accounting practices that seem to us aggressive and potentially inflate key metrics like Adjusted EBITDA, operating income, and cashflow. We do not believe the market is fully aware of these issues.

As one former senior employee from Gerresheimer stated:

“I think, from my knowledge, and obviously I can only speak to what I know here. Certainly, and that is also what I indicated previously, there has been a change over the years to, well, you can call it more aggressive accounting. But, from what I know, that was never over the line. So, I cannot comment obviously on all the business units. And certainly, if you want to hit your targets … then you will try and find ways in order to deliver on your promises be it revenues or be it profitability.”

While another stated:

“So, we questioned some of these [accounting] topics, and we get explanations, to be honest, not always satisfying from an accounting point of view, but still the final decision needs to be made by management.”

When viewed as a whole, we believe these practices paint an even bleaker picture of an already distressed business, while severely challenging forward-looking assumptions on several KPIs.

Most critically, we believe that in the absence of these practices, Gerresheimer may have been in breach of its previous debt covenant. We remain skeptical of the 'sufficient headroom' that GXI now claims to have after the covenant reset that management communicated, but failed to meaningfully explain during its Q3 2025 earnings call.

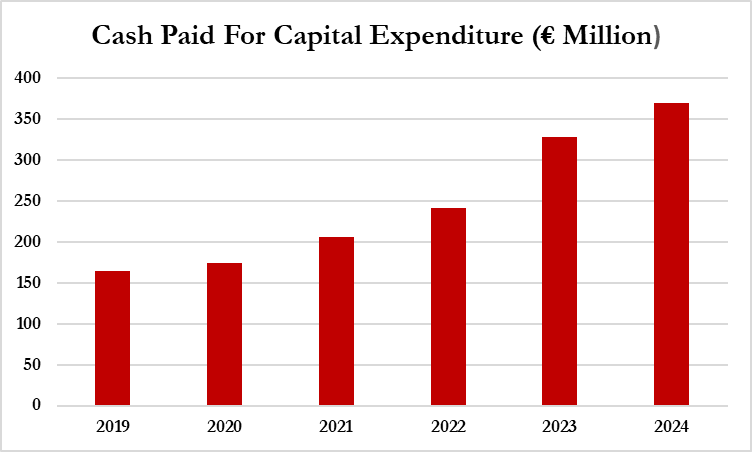

One such area of accounting that we believe warrants scrutiny is Gerresheimer’s use of capitalized expenditures, which have increased from €185 million in 2019 to €370 million in 2024.[1]

In 2021, Gerresheimer started reporting “cash-effective capital expenditure.” Prior to that, we used cash-paid for capital expenditure found on the cash flow statement. ↩︎

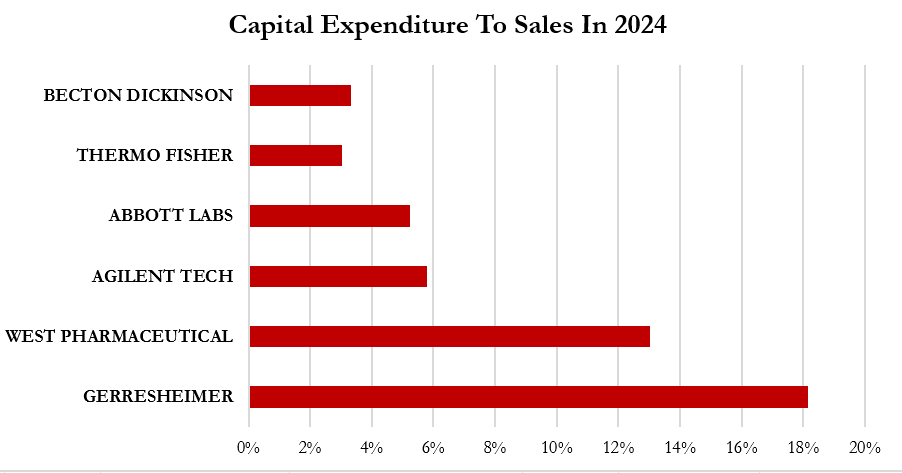

At the current level, Gerresheimer’s capitalized expenditure to sales is significantly higher than peers.

