From Moscow To TJ Maxx — How Brunello Cucinelli Continues To Lie About Its Russian Business While Aggressive Discounting Damages Its Exclusive Positioning

Introduction

- Brunello Cucinelli (BIT: BC, US OTC: BCUCY) is a €7 billion ($8.2 billion) high-end Italian “quiet luxury” fashion brand. It was founded in 1978 by company namesake and current Chairman Brunello Cucinelli, who has been described as a “philosopher-saint” and who leads the company based on his philosophy of "Humanistic Capitalism.”

- 5 days ago, the Financial Times reported on allegations from hedge fund manager Pertento Partners that Cucinelli continues to operate in Russia in violation of EU sanctions on luxury goods. In response, Cucinelli claimed that its Russian stores are shut, that its Russian sales have declined from 9% of total revenue in 2021 to just 2% today, and that these limited sales are compliant with EU sanctions.

- Our investigation, spanning over three months and involving interviews with former Cucinelli employees and partners, an extensive analysis of trade data, and visits to Cucinelli’s Russian stores, casts doubt on Cucinelli’s claims, and reveals that Cucinelli has misled shareholders. We found that Cucinelli continues to operate several stores in Moscow with a wide offering of items priced at thousands of euros.

- We also highlight that Cucinelli has resorted to aggressive discounting to manage bloated inventory that dwarfs direct peers, with items ending up in stores like TJ Maxx, risking dilution to the brand’s exclusive positioning.

- Even ignoring our findings, Cucinelli trades at ~46x next year’s earnings, a higher multiple than any luxury peer, despite slowing revenue growth, average operating margins, and rising competition from peers like Khaite and The Row, each reporting triple-digit growth.

- Further, Cucinelli is able to capitalize significant and growing rent costs under IFRS accounting standards. If one were to fully expense Cucinelli’s rising rent costs, EBITDA would be 36% lower than the reported number and year on year growth falls from 12.9% to 6.7% in the first half of 2025.

Brunello Cucinelli’s Substantial Ongoing Russian Business

- In 2020, Chairman Cucinelli told shareholders Russia was an “extremely important” market, and by 2021 Russia had grown to 9% of the company’s total revenue. A former Cucinelli executive told us that Russia was “absolutely exploding” in 2021, with the company making significant investments in continued expansion.

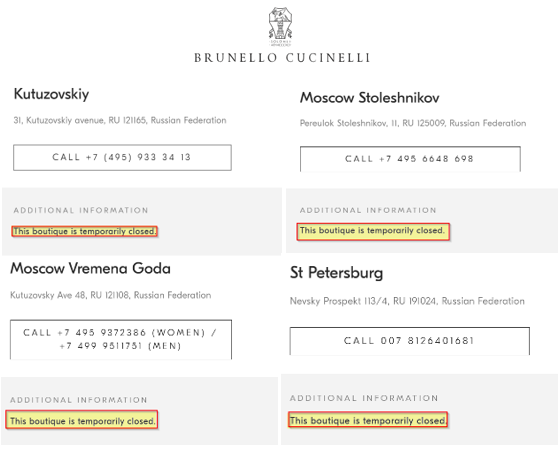

- After Russia invaded Ukraine in 2022, the European Union prohibited the export of luxury goods over €300 to Russia, leading many luxury brands to close their Russian stores, including Brunello Cucinelli, whose stores ostensibly remain closed today, according to its website.

- Further signaling its exit from the Russian market, Cucinelli projected that Russian sales would decline to just 4% of revenue in 2022, also disclosing a full write–down of goodwill in its Russian subsidiary. By the end of 2023, it stopped disclosing Russian sales altogether, seeming to imply that they were immaterial for shareholders.

- Chairman Cucinelli’s industry associations support a strong stance against Russia, such as his membership of the Council for Inclusive Capitalism, which has applauded the business community's response to Russia’s invasion, saying that it shows that “short-term profits matter less” than supporting Ukraine.

- Despite losing the majority of its “exploding” Russian market and a wider luxury industry slowdown, Cucinelli has continued to report double-digit revenue growth and its stock has outperformed virtually every luxury peer, with Cucinelli claiming that sales in other regions have allowed it to “more than cover the effects of the restrictions applied to the Russian market.”

- In August 2024, a Russian model uploaded a video to Instagram claiming that Cucinelli’s Moscow store was open, serving customers, and stocked with the latest collection. The post prompted an investigation from the Daily Mail, to which Cucinelli’s spokesperson responded that its employees were “only providing customer care and style advice to our loyal customers,” and that the company complied “with all existing regulations.”

- Last week, Cucinelli’s CEO seems to have contradicted these claims by stating that, while its boutiques are closed, its Russian staff currently engages in “one-on-one sale activities” in its showroom that are limited to what can “legally be sold,” per the Financial Times report mentioned above.

- The CEO also stated that exports to Russia declined significantly from 2021 to last year and that the region now represents just 2% of sales, down from 9% in 2021, stating that he hopes these figures put the Russia story “into perspective.” We find these claims difficult to reconcile with our on-the-ground investigation and analysis of thousands of trade records, which seem to point to an expansion of Cucinelli’s Russian business, rather than a contraction.

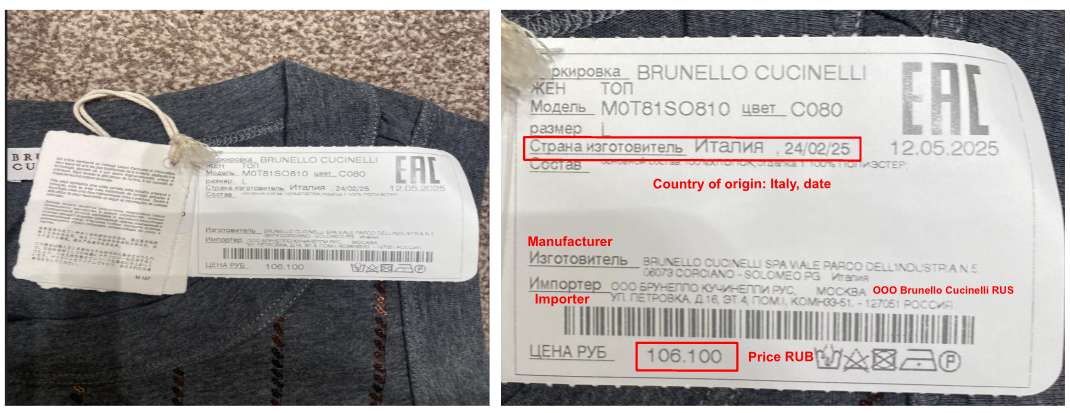

- Despite Cucinelli CEO’s claims of store closures, we sent secret shoppers to some of Cucinelli’s Moscow stores in August and September 2025 who confirmed that the stores are open and selling multi-thousand euro luxury goods. Notably, the tags on many of these garments reveal that they had been manufactured in Italy in either 2024 or 2025, years after EU luxury sanctions were imposed.

- Our shoppers made multiple purchases, with the sales receipts being issued by Cucinelli’s Russian subsidiary.

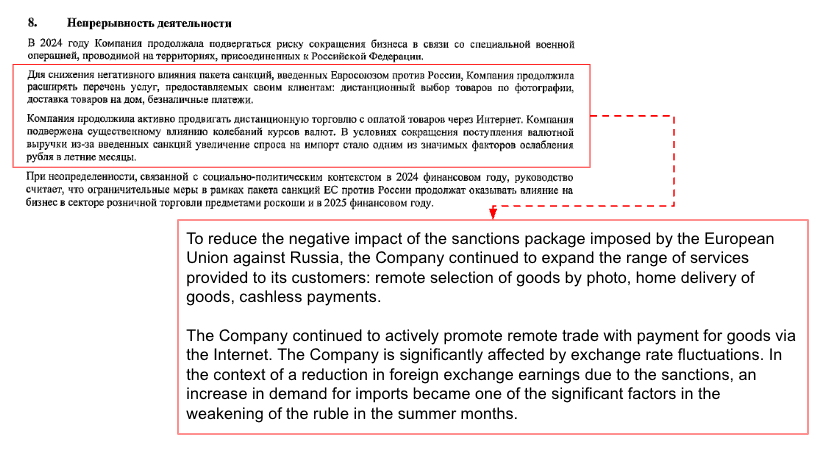

- We obtained financial statements from Cucinelli’s Russian subsidiary that reveal the entity generated ~€15 million in sales in both 2023 and 2024, despite the key stores it operates purportedly being closed. The subsidiary’s financial statements reveal a strategy to “reduce the negative impact of sanctions” by continuing to sell through “remote trade” and “home delivery.” As detailed below, we believe this represents just a portion of the revenue Cucinelli is generating from Russia.

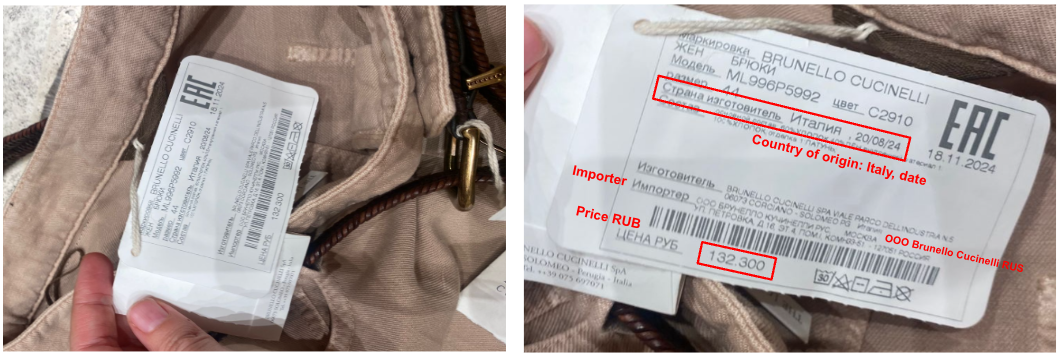

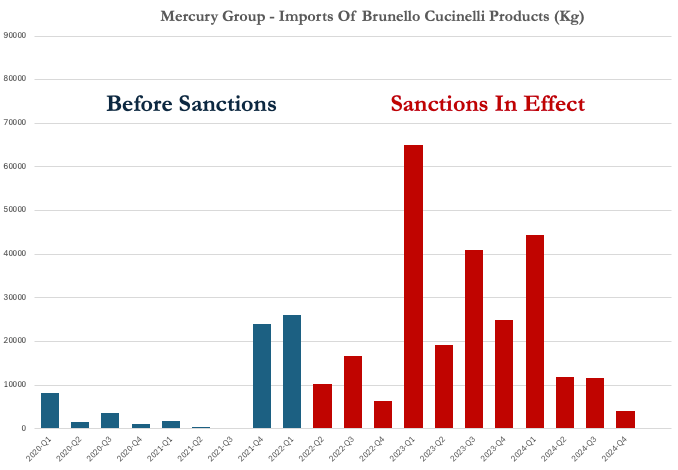

- Trade data indicates that Cucinelli grew its exports after sanctions were imposed. From 2021 to 2023, Cucinelli’s exports to its Russian subsidiary skyrocketed by an estimated ~715% in weight terms. Although some of this increase could be due to a higher volume of lower priced items, such a dramatic increase is strange in the context of Cucinelli’s apparent store closures in Russia.

- A former Cucinelli executive told us that Chairman Cucinelli wanted to “stay neutral” and “continue to trade” with Russian partners, describing the Russian market as a “delicate topic.”

- Notwithstanding the former executive’s admission, the market seems largely unaware of the sheer scale of Cucinelli’s Russian business. We interviewed an industry veteran who works directly with Cucinelli, who was completely unaware that it continues to sell in Russia. They told us: “I mean everywhere I worked we had to stop shipping to Russia and it was a significant loss … that’s actually super surprising that they’re doing that… Hence the double digit increases quarter over quarter, they haven’t lost that huge chunk of business like everyone else did.”

The Intimate Partnership With The Mercury Group In Russia

- In addition to selling through its own Russian stores, Cucinelli also sells through high-end stores like TSUM, controlled by Russian luxury conglomerate Mercury Group, which appears to be supporting Cucinelli’s growth in the region in spite of EU sanctions.

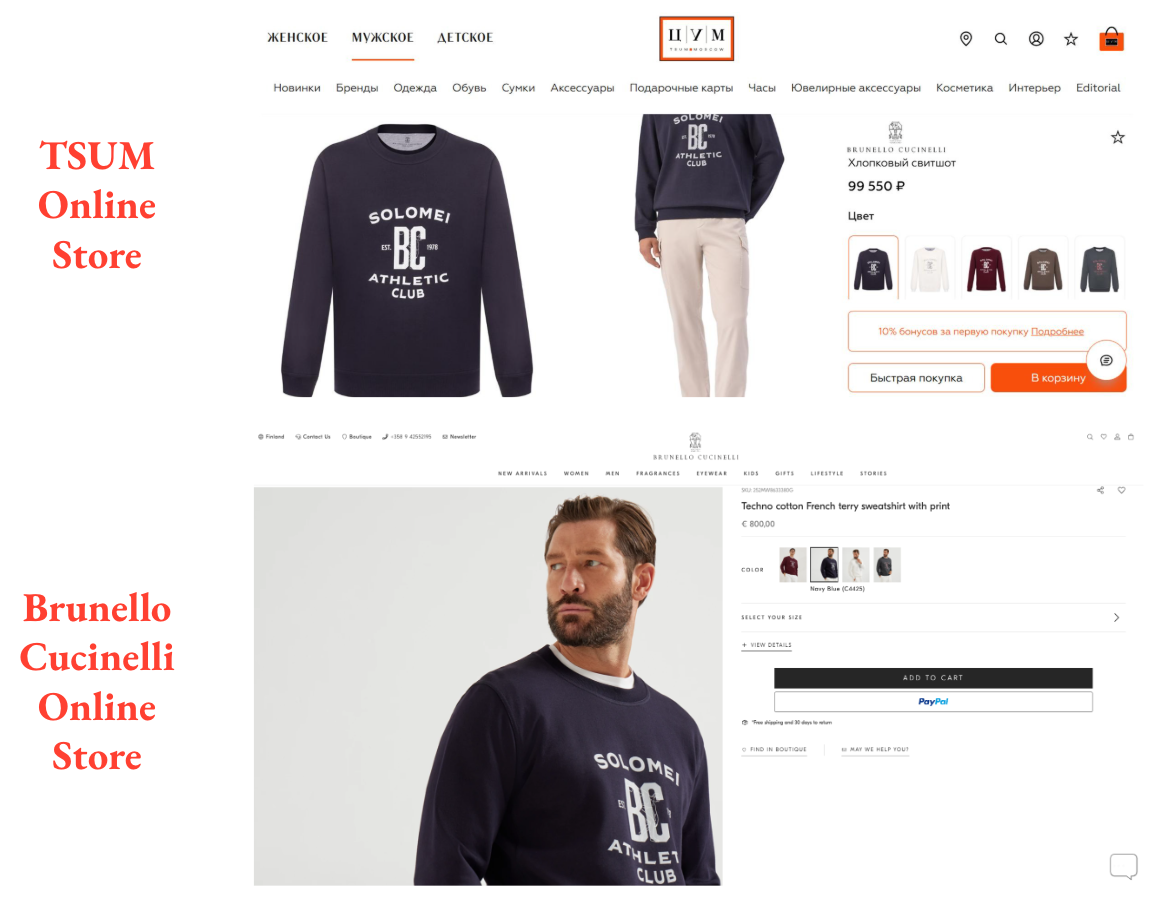

- Our secret shoppers visited TSUM’s flagship store, which had a dedicated Cucinelli area, and documented numerous Cucinelli products for sale, including items manufactured in 2025 selling for the equivalent of €5,000.

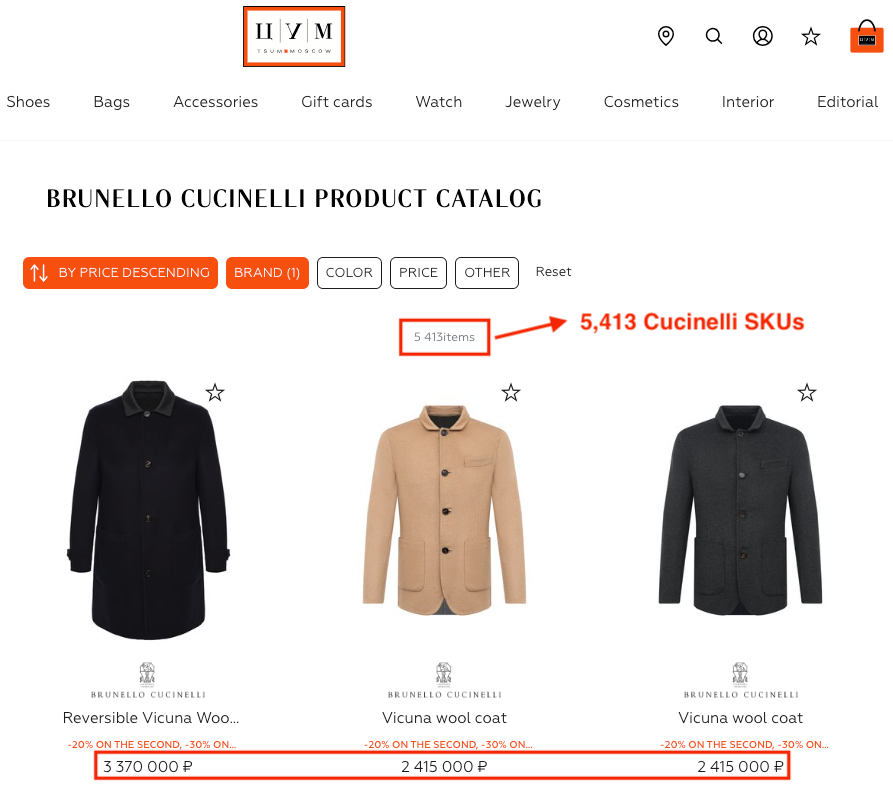

- TSUM’s online store currently features 5,000+ Cucinelli SKUs, significantly more than direct peer Loro Piana at just ~97 SKUs. Among TSUM’s online offerings, we found Cucinelli garments selling for up to €30,000.

- Rather than halting sales to TSUM’s parent company Mercury when sanctions were implemented, Cucinelli appears to have accelerated its exports by 470% between 2021 and 2023 on a weight basis, according to trade data provider Tradesparq. In 2023, Cucinelli exported an estimated 150 metric tons of product to Mercury.

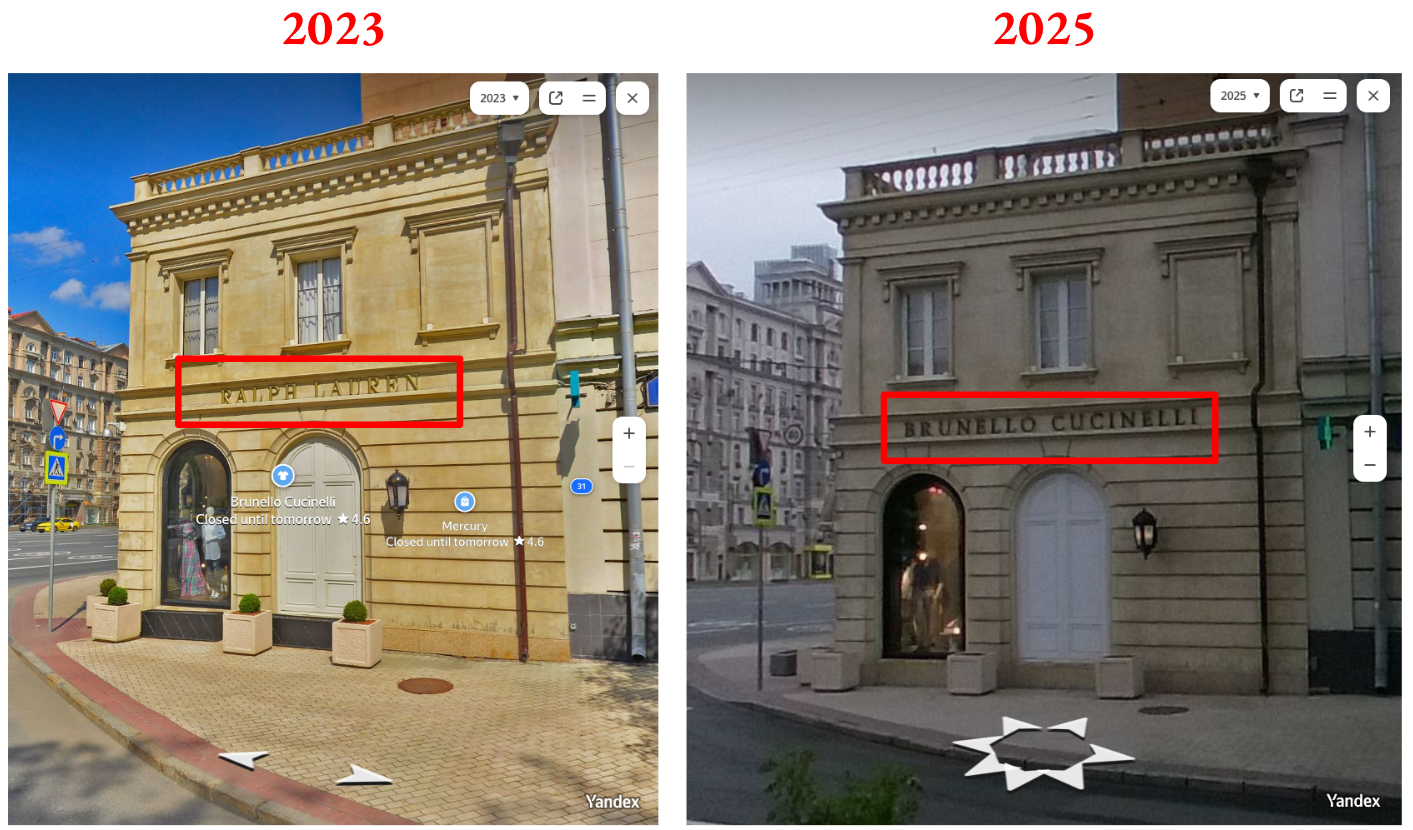

- Further, in the midst of sanctions, Cucinelli appears to have relocated a store in Moscow in partnership with Mercury, taking over a space left vacant by Ralph Lauren after it exited the Russian market, per street photos from Yandex.

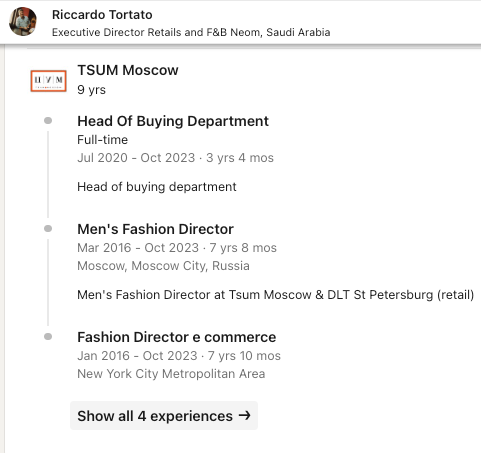

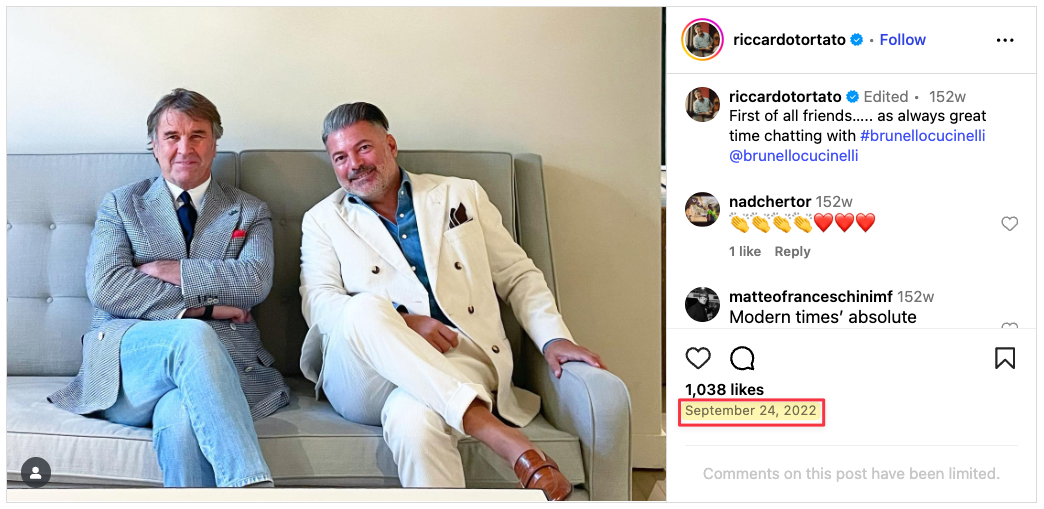

- Chairman Cucinelli also appears to be close personal friends with the former head buyer from Mercury’s flagship TSUM department store. Numerous social media posts show the two men together, with the former head buyer referring to Chairman Cucinelli as “the first of all friends” and “my dear @brunellocucinelli.” One meeting appears to have occurred just ~6 months after EU luxury sanctions came into force.

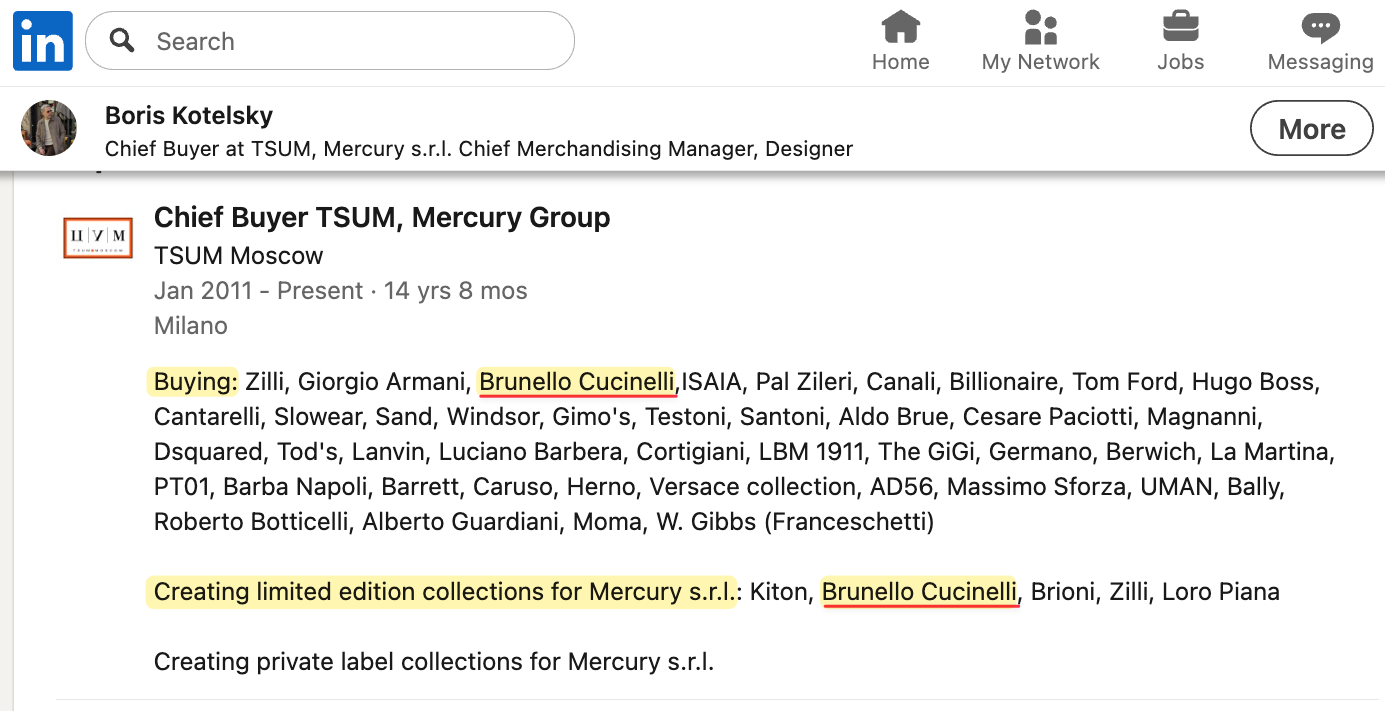

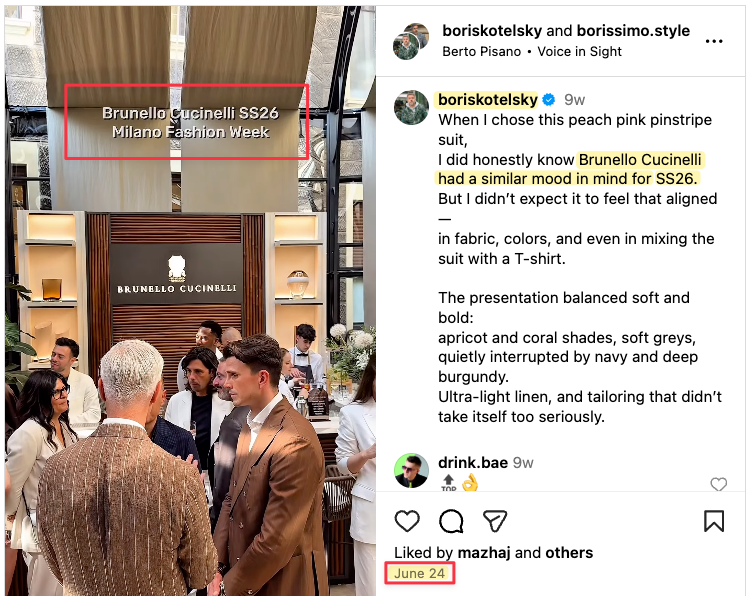

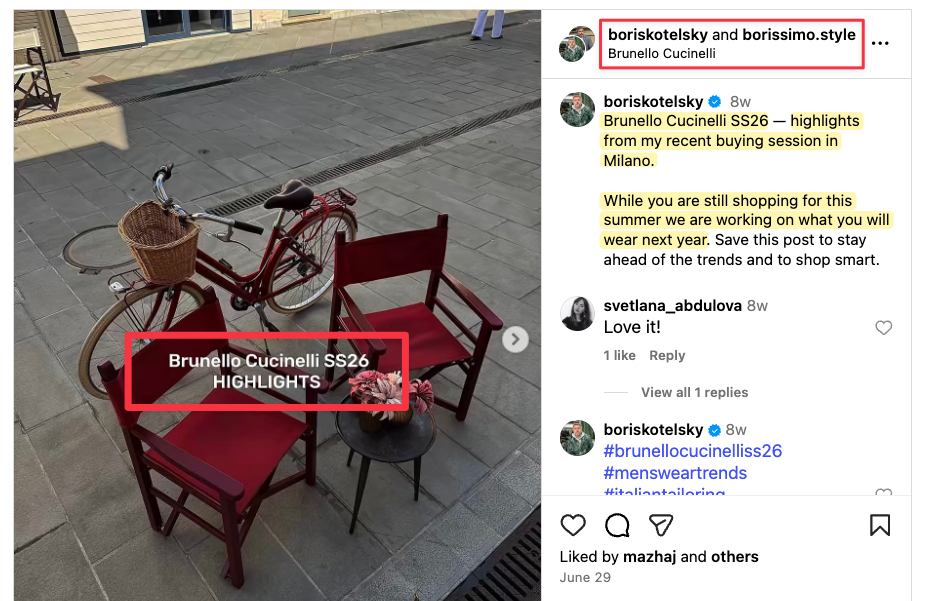

- TSUM’s current Chief Buyer also posted a photo with Chairman Cucinelli in January 2025. More recently, in June 2025, the Chief Buyer attended Cucinelli’s events at Milano Fashion Week, which included a “buying session” of Cucinelli’s spring/summer 2026 collection, per his Instagram posts. This seemed to include the purchase of suits, the lowest retailing for €4,000 on Cucinelli’s EU site.