Capitalization of expenses allows businesses to shift costs to the balance sheet and recognize them over time rather than when they are incurred. Determining which costs qualify as capital expenditures can require significant discretion from management and accounting teams, and can often be used as a way to boost key metrics like EBITDA.

A former Gerresheimer senior leader told us there was a “push” to categorize costs as capital expenses to manipulate EBITDA and the perception of business performance.

“Yeah, I mean, If there was a way to do that appropriately, to take what would otherwise be expenses against EBITDA and move it into capital investment, there was certainly a push to do so. And I think the performance of the business versus its peers was always a bit challenged, so they’re trying to do what they can to manipulate that EBITDA performance in particular.…

So, yeah, I don’t know that it was anything askew, but, it was quite, almost comical that every year there would be a different perspective as to how that should be manipulated or managed. So, someone was always looking at ways to improve that performance from an outside standpoint, or what was reported I suppose, against capital investments.”

Aggressive Accounting Practice #1: Gerresheimer Has Capitalized An Increasing Amount Of “Development Costs” In Recent Years, Providing Immediate Boosts To Operating Income

While It Claims It “Usually” Amortizes These Costs Over “Three To Ten Years,” Actual Amortized Amounts Indicate Gerresheimer Is Stretching These Costs As Far Out As 34 Years, Boosting 2024 Operating Income By An Estimated 7%.

One such area of capitalization that we believe warrants scrutiny is Gerresheimer’s capitalization of a portion of its development costs.

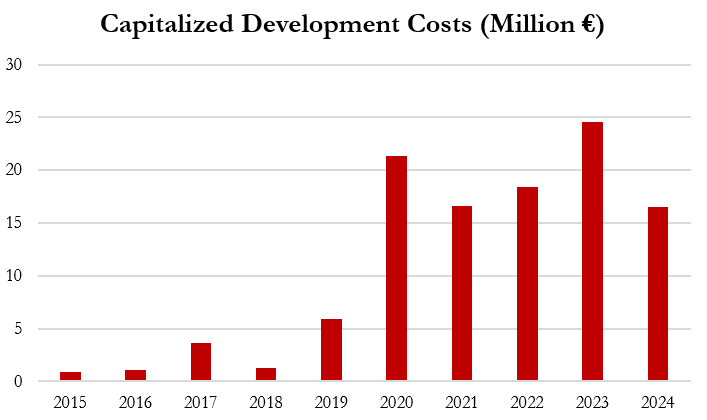

These capitalized development costs have grown from a total €12.8m from 2015 - 2019 to €97.4 million from 2020 - 2024, providing a significant and growing benefit to earnings in recent years. As an example, if no development costs had been capitalized in 2024, operating income would have been 8.4% lower.[1]