- Based on these relationships, we find it highly unlikely that Chairman Cucinelli is unaware of his own company’s continued business relationship with Mercury Group, through which large volumes of luxury goods continue to flow to Russia, many selling for the equivalent of thousands of euros.

Third Party Exports of Cucinelli’s Products Into Russia

- The EU has specifically prohibited circumvention of sanctions through third-parties, with criminal penalties in Italy including up to 6 years imprisonment. Even without these serious penalties, we would expect a luxury brand like Cucinelli to have control and exercise caution over where its products end up and to whom they are sold.

- In response to allegations that Cucinelli ships to Russia via intermediaries, Cucinelli’s CEO told the Financial Times that the company was not aware of any “triangulation” and that “internal checks … never highlighted anomalies."

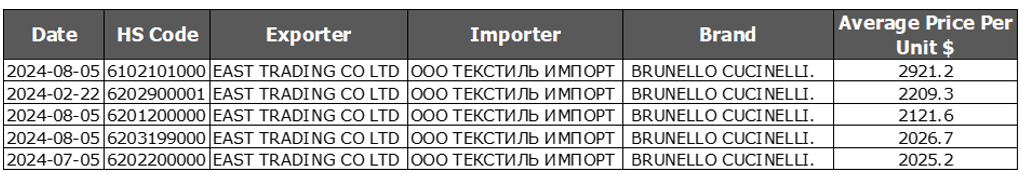

- We question the thoroughness of Cucinelli’s “internal checks,” given that publicly-available records reveal that obscure intermediaries in countries like Lithuania, Iran, and China have exported an estimated ~60 metric tons of Cucinelli’s products to Russia since sanctions were imposed, according to trade data.

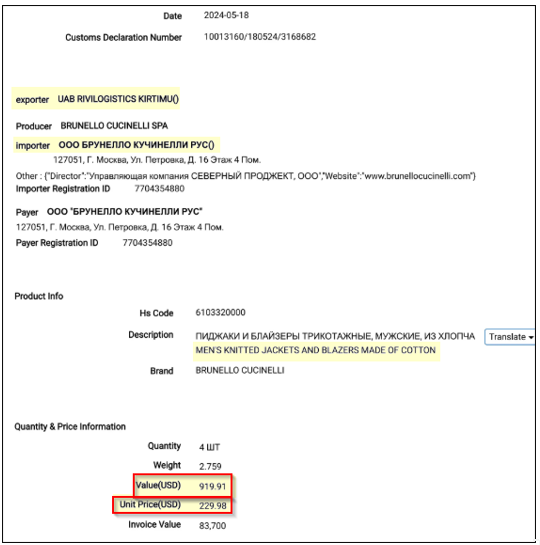

- For example, in May 2022, just two months after the EU imposed sanctions on luxury goods, Cucinelli’s Russian subsidiary started importing products indirectly through a Lithuanian entity called “RIVI Logistics,” which has since moved an estimated ~26,000 kilograms of Cucinelli products into Russia, based on trade data.

- Many products appear to have artificially low declared values on export documents in a potential attempt to circumvent sanctions. For example, Cucinelli jackets declared at less than €300 while the lowest priced jacket on Cucinelli’s entire website is currently selling for €1,990 .

- From August to October 2024, a Hong Kong entity called “Yinshang Trading” shipped 20,000 kilograms of Brunello Cucinelli branded clothes to an importer in Russia. Yinshang’s parent company shared an office with an entity that has been sanctioned by the U.S. government for supplying sensitive electronics to Russia.

- Beginning in July 2024, Iranian hydroponics company “Aras Tarla Amir” began facilitating Cucinelli exports to Russia, totaling 4,012 kilograms of product. The trade records for these shipments reveal that the product values are often far in excess of the EU’s €300 threshold. Many of these shipments disclose the loading place as Belarus, another country now under EU luxury goods sanctions.

- These are just a few examples of intermediaries seemingly moving metric tons of Cucinelli product into Russia. Overall, our report details 8 examples of these intermediaries.

Inventory & Brand Dilution

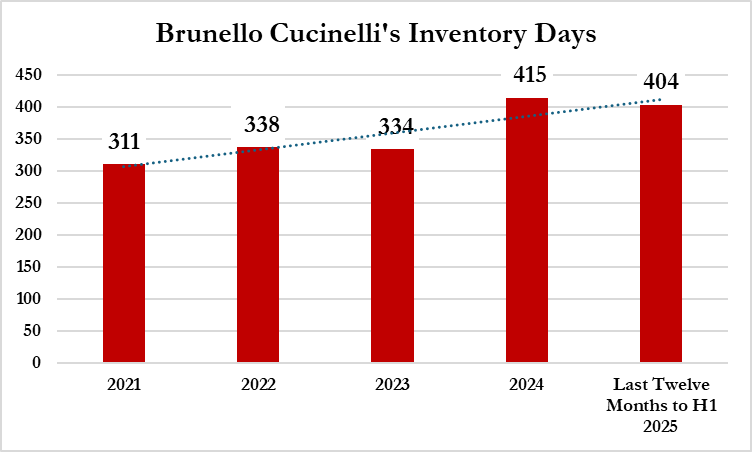

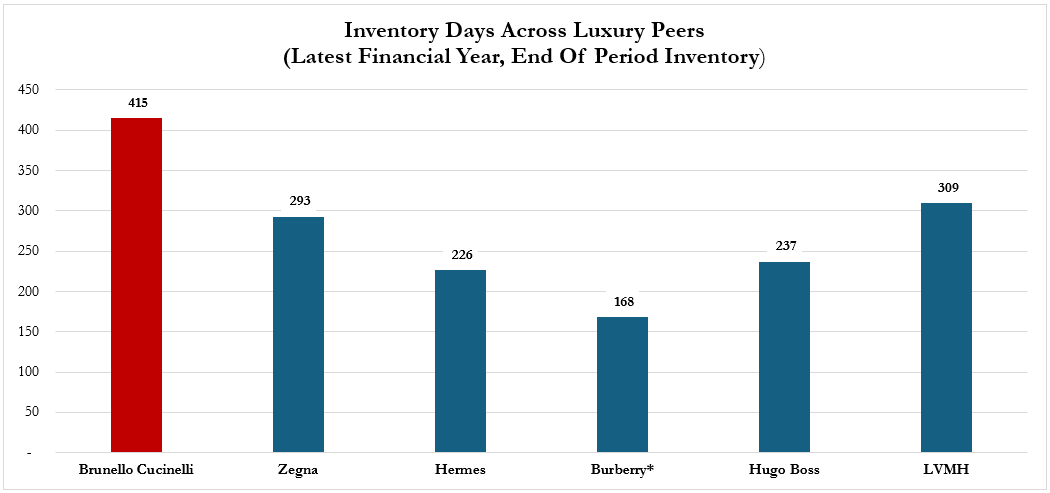

- While Cucinelli claims that its inventory levels are “healthy in relation to our collection offering,” it holds significantly more inventory than any of its luxury peers. For the twelve months to 1H 2025, we calculated 404 days of inventory, higher than the peer average of 247 days in the latest financial year, and the highest of any luxury peer we could identify.

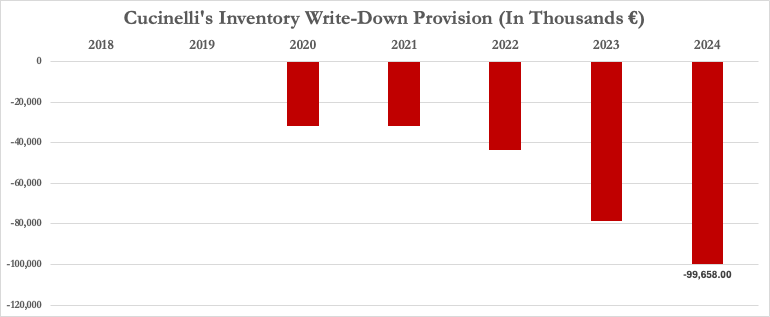

- From 2014 - 2019, Cucinelli stated in its annual reports that it does not make write-down provisions for obsolete inventory due to the company’s efficient process of selling and disposing of residual items. Yet, Cucinelli has recorded accelerating inventory write-down provisions every year since 2020, peaking at nearly €100 million in 2024.

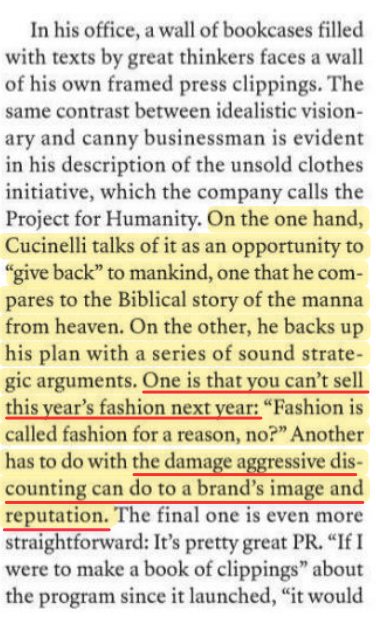

- Chairman Cucinelli has stated that you can’t sell this year’s fashion next year, arguing that donating clothing is superior to discounting due to the damage aggressive discounting can do to a brand’s image and reputation, per a 2020 interview. Despite this, we found thousands of Cucinelli SKUs being sold at aggressive discounts across multiple 3rd party online outlets, dwarfing the volume of discounted items we found from peers such as Loro Piana.

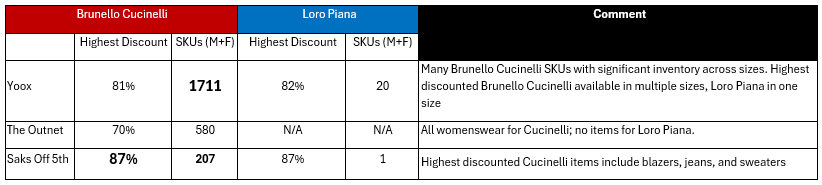

- Across U.S. discount websites Yoox, The Outnet, and Saks Off 5th, we identified ~2,500 Cucinelli SKUs being offered at up to -87% discounts, relative to just ~21 SKUs from Loro Piana on the same platforms in September 2025.

- Cucinelli’s products are even available at TJ Maxx, where we identified at least 32 different SKUs that appear to have deep availability based on many different sizes being offered. Meanwhile, we were unable to find a single item from Loro Piana on TJ Maxx’s US website. In our report, we detail numerous social media posts featuring shoppers who were surprised to find Cucinelli products at TJ Maxx.

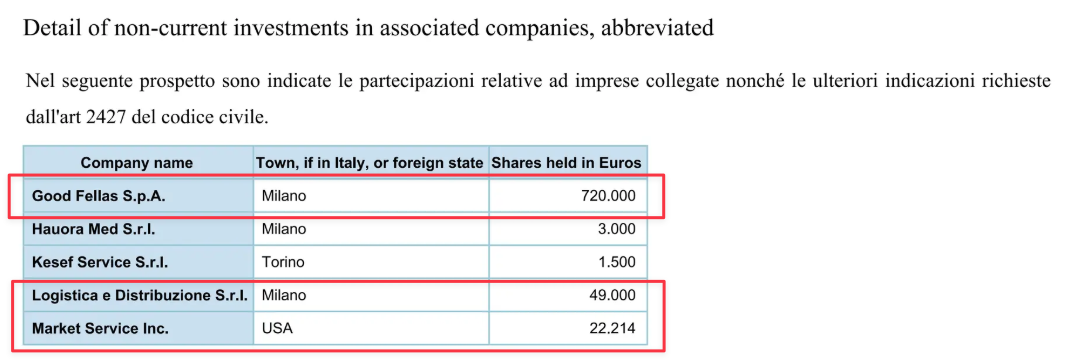

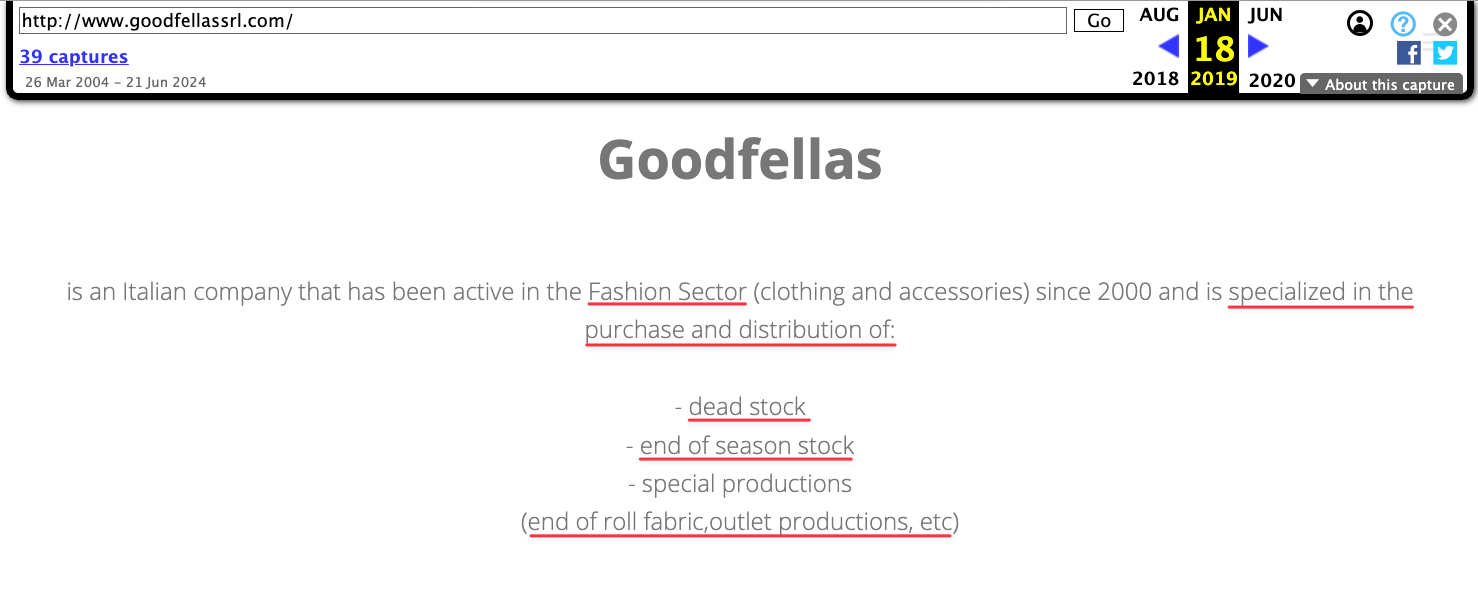

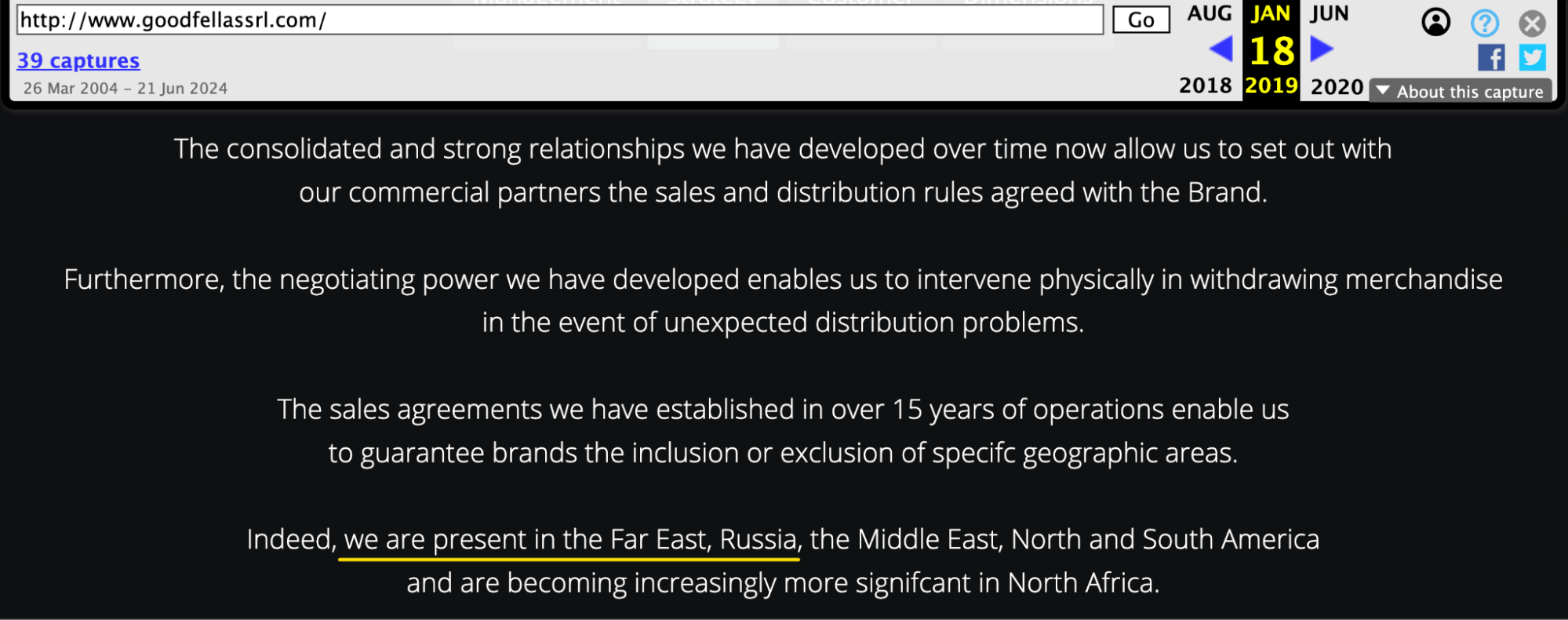

- Since 2019, Cucinelli has partnered with undisclosed fashion liquidators, specialized in the purchase and distribution of end of season stock, according to Italian corporate records and archived websites. Through this partnership, dead stock reaches “remote places of the world,” including Russia, according to a former Cucinelli employee.

- A luxury consultant who knows Cucinelli personally told us, “And it's always a very bad sign when you are in outlets, because this means that you have overproduced, that your store cannot anymore absorb it, and that you need to write off your stock. Right. Which is a disaster. And it is what is happening to him. And it's a vicious circle.”

Conclusion

- Brunello Cucinelli and its founder have extolled the virtues of a new form of capitalism - more humane, more ethical - seemingly convincing the market to reward it with a significant premium that makes it the most richly valued luxury clothing brand in the world despite rising competition and slowing growth.

- Despite the virtue signalling, Cucinelli appears to have blatantly disregarded European law by continuing to sell ultra high-value luxury goods in Russia. At the same time, spokespersons for the company have made a series of contradictory and misleading statements about the operations in Russia, including that its stores are closed or its staff is simply providing style and advisory services, which the evidence from our on-ground investigation contradicts.

- After extensive review of trade records, which show increasing volume of Cucinelli’s products flowing into Russia post-sanctions, we think investors should heavily scrutinize Cucinelli’s claims of diminishing Russia trade.

- This continuation and apparent expansion in Russia may be an attempt to compensate for more fundamental problems within the company, including ballooning inventory. With products now found on the racks of bargain fashion discounters like TJ Maxx, brand dilution risks remain real.

- Chairman Cucinelli frequently discusses the idea of moral sustainability, including a focus on how “you should live with honesty.” In the spirit of this ethos, we believe shareholders deserve more honesty with respect to Cucinelli’s Russian operations and inventory management.

Initial Disclosure: After extensive research, we believe the evidence justifies a short position in shares of Brunello Cucinelli SpA (BIT: BC). Morpheus Research holds short positions in BC. This report represents our opinion, and we encourage all readers to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Background: A €7 Billion Family-Led Italian Luxury Fashion Company, Founded By A “Philosopher-Saint” Advocating And Recognised For “Humanistic Capitalism”

Brunello Cucinelli (Euronext Milan: BC, US OTC: BCUCY) is a high-end luxury Italian fashion brand, headquartered in Solomeo, a small hamlet in Umbria, a region in central Italy.

The company was founded in 1978 by company namesake, Brunello Cucinelli, who currently serves as Executive Chairman and Creative Director of the company.

Cucinelli’s business strategy largely revolves around “Humanistic Capitalism,” the personal business philosophy of its founder, who has been described as a “fashion entrepreneur/philosopher-saint” by Forbes.

Brunello Cucinelli has personally received a myriad of awards and accolades in Italy and around the world for his humanistic capitalism and business success.

Recently, these include the Neiman Marcus Award for Distinguished Service in the Field of Fashion (2023) and WWD John B. Fairchild Honor Award (2024), the latter in recognition of “consistent dedication to artistry, creativity, craftsmanship, exclusivity, and human dignity,” per Cucinelli's biography.[1]

Mr. Brunello Cucinelli’s vision for Humanistic Capitalism has been widely covered by major publications such as Financial Times, Fortune, and GQ. ↩︎

The company went public on the Borsa Italiana, Italy’s stock exchange, in 2012.

Cucinelli’s family members occupy key roles in the company, including his two daughters, who are board members and were promoted to Vice President roles in July 2024, according to their corporate bios. Both of their husbands are board members of the company, one of whom serves as Cucinelli’s co-CEO.[1]

Brunello has two daughters, Camilla and Carolina, according to the company website. Carolina married Alessio Piastrelli, per The New York Times. Piastrelli joined Brunello Cucinelli in 2007 and has been a board member of the company since April 2023, per the company’s website. Brunello’s co-CEO, Riccardo Stefanelli, is married to Camilla, according to Robb Report, a luxury lifestyle magazine in the U.S. Stefanelli joined the company in 2006 and was appointed board member in 2011, according to his corporate bio. ↩︎

Cucinelli is often described as operating in the space of “quiet luxury,” where flashy branding and conspicuous consumption are deemphasized, per fashion magazine The Walk.

While the company initially specialized in cashmere items, it has expanded to include a range of “lifestyle,” “ready-to-wear,” and “casual chic” items for both men and women, per its press release and website.

Today, Cucinelli operates 130 stores directly and an additional 51 locations within third-party department stores, with retail driving 63.7% of sales and wholesale making up the remainder in the first half of 2025. Its largest market is the Americas, accounting for 35.8% of total sales in the same period. [Pg. 6]

Fundamentals: Cucinelli Trades At ~46x Next Year Consensus Earnings, A 105% Premium To Peers, Despite Facing Rising Competition From Faster Growing “Quiet Luxury” Peers

Even if the market were to ignore the findings of our investigation, a fundamental downside risk for investors is the extremely rich premium at which Cucinelli trades, seemingly requiring flawless execution to meet targets as it continues to pursue double-digit revenue growth.

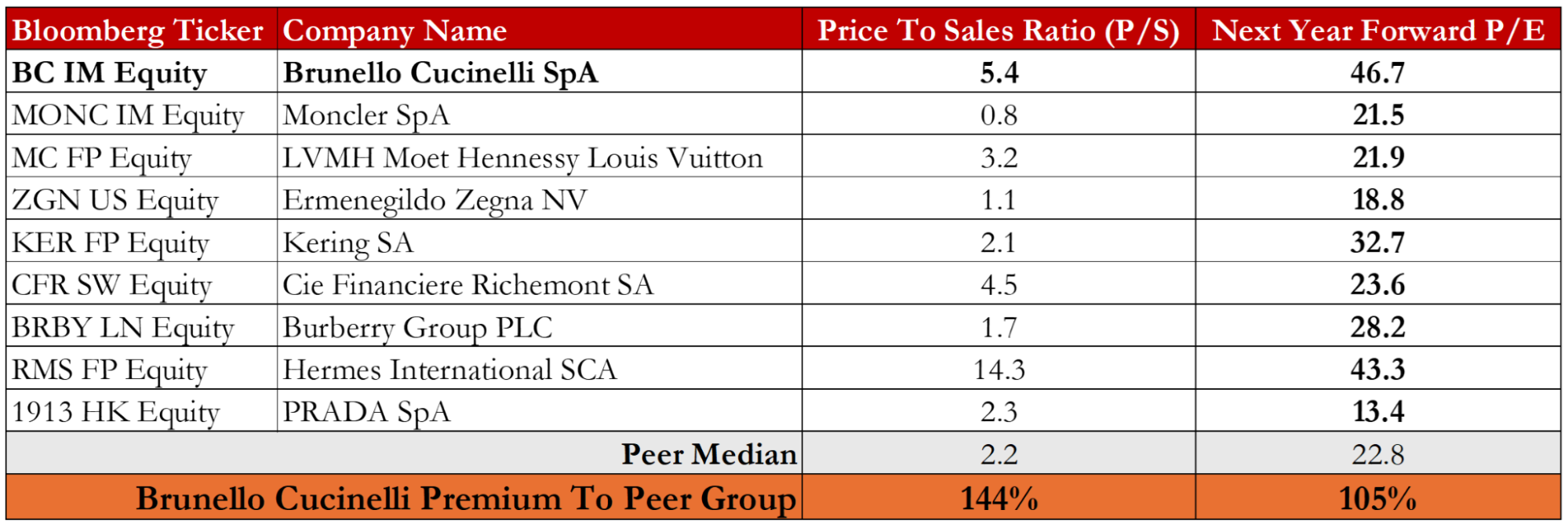

The company is currently valued at 5.4x sales as of September 23, 2025, more than double the peer median of 2.2x sales. On a price-to-earnings basis, Cucinelli is the most richly valued of all luxury clothing companies, trading at ~46x next year forward earnings, per Bloomberg, a 105% premium to its peer median.[1]

Use Bloomberg field: EE010 - Est P/E Next Year (EST_PE_NXT_YR). ↩︎

Cucinelli’s operating margins of 16.6% are significantly lower than similarly valued peer, Hermes, which has best in class operating margins at 41.4% in H1 2025. [Pg. 2]

Cucinelli appears to be a valuation outlier.[1]

We used this same peer set as RBC in its initiation report “A Premium Price Tag” from May 12, 2025. ↩︎

Cucinelli’s profitability, on an EBITDA basis, is also materially worse when one accounts for its full rent costs, which are up 20% YoY in the first half of 2025. [Pg. 17]

Under IFRS-16 accounting standards, much of Cucinelli’s rent cost is excluded from EBITDA. After expensing the full amount of rent cost, Cucinelli’s EBITDA is actually 36% lower and year on year growth falls from 12.9% to 6.7% in the first half of 2025.[1]

Accounting Age, an online trade publication for accountants, explains the accounting changes around rental costs necessitated by IFRS-16 accounting standards. Previously, all operating lease commitments were recognized as operating expenses. Cucinelli acknowledges the impact in its annual reports. (Pg. 56) EBITDA under IFRS 16 was €200.7 million in H1 2025 and rent cost was €104.7 million (of which €31.8 million is already expensed). (Pg. 43) Removing the remaining €72.9 million leaves resultant EBITDA of €127.8 million. The same calculation can be done for H1 2024: EBITDA under IFRS 16 was €177.8 million and rent cost was €87.2 million (of which €29.2 million is already expensed). (Pg. 43) Removing the remaining €58 million leaves resultant EBITDA of €119.8 million, implying 6.7% YoY growth. ↩︎

Against the backdrop of its elevated valuation and slowing profitability, Cucinelli faces fierce competition in its core U.S. market from faster growing peers such as Khaite and The Row, two newer quiet luxury brands reporting triple-digit sales growth.

Background: In November 2020, Chairman Brunello Cucinelli Told Shareholders Russia Was An “Extremely Important” Market

By 2021, Russia Had Grown To 9% Of Brunello Cucinelli’s Total Revenue, And Was Described To Us By A Former Cucinelli Executive As “Absolutely Exploding”

Historically, Russia has been a critical growth market for Cucinelli, according to the company’s public disclosures and our interviews with former employees.

During Cucinelli’s Q3 2020 conference call, Chairman Brunello Cucinelli described the Russian market as “extremely important” with “marvelous” clients:

“When we talk about Russia – by the way, we do not just talk about St. Petersburg and Moscow that we all know, that's the former Soviet Union– that is extremely important to us. So we are talking about marvelous clients.”

By 2021, Russia had grown to 9% of revenue, with the company noting “considerable increases” in sales in the region, per its 1H 2021 results presentation.

A former Cucinelli executive we interviewed echoed this sentiment, telling us that Russia was “absolutely exploding” in 2021, and that Cucinelli was making significant investments in expansion.

“There was a lot of focus there [on Russia] because that area was absolutely exploding….We had direct stores. We had franchises with Mercury. We were building shop-in-shops, it was one of the biggest footwear businesses. So it was really booming.”

Cucinelli’s Russian business includes brick-and-mortar stores in cities like Moscow and St. Petersburg, which operate under the company's local subsidiary. It also includes relationships with retailers like TSUM, a department store chain that is owned by The Mercury Group, a Russian luxury goods conglomerate, per Business of Fashion.[1]

Background: After Russia Invaded Ukraine In Early 2022, The European Union Prohibited The Sale Or Export Of Luxury Goods Above €300 To Russia

In Response To The Russian Invasion And Subsequent EU Sanctions, Many Luxury Brands Closed Their Russian Stores, Including Brunello Cucinelli Whose Key Stores Ostensibly Remain Closed, Per Its Website

In March 2022, after Russia invaded Ukraine, the EU passed a package of sanctions that included a prohibition to “sell, supply, transfer or export” luxury goods whose value exceeded €300 to Russia, with the EU Commission president stating:

“ ... we will ban the export of any EU luxury goods from our countries to Russia, as a direct blow to the Russian elite. Those who sustain Putin's war machine should no longer be able to enjoy their lavish lifestyle while bombs fall on innocent people in Ukraine.”

Luxury brands were hard hit by the sanctions, with companies like Chanel, Hermes, and LVMH announcing a pause in Russian shipments “overnight,” and closing their Russian stores, per fashion magazine Vogue.