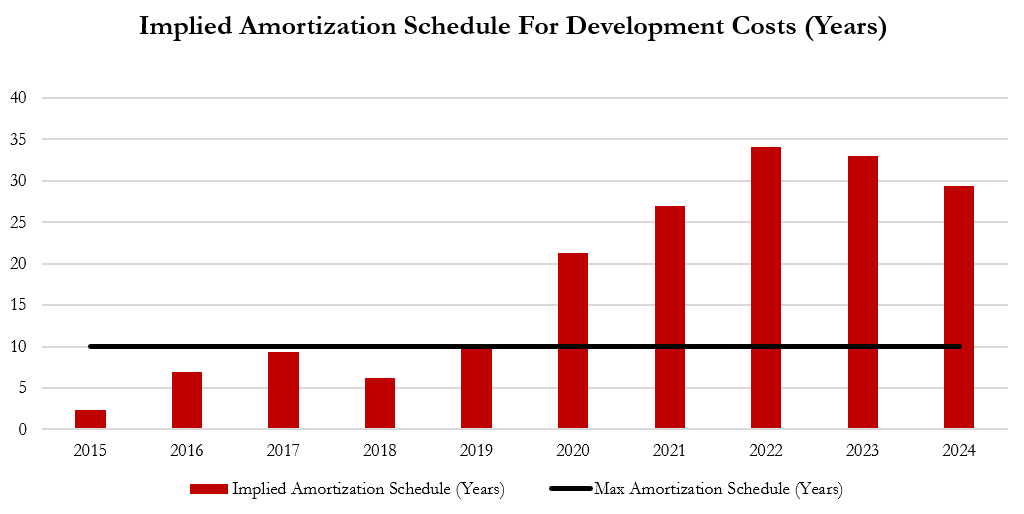

Gerresheimer states that the amortization window to recognize these development costs is “usually three to ten years,” according to its 2024 annual report. However, its actual amortization charges imply that the company is stretching the recognition of development costs over as much as 34 years, per our estimates— not 3 to 10 years.

For example, in 2024, Gerresheimer's annual report shows that it started the year with a carrying cost associated with development costs of €116.8 million.

During the year, the company reported an amortization charge of €3.9 million, implying a useful life of ~29 years. At 6.5 years - the midpoint of the schedule - the charge would have been €18 million, per our estimates. This represents a €14 million difference and a 7% boost to operating income.[1]

We calculate the implied amortization schedule each year, by dividing the carrying cost of the development cost intangible asset at the beginning of the year by the development cost amortization charge. We assume a straight-line amortization method and no disposals or additions of development costs. ↩︎

The graph below shows how the company appears to have been delaying the recognition of development costs by extending the amortization schedule of its intangible assets— this practice inflates short term profits by delaying the recognition of costs.

Aggressive Accounting Practice #2: In 2020, Gerresheimer Extended The Useful Life Of Technologies In Its Advanced Technologies Division From 15 Years to 25 Years, Further Propping Up Near Term Earnings

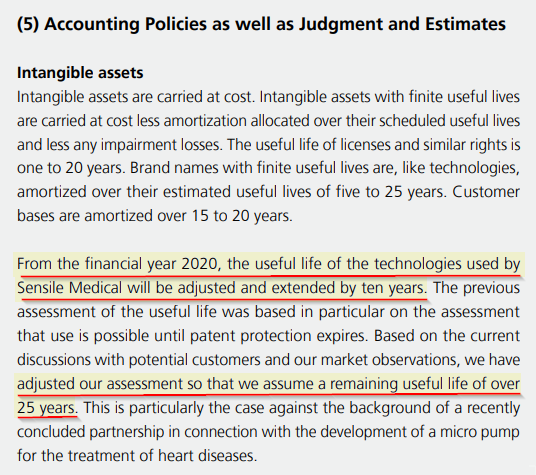

Another accounting area that we believe warrants scrutiny is the change in amortization schedule related to the intangible assets from Gerresheimer's Advanced Technology division between 2019 and 2020.

The Advanced Technology division was established with the acquisition of Sensile Medical in 2018. As we will discuss below in Part IV, this acquisition translated into sustained losses for Gerresheimer.

Starting in 2020, Gerresheimer decided to extend the “useful life of the technologies used by Sensile Medical,” from 15 years to 25 years, per its annual report. [Pg. 114] This extended the useful life by 66%, likely providing another short term boost to earnings.

Gerresheimer did not specifically detail the impact of this change, nor did it specifically detail the amortization charges per division. Yet, between 2019 and 2020, the amortization charge for “customer relationship, brand names, technologies and similar assets” declined by 23.7% from €55.7 million in 2019 to €42.5 million in 2020. [Pg. 120]

Aggressive Accounting Practice #3: In 2023, Gerresheimer Started Capitalizing Borrowing Costs— A Practice It Had Not Engaged In During The Previous 15 Years, According To Its Financial Statements