Brunello Cucinelli, which states that it operates in the “most exclusive segment of absolute luxury” and whose typical sale price is multiples higher than the €300 limit, reportedly closed its stores, per Fashion Network.[1]

Cucinelli’s decision to close its stores was also corroborated by Italian business and financial newspaper, Milano Finanza. ↩︎

“Since Putin’s invasion of Ukraine began on February 24, Brunello Cucinelli has closed down all three of its boutiques in Russia. And due to sanctions, like all Italian brands, the house can only sell products costing less than 300 euros to Russian consumers. Meaning nothing for most luxury marques.”

As of today, Cucinelli’s key stores in Moscow and St. Petersburg are still closed, according to the store locator available on its website.

In addition to closing its stores, Cucinelli fully wrote off the goodwill allocated to its Russian subsidiary, worth ~€7 million, according to its half-year 2022 financial report. [Pgs. 77-78]

Bull Case: Despite Apparent Loss Of The “Booming” Russian Market And A General Slowdown In Luxury, Cucinelli Continues To Report Double-Digit Growth, Significantly Outperforming Many Of Its Peers

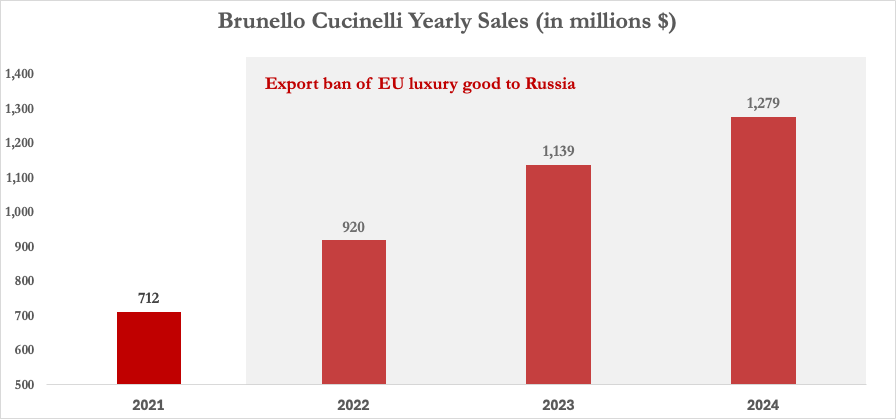

Despite Russia representing 9% of Cucinelli’s sales in 2021 and a “booming” growth opportunity, the sanctions and ostensible exit from the Russian market have not disrupted the company’s track record of double-digit growth.[1]

5-year revenue CAGR is 16%, per Bloomberg. ↩︎

Cucinelli claimed in its 1H 2022 report that growth in other regions has allowed it to “more than cover the effects of the restrictions applied to the Russian market.” [Pg. 12, Pg. 41]

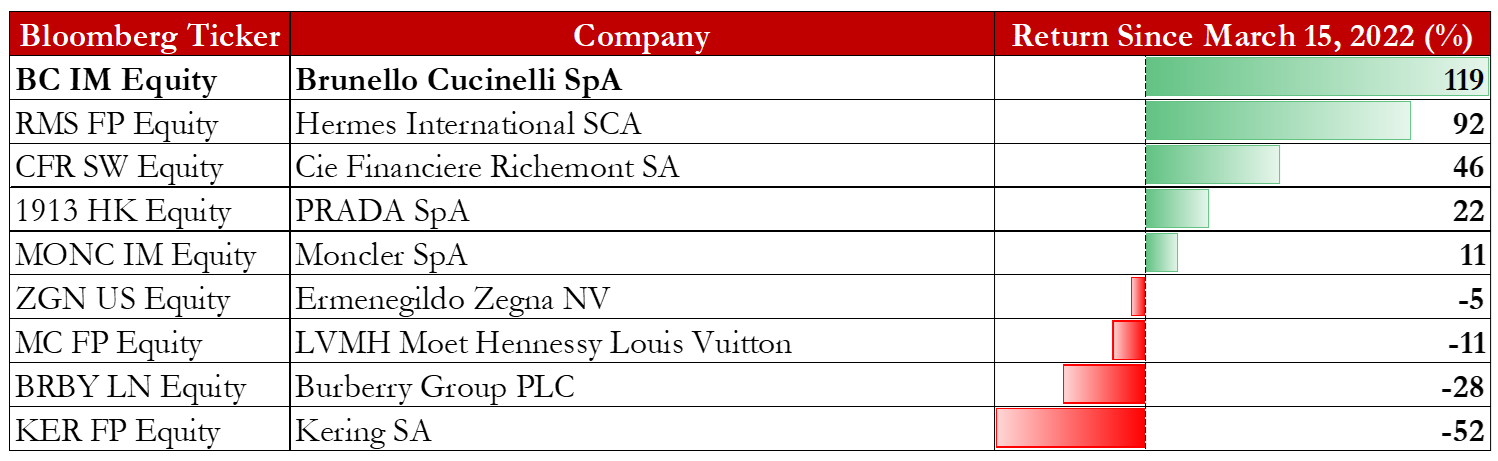

Since sanctions were implemented, Cucinelli’s share price has outperformed virtually every luxury peer.

Cucinelli’s growth is even more impressive considering that the luxury market is currently experiencing an industry-wide slowdown, with firms like Bain predicting negative industry growth in 2025.Looking forward, Cucinelli and sell-side analysts have guided for robust growth in the coming years.

For the remainder of 2025 and for 2026, the company confirmed its guidance of ~10% sales growth, per its Q1 2025 presentation.[1]

Sell side analysts have extrapolated Cucinelli’s guidance with market consensus estimates predicting another 5 years of consistent ~10% topline growth, according to Bloomberg. ↩︎

Part I: Cucinelli Appears To Be Skirting Sanctions And Misleading Investors About The True Scale And Legality Of Its Russian Operations

Based on Cucinelli’s claimed store closures, the write-down of goodwill in its Russian subsidiary, and its failure to disclose any sales from the Russian market in its annual reports, many investors may have been under the impression that the brand had exited the Russian market entirely.

This ostensibly strong stance against Russia is reinforced by the many industry associations maintained by Chairman Cucinelli, as well as Brunello Cucinelli’s board of directors. For example, Chairman Cucinelli is a prominent member of the Council for Inclusive Capitalism, which stated in 2022:

“The private sector’s public response to Russia’s invasion has been a remarkable show of leadership. It shows that business leaders understand the corrosive effect of international law violations to their companies, the markets they operate within, and their customers …

Furthermore, these actions show that short-term profit matters less than acting to protect the stronger, dynamic economies and societies that provide the foundation of sustainable growth.”

Likewise, Chairman Cucinelli is currently slated to receive the Outstanding Achievement award from the British Fashion Council, which has asked those in its network to condemn the Russian invasion.

“We encourage all those in our network to show their support, however they can, for the global campaign condemning Russia’s invasion of Ukraine.”

Brunello Cucinelli’s board of directors also includes F1 CEO Stefano Domenicali, who has taken a particularly strong stance against Russia, vowing to “never” return to the Russian market, per Reuters.

“Formula 1 CEO … Domenicali said the sport has no intention of returning to the country. ‘I've always believed that you should never say never,’ Domenicali told Sport Bild magazine, per GrandPrix.com. ‘But in this case, I can promise for sure – we will no longer negotiate with them.’”

As detailed below, after facing allegations of continued sales in Russia, Cucinelli has attempted to minimize the reality of its Russian operation, which unbeknownst to investors, appears to have continued to grow after EU sanctions were implemented.

The sheer scale and intentionality of this expansion is demonstrated by our review of tens of thousands of trade records, our interviews with former Cucinelli employees, the scraping of social media posts, and an on-the-ground investigation in Russia.

In October 2024, Cucinelli Denied That It Was Selling Its Products In Russia By Saying That “[Local Employees] Are Only Providing Customer Care And Style Advice To Our Loyal Customers”

In A Contradictory Statement In September 2025 Cucinelli’s CEO Said Its Russian Staff Are “Currently Engaged In One-On-One Sales Activities In Our Showroom And The Product On Sale Is Limited To What Can Legally Be Sold”

In October 2024, The Daily Mail, published an investigation alleging that luxury brands were still selling their products in Russia.

As part of their investigation, The Daily Mail cited a social media post by Russian model Polina Pushkareva where she commented on a Brunello Cucinelli boutique in Moscow:

“This is Brunello Cucinelli’s store. It looks closed at first glance but when you come closer it’s fully lit up. It has all the clothes, all the accessories fully displayed. And all the mannequins wear the newest collection … I think they’re just selling shit under the table. Because there’s no fucking way they somehow imported the newest collection just for nothing.”

Through a spokeswoman, Brunello Cucinelli responded to The Daily Mail's investigation, which wrote:

"A spokeswoman for Brunello Cucinelli said 'We fully comply with all existing regulations', adding that their local employees ‘are only providing customer care and style advice to our loyal customers.’"

Less than a year later, in September 2025, an article by the Financial Times contained new allegations of EU sanctions breaches in relation to Russia — this time from a UK-based hedge fund short the stock, Pertento Partners.

Contrary to the previous statement to The Daily Mail, Brunello Cucinelli’s CEO, Luca Lisandroni, responded to the new allegations, stating:

“[Russian staff are] currently engaged in one-on-one sales activities in our showroom and the product on sale is limited to what can legally be sold.”

We find it odd that in less than a year, Cucinelli’s spokesperson went from saying that their Russian staff was only providing “customer care and style advisory” to being engaged in “one-on-one sales activities.”

Last Week, Cucinelli’s CEO Confirmed To The Financial Times That Its Russian Boutiques Were Shut

Reality Check: Cucinelli’s Russian Boutiques Are Still Open And Selling To The Public, According To Purchases Made By Secret Shoppers We Dispatched To Cucinelli Stores In Moscow During August And September 2025

Last week, Cucinelli’s CEO, told the Financial Times that its Russian boutiques were shut.

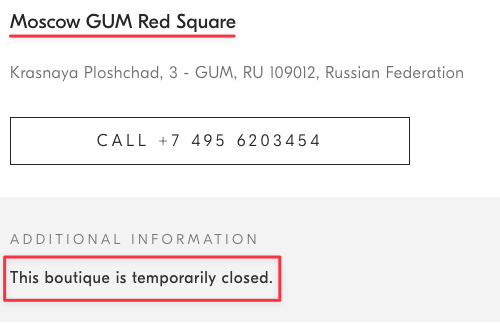

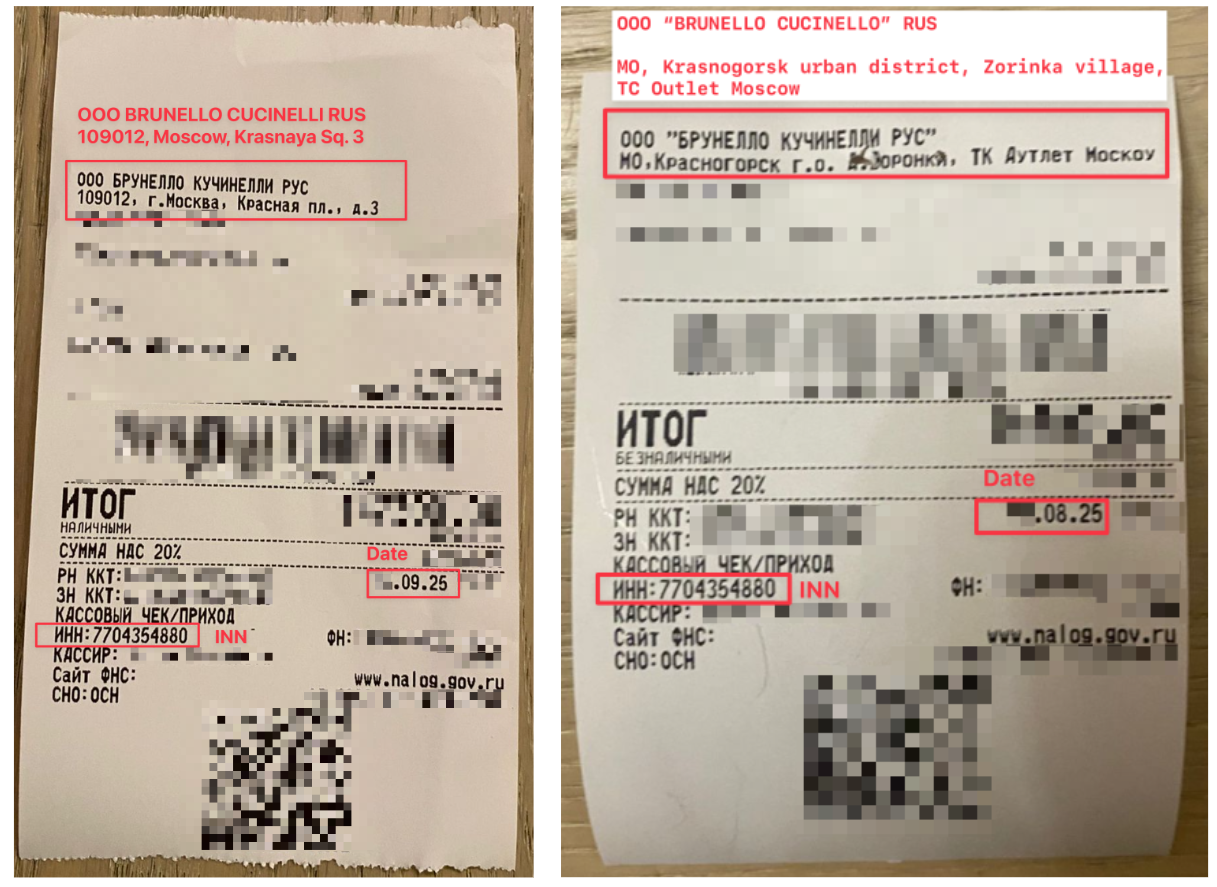

In August and September 2025, we dispatched secret shoppers to several Cucinelli stores in Russia, including its Moscow GUM Red Square store. Since at least December 2023, Cucinelli’s website shows that the store has been “temporarily closed,” per archived versions of its website.

Despite the CEO’s comments and Cucinelli’s website, our secret shopper was able to walk into the Moscow GUM Red Square store, where they found other customers inside.

Our secret shopper also visited one of Brunello Cucinelli’s Moscow outlets, where they were able to walk in.

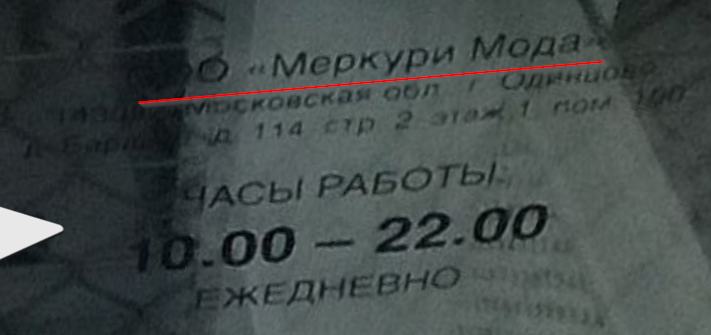

On both these visits, our secret shopper made purchases in the stores. The receipts obtained were issued by Brunello Cucinelli’s Russian subsidiary, OOO Brunello Cucinelli RUS. Both receipts have the address of the stores where the purchases were made and show Cucinelli’s Russian tax ID number.[1]

For all Russian translations we used Google Translate. The Russian tax identification number (“INN”) shown in the receipt (i.e. 7704354880) matches that of Cucinelli’s Russian subsidiary, according to a list available on Brunello Cucinelli’s website with the registered offices of the group subsidiaries. It also matches the INN number for Brunello Cucinelli Russian subsidiary local tax filings. ↩︎

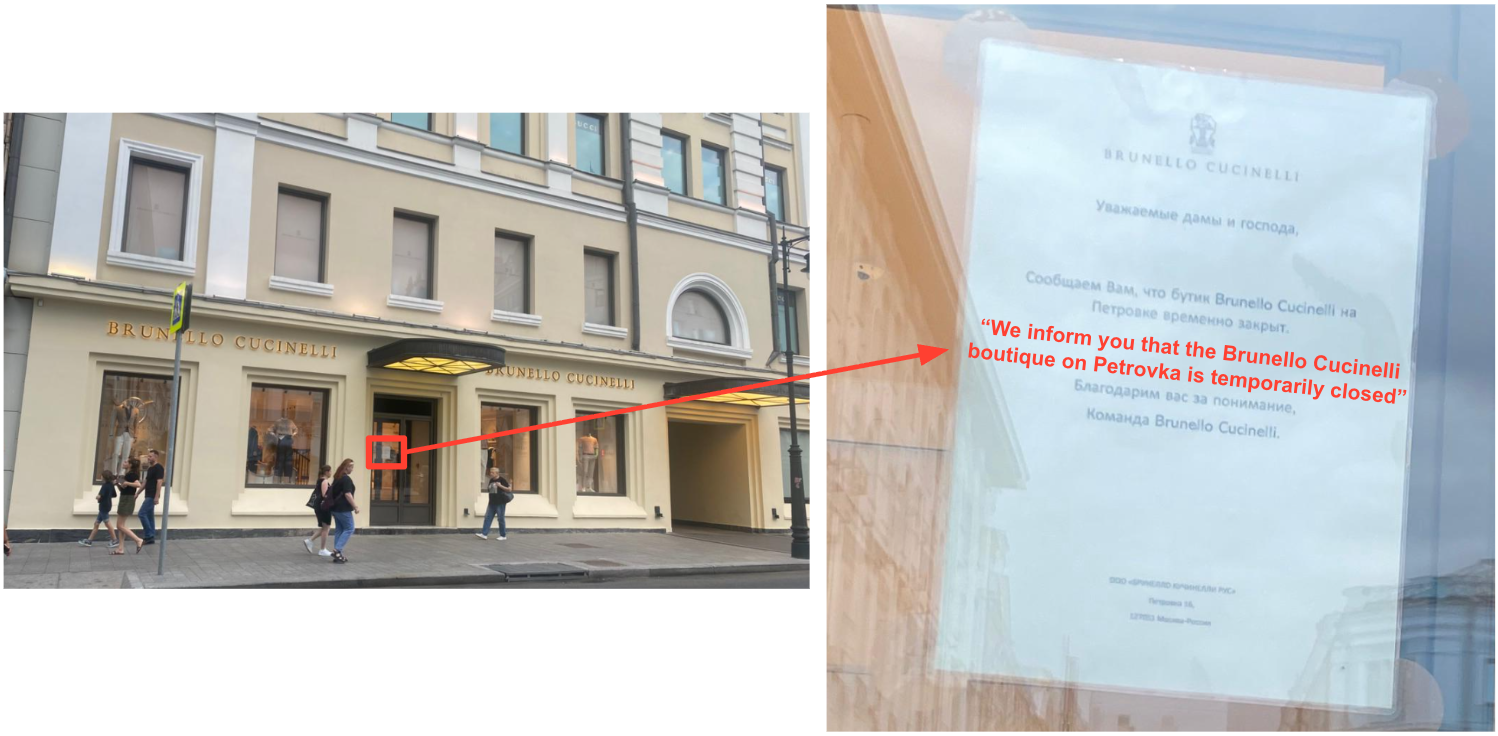

Further, Cucinelli has a store at 16 Petrovka Street in Moscow, which is not mentioned on Brunello Cucinelli’s boutique locator. The store was newly opened around 2022, taking over from the old Burberry store, according to Yandex Street's photos.[1]

In summer 2025, we visited the store. Unlike the other 2 stores, we found a sign at the door of the store that said that the store was "temporarily closed.”

Despite the door sign, our researcher was able to photograph customers inside the store.

Cucinelli’s Russian subsidiary uses the address of this store for its local tax filings. It is unclear if this is the showroom which Cucinelli’s CEO said that the company staff is “engaged in one-on-one sales activities.”[1]

The Financial Times said that “Cucinelli’s showroom is located close to its store at Moscow’s Red Square.” 16 Petrovka St is located 1 kilometer away from Cucinelli’s Moscow Gum Store in the Red Square, per Yandex Maps. ↩︎

Cucinelli CEO To The Financial Times: “Our [Russian] Activities Are Based On Shipments Within The Price Limits Allowed By The European Union, And On Residual Stock In The Country Which Was Delivered To Russia Before The Outbreak Of The War"

Reality Check: Cucinelli’s Product Offering In Russia Includes Many Items Manufactured As Recently As 2025 And Priced Far Above €1,000, Implying Export Values Likely In Excess Of The €300 Sanctions Threshold, According To Our Secret Shoppers

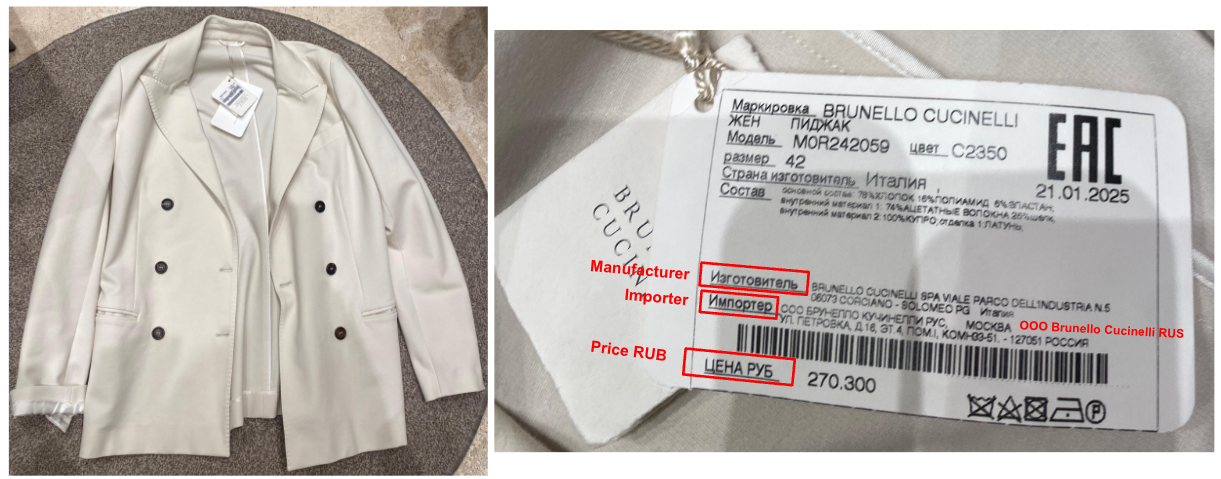

While the wholesale prices or transfer pricing value of items shipped by Cucinelli to its Russian subsidiary are unknown, we assume that the gross margin reported by Cucinelli’s Russian subsidiary are indicative of the wholesale price that determines the value disclosed in the export declarations in order to comply with EU sanctions.

Based on Cucinelli’s Russian subsidiary 2024 gross margin of 60.2%, one would not expect to see Cucinelli’s products available in Russia with a price tag higher than €755 (~RUB 74,500). Even at a more generous wholesale margin of 70%, one would not expect to find Cucinelli’s products in Russia with a price tag higher than €1,000 (~RUB 99,000).[1]

Our shoppers observed and discreetly documented numerous Cucinelli items priced above €1,000. We have provided 20 examples in a slide deck available here.[1]

The items documented include products from Cucinelli Moscow GUM store and from TSUM Department store, of which we will elaborate more below. ↩︎

All the documented items available in the GUM Red square store were manufactured by Brunello Cucinelli SpA and imported by its Russian subsidiary, Brunello Cucinelli RUS OOO, according to the product tags.

For example, a white blazer retailed for RUB 270,300 (~€2,860) and had an EAC label (conformity standard) dated 2025.[1]

A Eurasian Conformity (EAC) mark indicates that a product meets the technical and safety requirements of the Eurasian Economic Union (EAEU), including Russia, per World Bridge, a certification provider. For clothing and footwear must contain the manufacturer and date of manufacture, according to Inorms, a consultant in the field of EAC certifications in Russia and CIS countries. ↩︎

Other examples include a woman’s top and pants, each valued over €1,000 and manufactured in 2024 and 2025, respectively, according to their tags.

As further independent confirmation of new collection items selling for over €1,000, in July 2025, a Russian influencer published a picture outside a Brunello Cucinelli store located on a major avenue of Moscow (more on this location later). In the picture, we can see a striped cotton sweater in the window.

That sweater appears to be from Cucinelli’s 2025 winter collection, indicating that the brand’s newest clothing is still making its way to Moscow. Further, at a retail price of €1,800, this item would almost certainly exceed the €300 threshold imposed by EU sanctions even at a much lower wholesale price.[1]

A former Brunello Cucinelli sales assistant explained how to read the SKU number. “It will start from the number of the year”, and “the third number is the season…number 2 is for winter.” ↩︎

After EU Sanctions Went Into Effect, Cucinelli Told Investors That Its Russian 2022 Sales Would Experience A “Significant Reduction”

Reality Check: Instead Of A Reduction, Cucinelli Increased Its Shipments To Its Russian Subsidiary by ~715% From 2021 To 2023 In Weight Terms, Despite Allegedly Closing Its Russian Stores, According To Trade Data

After Russia’s invasion, Brunello Cucinelli estimated that Russia-derived sales would experience a “significant reduction” from 9% in 2021 to 4% in 2022, per its investor presentation.

By 2023, Cucinelli stopped disclosing Russian sales altogether, implying that the revenue contribution from Russia was likely immaterial.

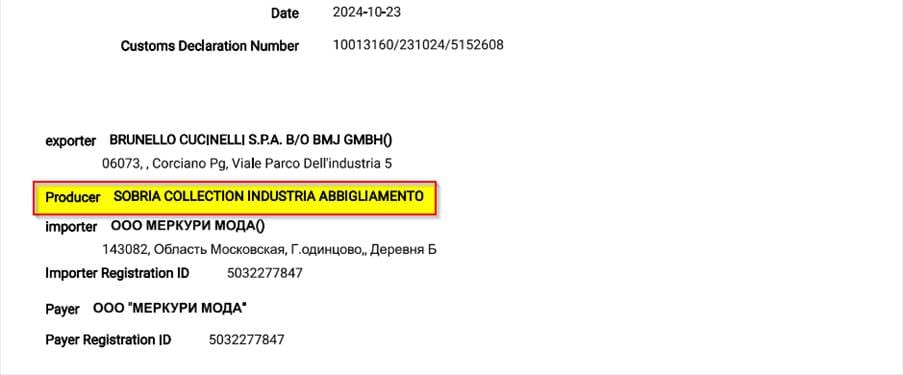

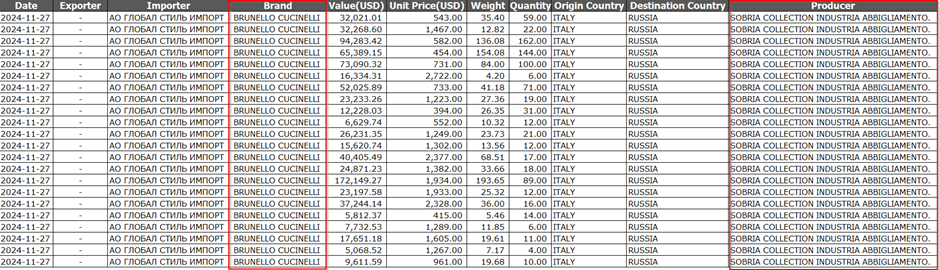

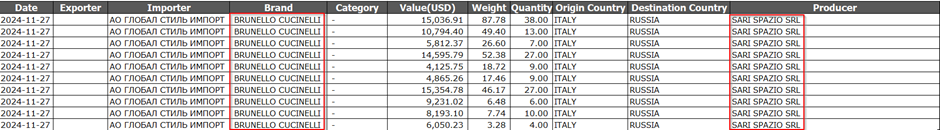

In contrast with Cucinelli’s disclosures or lack thereof, trade data reveals that Cucinelli dramatically increased the volume of shipments to its Russian subsidiary after the EU sanctions were implemented.

In 2021 and prior to sanctions, Cucinelli exported approximately 7,423 kilograms of product to its Russian subsidiary, per trade data platform Tradesparq. By 2023, that number had grown by ~715% to 53,137 kilograms, indicating a rapid acceleration in Cucinelli’s Russian business.

In the 3 years since the luxury goods sanctions have gone into effect, Brunello’s Russian subsidiary has imported an estimated 110,000 kilograms of luxury goods across 6,500+ shipments, per trade data obtained from Tradesparq.[1]

To compile these figures, we searched trade data platform Tradesparq for all imports by Brunello Cucinelli’s Russian subsidiary (ООО БРУНЕЛЛО КУЧИНЕЛЛИ) from 1/1/2020 through 12/31/2024 and aggregated the total weight on a quarterly basis. We then removed all shipments that matched on date, weight, and value to control for duplicates. ↩︎

Although some of this increase could be due to a higher volume of lower priced items, such a dramatic increase is strange in the context of Cucinelli’s apparent store closures in Russia along with its claimed decline in Russian revenue from 9% in 2021 to 2% today, per the FT article.

Based on Cucinelli’s open stores and the ongoing sales of high-value items in Russia, we think the more likely explanation for the growth in the weight of its exports to Russia is that its Russian business is expanding rather than contracting as claimed.

While Cucinelli’s direct exports to its Russian subsidiary appear to have declined toward the end of 2024, coinciding with public allegations of continued Russian sales, its products continue to reach Russia, as detailed throughout this report.

We Obtained Financial Statements From Cucinelli’s Russian Subsidiary, Which Imply That The Company Has Continued To Operate At A Material Scale And Which Reveal A Strategy To Continue Selling Through “Remote Trade” And “Home Delivery”

A Former Cucinelli Executive Told Us That Chairman Cucinelli Wanted To “Stay Neutral” And Continue To Sell To Russia Despite Russia’s Invasion Of Ukraine, Describing The Russian Market As A “Delicate Topic”

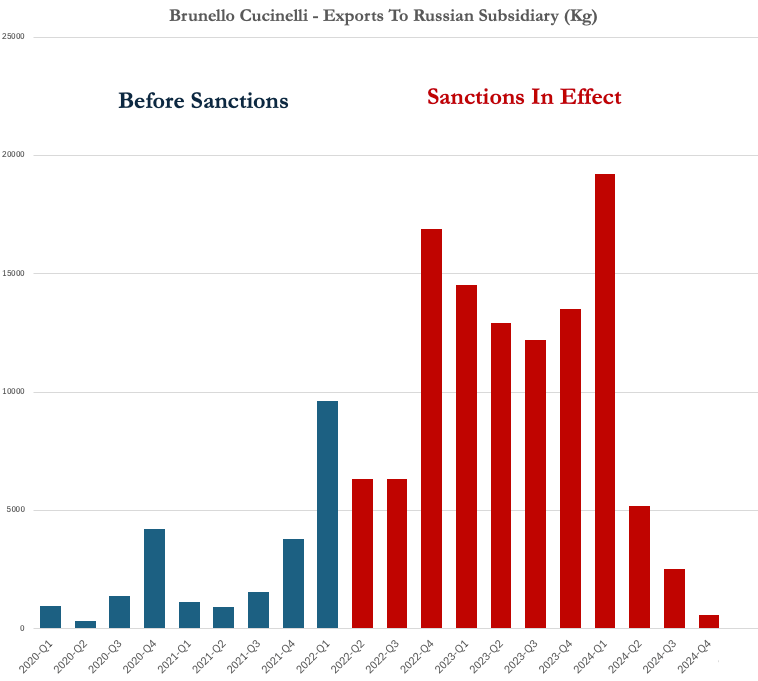

Following Russia's invasion of Ukraine, Cucinelli’s Russian stores have continued to generate substantial revenue from selling goods, per the audited financial statements filed by its Russian subsidiary.