“Mr. Metzner [Former CFO], Who Left The Company, He Was Only Trying To Find Topics To Do Financial Engineering On That … And One Of The Things That He Identified Was Then, We Can Just Lower The Interest Cost By Capitalize Them” – Former Gerresheimer Employee

From 2007 until 2022, Gerresheimer did not capitalize any borrowing, according to the company’s financial statements during that period.[1]

Beginning in 2023, Gerresheimer suddenly capitalized ~€2 million in borrowing costs and another ~€9 million in 2024. [1, 2]

This practice provided an immediate boost to net income in 2024, while stretching the recognition of these costs over 3 to 10 years per the schedule.[1] In 2024, the capitalized borrowing costs were equivalent to ~8% of net income.

None of these capitalized borrowing costs had to do with the acquisition of Bormioli, since the transaction closed after the date of the 2024 financial statements. ↩︎

As a former employee stated:

“Mr. Metzner [former CFO], who left the company, was only trying to find topics to do financial engineering on, and one of the things he identified was that they could just lower the interest cost by capitalizing them.”

Aggressive Accounting Practice #4: Despite Record Levels Of Overdue Receivables, Gerresheimer’s Provisions For Bad Debts Are At A Near 15-Year Low, Boosting Operating Income By ~2.5% In 2024 Relative To Historical Provisions, Per Our Estimates

Getting paid for products that a company sells is paramount for any business. Changes in overdue receivables are thus a key metric for investors to track.

Since 2016, Gerresheimer’s overdue receivables have accelerated from ~6% of total receivables to 15.2% in 2024.[1]

Normally, an increase in overdue receivables is a sign of deteriorating credit quality that could necessitate increased allowances for bad debt.

Despite the clear increase in overdue receivables shown in Gerresheimer’s financials over the last 8 years, current allowances for bad debt sit at an almost all-time low.[1]

Under-provisioning for bad debts can create an artificial boost to earnings. From 2009 to 2022, Gerresheimer provisioned an amount equal to 15% of overdue receivables, on average. If it had maintained this ratio for 2024, it would have required an extra €4.9 million in provisions, or approximately 2.5% of operating income for the period.

Aggressive Accounting Practice #5: Gerresheimer Increasingly Relies On The Removal Of “One-Off” Expenses To Calculate Adjusted EBITDA, Which Increased To 12.8% Of Adjusted EBITDA In The First 9 Months Of 2025

These Included €16.6 Million Of Nebulous “Restructuring” Costs Related To “Cost Efficiency Programmes”

“They Also Pushed That Everything What Comes Up From The Costs, As Much As Possible, Is Shown As Exceptional Expense For That Ramp Up” - Former Gerresheimer Employee

Gerresheimer has consistently removed exceptional, or “one-off,” expenses from its adjusted EBITDA calculation. The removal of these one-off costs increased from 6.6% of Adjusted EBITDA in 2024 to 12.8% in the first 9 months of 2025, higher than the last 5 financial years.

In 9M 2025, Gerresheimer removed €40.3 million in claimed “one-off” expenses, including €16.6 million in opaque “restructuring” costs related to “cost efficiency programs.” [Pg. 10]

While it may seem normal for Gerresheimer to incur significant restructuring costs as it digests the sizable Bormioli acquisition, this €16.6 million “restructuring” expense appears to be wholly separate from the costs related to the Bormioli acquisition, based on Gerresheimer’s disclosures, which addresses other one-off items in connection with the Bormioli acquisitions.

Aggressive Accounting Practice #6: In September 2025, The German Regulator, BaFin, Announced An Investigation Into Gerresheimer’s “Bill-And-Hold” Billing, Which Management Has Claimed Amounted To Just €28 Million In 2024

“It Was A Common Practice All Across The Businesses … And What They Wanted To Do Was Mask Their Topline” – Former Gerresheimer Senior Leader

In September 2025, German financial regulator BaFin said it was investigating Gerresheimer’s revenue recognition practices related to “bill-and-hold” agreements, per Reuters.

The BaFin press release stated that the regulator had “concrete” evidence of revenue recognition issues that may result in overstated revenue, potentially impacting reported adjusted EBITDA and adjusted EPS.