In 2023 and 2024, the subsidiary generated approximately RUB 1.5 billion (~€15 million) in revenue per year.[1]

Average 2024 of €1 = RUB 100.41. ↩︎

These reported figures represent only a 33% decrease from Cucinelli’s Russian subsidiary reported sales in 2021, when Russia represented 9% of Cucinelli’s revenues.

If Cucinelli’s Russian operations were in fact reduced to a single showroom offering one-on-one sales of items with wholesale values under €300, one would have expected to see a more dramatic collapse in the overall revenue of Cucinelli’s Russian subsidiary. [Pg. 60] [Pg. 6]

Based on previous disclosures made by Cucinelli, the financials of its Russian subsidiary appear not to include its wholesale business in Russia. We estimate that in 2021, the year when Russian sales reportedly peaked, the revenue from Cucinelli’s Russian wholesale business was 50% larger than the revenue reported by its Russian subsidiary.[1]

Russia represented 9% of Cucinelli’s sales as of 2021. This is equivalent to €64 million. In 2021, Cucinelli’s Russian subsidiary reported RUB 2.2 billion (~€25.6 million) in sales, according to its audited financials. We assume that the difference between Cucinelli’s reported Russian sales and the sales reported by its Russian Subsidiary, represents their wholesale business in Russia. We estimate that this figure was €38.4 million in 2021, which is 50% higher than the sale reported by the Russian subsidiary, which operates several retail stores in Russia. ↩︎

Moreover, the 2024 audited financial statements of Brunello Cucinelli’s Russian subsidiary state that the company addressed the “negative impact” of EU sanctions by expanding services. These services included “remote selection of goods by photo, home delivery of goods,” and cashless payments.

A former Cucinelli executive told us that Chairman Cucinelli wanted to continue trading with Russian customers and “stay neutral.”

“But listen, it's very risky. And I think it's very complex. I remember in the beginning for sure, Brunello never wanted to absolutely not touch his hands on it. He wanted to stay neutral and continue to trade with these partners and not take, let's say, the French position, you know, like we close everything and we won't sell you a single thing.

But obviously for a company that stands, let's say, on ethical, philosophical, philosophical, ideology. You know, obviously you have to stand for what you say… I know it's always been a delicate topic.”

Part II: Brunello Cucinelli’s Partnership With Russia’s Largest Luxury Conglomerate To Quietly Grow Russian Volumes In Spite Of Sanctions

Cucinelli’s CEO admitted to the Financial Times that they “continued to supply department stores in Moscow.”

As part of our research, we found that Cucinelli’s products are available from high-end stores such as TSUM which are controlled by the Mercury Group, Russia’s largest luxury goods conglomerate.

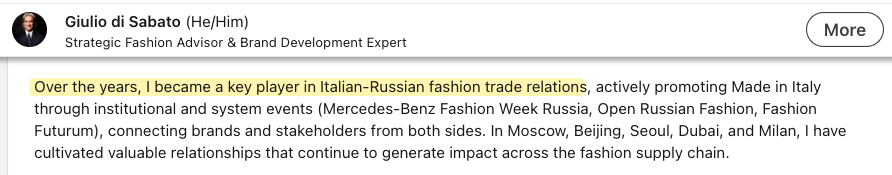

The relationship between Cucinelli and Mercury, however, appears to be deeper than that of a normal manufacturer-reseller relationship, with Mercury playing a key role in Cucinelli’s quiet Russian expansion.

Cucinelli’s CEO Confirmed To The Financial Times That The Company Is Supplying Department Stores In Moscow But Acting “In Full Observance Of EU Rules, Only Supplying Items Of Our Collection Within The Price Caps Fixed By The EU”

Our Secret Shopper Visited TSUM, A High-End Russian Department Store, And Found Cucinelli Items Priced At €5,000+ That Had Been Manufactured In Italy In 2025, Per The Product Tags

Further, TSUM’s Online Store Features A Massive Collection Of 5,000+ Cucinelli SKUs

We dispatched a secret shopper to TSUM’s flagship location in central Moscow to check for Cucinelli products, who found an entire Cucinelli section in the store.[1]

Our shopper found numerous Cucinelli items priced well over the sanctions limit of €300, with product tags revealing that many of these products had been manufactured in Italy in 2025.

For example, we found a blazer with a price tag of RUB 499,500 (~€5,080), which was manufactured in Italy in March 2025, according to the product tags.

Further, Cucinelli’s products are widely available on TSUM’s website, which we could only navigate by using a local VPN. As of the date of publication, the website features over 5,000 Cucinelli SKUs, with some garments selling for over 2,000,000 Rubles, or north of 20,000 euros.

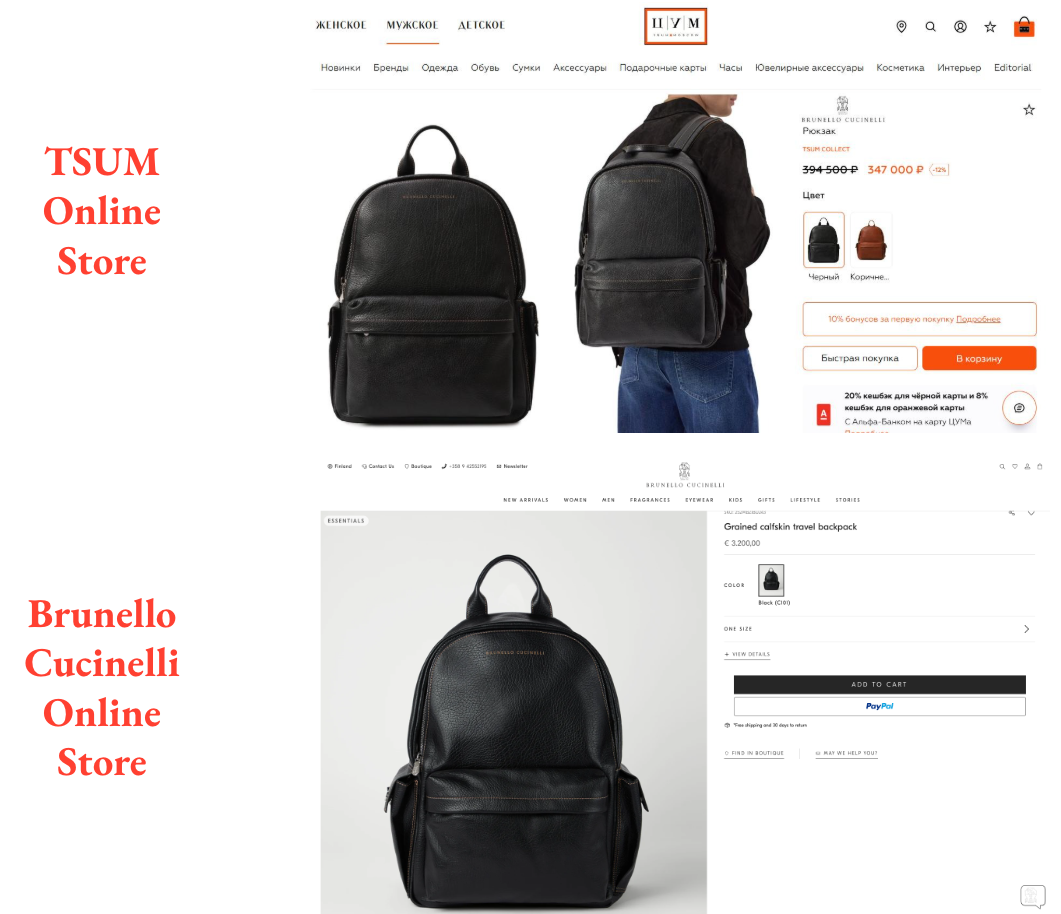

We also found several Brunello Cucinelli items available in the TSUM online store that are also available on Brunello Cucinelli’s online store, indicating that these items are from collections that debuted after the EU sanctions were implemented. [1.1, 1.2, 2.1, 2.2, 3.1, 3.2]

For example, we found a backpack in the TSUM online store that currently retails for €3,200 in Brunello Cucinelli’s online store in Europe.[1]

As mentioned, we used the Finland online store in Europe, but the pricing appears consistent across countries in Europe. ↩︎

Likewise, we found a sweater with the BC initials in the TSUM online store that currently retails for €800 in Cucinelli online store in Europe. (1, 2, 3, 4, 5, 6)

While products from some other luxury brands are also still available at Mercury-owned stores such as TSUM, the sheer volume of Cucinelli’s inventory at the Russian luxury store is unparalleled relative to direct peers. For example, direct “quiet luxury” competitor Loro Piana shows just 97 SKUs on TSUM’s website, a small fraction of the 5,000+ SKUs from Cucinelli.[1]

The TSUM website can be accessed by setting a VPN to Russia or Uzbekistan. ↩︎

Trade Data Reveals A Rapidly Expanding Relationship Between Cucinelli And Mercury

Since Sanctions Were Implemented, Rather Than Pausing Sales To Mercury, Cucinelli Accelerated Shipments To The Russian Conglomerate By ~470%, From ~26,270 Kilograms Of Product Exported In 2021 To Approximately 150,000 Kilograms In 2023

Overall, Since Sanctions Were Implemented In March 2022, Cucinelli Has Shipped 250,000 Kilograms Of Luxury Goods To Mercury Across ~5700 Shipments, According To Trade Data

Our on-the-ground research into Cucinelli and Mercury’s relationship is supported by publicly-accessible trade data, which shows that Cucinelli has dramatically increased its exports to Mercury since the EU implemented luxury goods sanctions in March 2022.

In 2021, for example, Cucinelli only exported approximately 26,270 kilograms of products to affiliates of Mercury Group in Russia. By 2023, however, that number had climbed by ~470% to nearly 150,000 kilograms, according to Tradesparq.[1]

These results can be replicated by using Tradesparq’s advanced search function and searching for all Russia-bound exports to Mercury Moda under both the English and Russian spelling, ООО МЕРКУРИ МОДА. We then removed all shipments that matched on date, weight, and value to control for duplicates. ↩︎

As with Cucinelli’s exports to its own subsidiary, the shipments to Mercury appear to taper in late 2024, coinciding with the October 2024 Daily Mail investigation that highlighted the company’s presence in Russia. Our research, however, shows that Cucinelli continues to sell its products, including 2025 collections, in Russia.

In The Midst Of Sanctions, Brunello Cucinelli “Closed” One Of Its Mercury-Operated Stores In Moscow, Only To Re-Open Another Store ~200 Meters Away That Is Also Operated By Mercury Group, Per Yandex Street Photos

In one example, Cucinelli appears to close one of its Moscow stores only to re-open a new store ~200 meters away to be operated by Mercury.[1]

At the old store, Mercury is mentioned on the door and a sign directs customers to the new store only a short distance away, per a Yandex street photo. ↩︎

The relocated store, pictured below, was previously a Ralph Lauren location. Ralph Lauren exited the Russian market ~3 years ago. Today, the location has been replaced with a Cucinelli store, per a Yandex street photo.[1]

This new location is operated by Mercury Group, the parent company of TSUM stores, according to a sign on the door visible in Yandex Street Photos. ↩︎

The new store has a sign on the door implying that it is operated by Mercury, per an image visible through Yandex’s Street Photo.[1]

In 2023, the old store in Moscow was captured with an open door and an apparent customer inside, per a street photo from Yandex. ↩︎

We Find It Hard To Believe That Cucinelli Is Unaware Of Its High-Value Products, Being Actively Sold In TSUM’s Russian Stores Given The Personal Friendship Between Chairman Cucinelli And The Former Head Buyer Of TSUM

Social Media Posts Show The Two Men Together, With Captions Implying A Close Relationship, At A Time When TSUM’s Parent Company Was Importing Significant Volumes Of Cucinelli Products In Spite Of Sanctions

Chairman Cucinelli appears to have a personal friendship with former TSUM head buyer Riccardo Tortato, per numerous social media posts that feature the duo together.[1]

TSUM’s head buyer from July 2020 until October 2023 was Riccardo Tortaro, according to his LinkedIn profile. ↩︎

These posts include pictures of Chairman Cucinelli and Tortaro together, including in September 2022— 6 months into effective EU sanctions on the sale of luxury goods to Russia.

Given what seems to be a close relationship, we find it impossible that Chairman Cucinelli is unaware that his luxury products have been sold en masse to TSUM in spite of sanctions, including during the period when Tortato was TSUM’s head buyer.

In January 2025, TSUM’s Current Head Buyer Also Met Chairman Cucinelli In Person, Per The Buyer’s Social Media

In June 2025, The Same Buyer Attended “[A] Buying Session In Milano” Of Cucinelli’s Spring/Summer 2026 Collection, Per His Social Media, Which Highlights The Purchase Of Cucinelli Suits Which Sell For At Least €4,000

TSUM’s chief buyer is Boris Kotelsky, according to his LinkedIn profile. Kotelsky has spent 14 years at TSUM. His LinkedIn profile states that he buys Cucinelli’s products and creates limited edition collections for Mercury (TSUM’s parent company), including Cucinelli products.

Chairman Cucinelli met Kotelsky in January 2025, according to a social media post by Kotelsky.

In June 2025, Kotelsky attended Cucinelli’s event at the Milan Fashion Week, where the company presented their spring summer 2026 collection, according to Kotelsky’s Instagram posts.

In a subsequent Instagram post, Kotelsky highlighted his “recent buying session in Milano” of Cucinelli’s spring summer 2026 collection. He further added “while you are still shopping for this summer we are working on what you will wear next year.”

The Instagram post showed jackets and suits, as part of the highlights from the “recent buying session in Milano.” The cheapest two piece suit currently available on Cucinelli’s European online store costs €4,000.[1]

Search the men’s Ready to Wear section, using the filter “Suits” and sort by “Price: Low to High.” The suit price includes the cost of the blazer and trouser. ↩︎

Overall, it seems that the market is largely unaware of Cucinelli’s current Russian business, which includes the operation of its owned stores and through the Mercury Group, and its impact on revenue, as evidenced by our interview with an executive from a top Cucinelli reseller who was surprised to hear of the continued Russian sales.

“That’s interesting, yeah that’s interesting, because all of us stopped, I mean, it was sanctions. I mean everywhere I worked we had to stop shipping to Russia and it was a significant loss… it was illegal to ship to Russia, so we had to, I mean we couldn’t even sell, there were sanctions to specific customers, so we had to like trace all of that…

I’m surprised, that’s actually super surprising that they’re doing that… Hence the double digit increases quarter over quarter, they haven’t lost that huge chunk of business like everyone else did.”