In response to BaFin’s action, Gerresheimer stated that it “continues to believe” that revenue was “appropriately recognized” for the fiscal year 2024.

Just one month later, however, Gerresheimer admitted that it had “likely” recognized ~€3 million in revenue prematurely related to a single contract, and that it was investigating an additional €25 million of revenue tied to other bill-and-hold contracts. Its announcement said:

“In the course of this independent investigation, the company has now become aware of new findings. Based on these findings, it is more likely to assume that, contrary to the previous opinion, the requirements for revenue recognition were not met for a contract with a volume of around EUR 3 million.”

Despite the issue being ostensibly limited to a single and relatively immaterial contract, Gerresheimer’s CEO stepped down just days after this admission.

Notwithstanding Gerresheimer’s claim of discovering just one inappropriately booked deal, the BaFin press release states that the regulator has evidence related to multiple contracts.

One analyst from MWB Research has described the investigation as a “manageable technical issue” stating that it “may weigh on sentiment.”[1]

MWB research note, October 27, 2025. ↩︎

Our research, based on multiple interviews with several former senior leaders from Gerresheimer, indicates that the bill-and-hold issue could be more prevalent than management has indicated.

A former Gerresheimer employee told us that the company initially used bill-and-hold at the “wish of the customer,” but then began to push it on customers to meet internal KPIs.

“It was correctly, according to IFRS-15, to execute the bill-and-hold agreement because it was explicitly the wish of the customer … but I had the feeling then, after this was made this round with the management, they started to use it when they get under pressure, when the KPIs were not meant, and tried maybe to convince customers to, or more customers, to agree on that agreement.”

The former employee explained that Gerresheimer developed bill-and-hold “templates” for customers to agree to that would allow Gerresheimer to be technically compliant with IFRS-15 requirements, even when those requirements were not actually met.

“Because templates were shared where a customer could just agree on a certain PO that these are the requirements. So, they signed, at least, all the IFRS-15 requirements, which are needed to fulfill the bill-and-hold agreements, they signed it. I don’t why, to be honest, I was not in negotiations … I think [redacted] opened a door to the devil’s, how do you say, and they just try to make use of it to make the KPIs.”

“Because, normally, if you sign it, then it’s only for 1-2 months, then you put it in your warehouse for 1-2 months until the customer can pick it up … but I guess at the end of ‘24, there was a lot of pressure on the KPIs, and then they just did it also with customers and not really fulfilled all of the IFRS-15 requirements, like for example the declaration that it’s really property of the customer.”

A former senior executive told us this was a “common practice” across all businesses at Gerresheimer and confirmed this was happening in response to market softness in an attempt to “mask the topline,” and provided an illustrative example of how it works.

“So what Gerresheimer did was, ok, Mr. Customer, ‘I am going to bill you, instead of the 80 million, I’m going to bill you 90 million, and I’m going to hold, in my facility, so I’m going to hold the ten million pieces that you don’t want this year.’ That’s exactly what’s going on … it was a common practice all across the businesses, all across the businesses. And what they wanted to do was to mask their topline.”

The former executive said that bill-and-hold was going to “bite” Gerresheimer eventually, because “you cannot continue doing this forever.”

“You cannot fight the demand. You cannot fight against the demand. Right. The market demand. So at a certain point that practice, and this is something that I told the guys, the practice of billing and holding is going to bite you at a certain point in time, because you cannot continue doing this forever.”

During Gerresheimer’s Q3 earnings call, a UBS analyst asked a very direct question to management about the nature of its bill-and-hold arrangements.

“Firstly, on the news flow two weeks ago, could you perhaps confirm that the bill-and-hold transactions that are subject of the current BaFin audit were at the customer request?”

Rather than simply answering “yes,” Gerresheimer CFO Wolf Lehmann stated that the company believed it followed the “rules and regulations,” and stated that the transactions in question amounted to less than 2% of annual revenue.