Part III: How A Vast Network Of Obscure Third Parties Have Moved Over ~60 Metric Tons Of Cucinelli Products Into Russia

In response to the Financial Times article highlighting a hedge fund’s accusations that Cucinelli’s products continue to reach Russia through intermediaries, Cucinelli’s CEO said it was not aware of any anomalies or triangulation, noting “internal checks as well as the Italian and foreign customs agency never highlighted anomalies.”

We question the extent of Cucinelli’s “internal checks” given that our research, based on publicly-available records, indicates that ~60 metric tons of Cucinelli products have been transported to Russia through obscure intermediaries since the advent of sanctions in March 2022.

In this section we detail the transactions of several of these entities with additional examples highlighted in Appendix A. These transactions strike us as a potential attempt to circumvent EU sanctions on luxury goods.

Background: Violating EU Sanctions Through Intentional Circumvention Can Result In Imprisonment For Up To Six Years Under Italian Law, Yet Cucinelli Products Appear To Flow To Russia Through A Complex Web Of Obscure Distributors

In February 2022, the EU Council made it unlawful “to participate, knowingly and intentionally, in activities the object or effect of which is to circumvent prohibitions” against Russia. Further, it has long been held under EU Law that having awareness that trade may have a circumventing effect and accepting such possibility is enough to establish liability.[1]

A 2011 CJEU judgment was explicitly incorporated into the Regulation in June 2024 to clarify that “participating in such activities without deliberately seeking that object or effect but being aware that the participation may have that object or effect and accepting that possibility” is also unlawful, per an EU FAQ note on Circumvention And Due Diligence. Since 2022, EU countries have secured over 1500 sanctions convictions, per law firm Duane Morris. (1, 2, 3, 4) These have included jail time for offenders, including 5 years imprisonment for a man exporting luxury vehicles to Russia from Germany, per its customs authorities. ↩︎

In April 2022, the EU Commission specifically warned of circumvention risk through third-party countries, which can easily divert goods to Russia, per a notice to operators. It advised exporters “to take adequate due diligence measures.”

All EU Member States are under the obligation to implement and enforce EU sanctions. In Italy, those violating EU sanctions are faced with serious criminal charges. Italian law lays down up to six year prison sentences for breaching EU trade restrictions. [Art. 20]

Despite the existence of strict sanctions against Russia, and serious penalties for businesses seeking to circumvent these sanctions, Cucinelli’s products have been flowing to Russia en masse through a variety of opaque distributors and bizarre transactions.

Suspect Distributor #1: In May 2022, Just 2 Months After The EU Imposed Sanctions, Cucinelli’s Russian Subsidiary Started Importing From A Small Lithuanian Exporter Called “Rivi Logistics”, Per Trade Records

Some Shipments Appeared To Have Artificially Low Values, Such As Jackets Being Exported At A Declared Value Of Less Than €300 While Cucinelli's Lowest Priced Jacket Cost ~€2,000, Indicating A Potential Attempt To Circumvent Sanctions

Despite Lithuania’s support of sanctions and particularly strong stance against Russia, its proximity as a border country to Russia makes it a key conduit country for moving sanctioned goods into Russia.

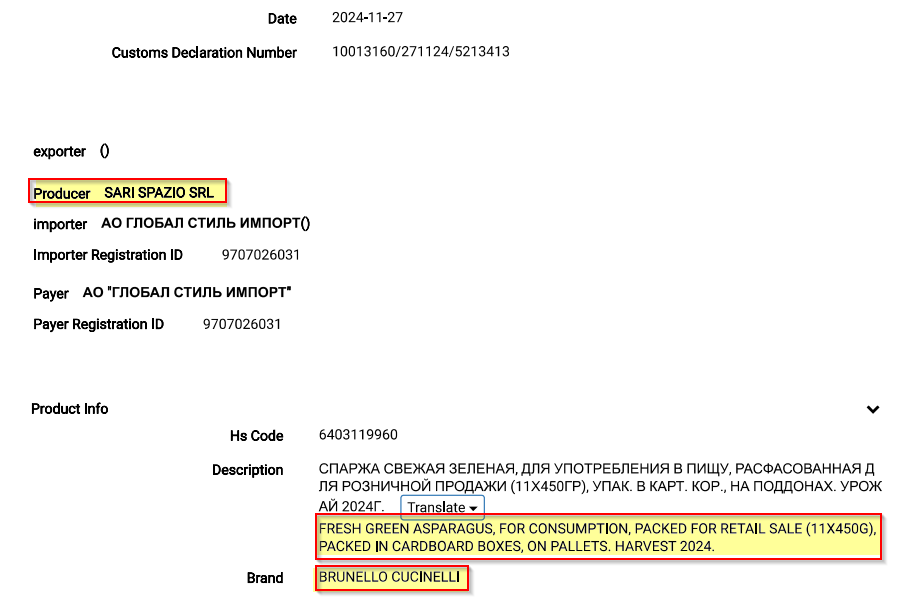

Just 2 months after the EU imposed an export ban on luxury products above €300, Brunello Cucinelli’s Russian Subsidiary started importing items from a Lithuanian transportation company called Rivi Logistics.[1]

Prior to March 15th 2022, Rivi Logistics was not the named exporter for any transactions to Brunello Cucinelli’s Russian subsidiary, per trade data. We searched Tradesparq using Rivi logistics and different naming combinations for the Russian entity including: OOO BRUNELLO CUCINELLI RUS LLC and ООО БРУНЕЛЛО КУЧИНЕЛЛИ РУС, yielding zero results. ↩︎

Rivi Logistics financials reveal a small loss-making business, with 9 employees and revenue of €3.8 million in 2024, per the Lithuanian corporate registry.

Despite its modest size, however, Rivi Logistics began exporting tens of thousands of kilograms of Brunello Cucinelli products to Russia just months after EU luxury sanctions went into effect in March 2022.

Between May 2022 and May 2024, Rivi Logistics shipped approximately 26,000 kilograms of product to Cucinelli’s Russian subsidiary, including jumpers, polos, jackets, and shoes, per Tradesparq data.[1]

The trade records include different name variants: UAB RIVILOGISTICS KIRTIMU, UAB RIVILOGISTIC, RIVILOGISTICS UAB, UAB RIVILOGISTICS. ↩︎

We found exports with suspiciously low declared values, which looked to be artificially deflated to pass as under the €300 threshold. In one such example on May 18, 2024, Rivilogistics exported 4 cotton blazers/jackets exported at a unit price of less than €300.

Currently, the cheapest blazer on Cucinelli’s website is €1990 and its cheapest jacket (technically a vest) is €1900. [1, 2]

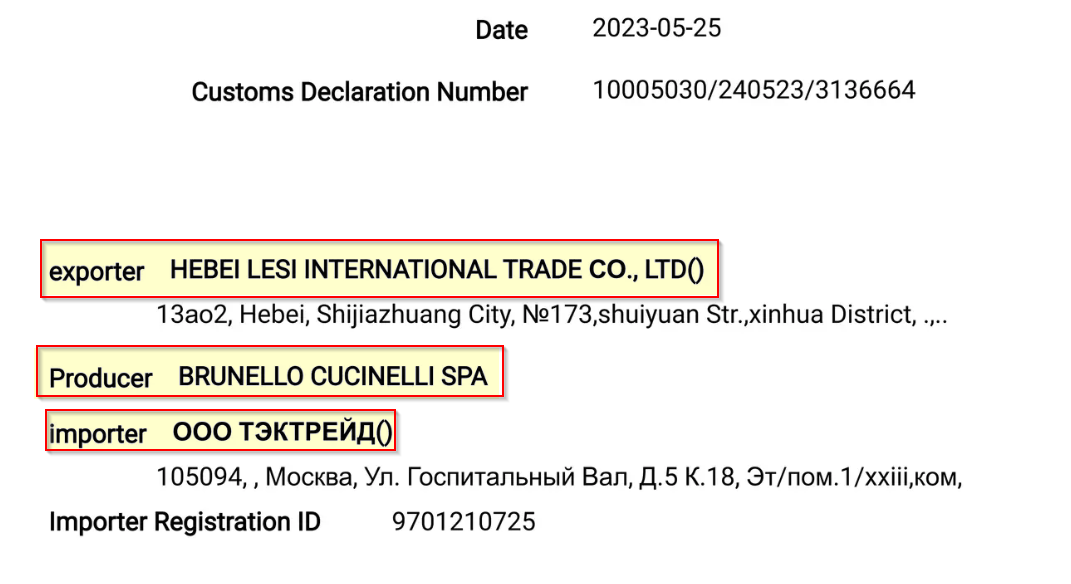

Suspect Distributor #2: Between November 2022 And May 2023, A Chinese Entity Called “Hebei Lesi International” Shipped 6,129 Kilograms Of Brunello Cucinelli Products To A Russian Importer, Per Trade Records

Another Chinese entity, called Hebei Lesi International, exported 6,129 kilograms of Brunello Cucinelli products to Russia between November 2022 and May 2023, per Tradesparq records. The average per unit price of all items exported was over $1000, per our calculations.[1]

For each export we calculated the shipment value in USD by the disclosed quantity. Tradesparq also has a unit price calculation based on a per Kg calculation. ↩︎

We visited the address listed on the export records in Hebei, but found no trace of the business in what appeared to be a hotel.

The importer for all the transactions was a Russian company called ООО "ТЭК ТРЕЙД" (aka “TT”Tek Trade), which is located in a residential complex near Moscow, with some commercial premises on its street level including a post office.

The company was registered in June 2022, after the EU sanctions on luxury goods were implemented.

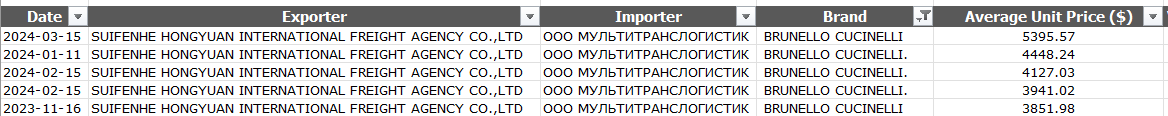

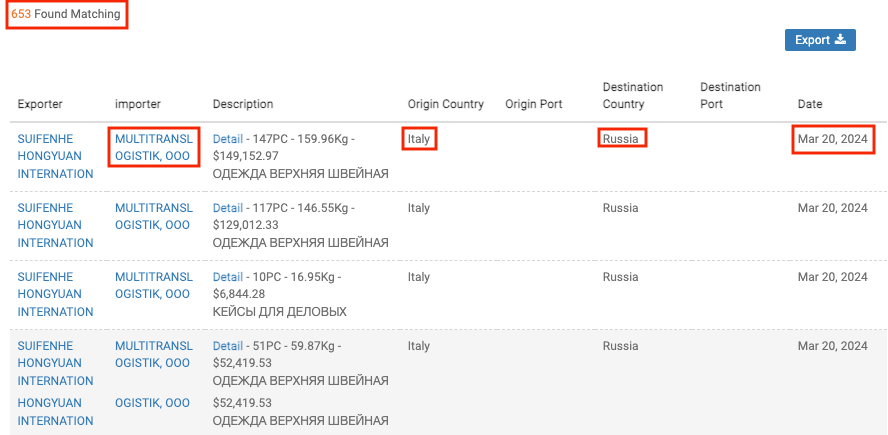

Suspect Distributor #3: From May 2023 To March 2024, A Chinese Entity Called “Suifenhe Hongyuan International” Shipped 14,545 Kilograms Of Brunello Cucinelli Branded Product To A Russian Importer, Per Trade Records

We Visited The Chinese Entity’s Registered Address On The Border Of China And Russia And Found A Dilapidated Office With No Signs Of Activity

Suifenhe Hongyuan International Is 70% Owned By A Russian Individual, Per Chinese Corporate Records

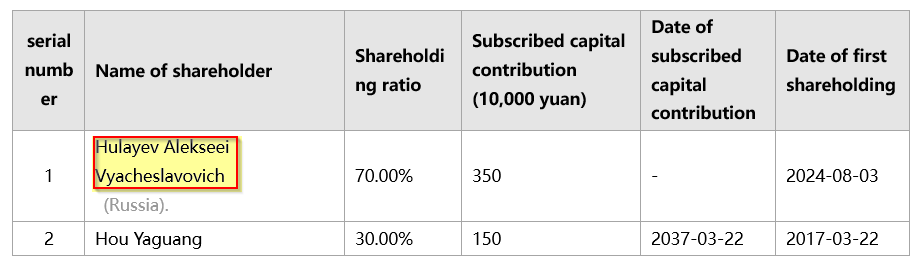

A large volume of Brunello Cucinelli products appears to have been shipped into Russia by a Chinese freight company called “Suifenhe Hongyuan International” between May 2023 and March 2024.[1]

The Chinese name is 绥芬河市宏源国际货物运输代理有限公司 ↩︎

Across 566 total transactions, Suifenhe Hongyuan International shipped 14,545 kilograms of Cucinelli-branded products, with a declared value of $16.2 million, to Russian importers, per trade data. The average price of shipments per unit was far in excess of the €300 threshold, per the trade records and as shown in the extract from the previous table.[1]

As noted above some trade records did not include the quantity of items, so we removed these from the calculation. ↩︎

Suifenhe Hongyuan is located in the Heliongjang Province, on the border with Russia and has a Russian individual, Alekseei Halyaev Vyacheslavocich, as the majority 70% shareholder.

The Russian importer in these transactions is called Multitranslogistik, which appears as the importer for other suspect distributors, discussed below.

We expected an exporter dealing in millions of dollars of Brunello Cucinelli products to have a reasonably upmarket office facility or some branding that was in line with the luxury goods and brands it was exporting. We found little evidence of that.

Our investigator found a dilapidated building with peeling walls and no sign of the company name.[1]

We found a discrepancy in the street name, but were able to locate the building in the area 兴建大厦 (translated as the Construction Building) mentioned in the address line: 黑龙江省牡丹江市绥芬河市新华街229号,兴建大厦603室“自主申报” ↩︎

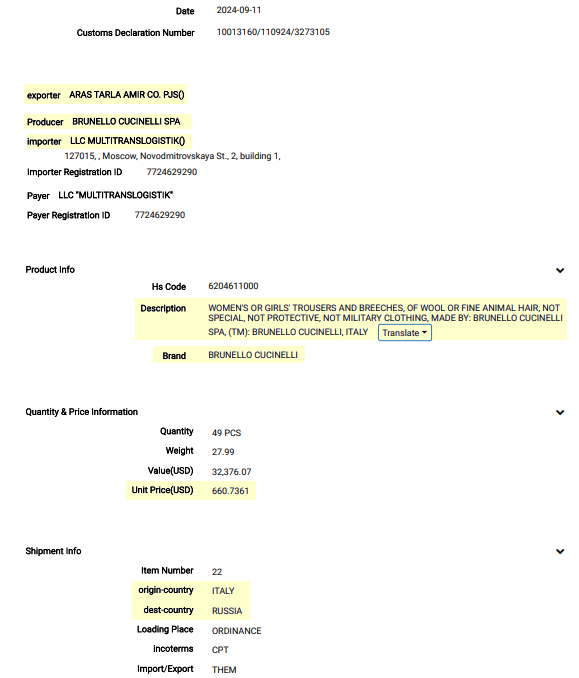

Suspect Distributor #4: From July To September 2024, An Iranian Hydroponics Company Called “Aras Tarla Amir” Sent 4,012 Kilograms Of Brunello Cucinelli Branded Products To Russia, With The Origin Of Goods Disclosed As Italy, Per Trade Data

The Iranian Company Has The “Necessary Infrastructure” To Export To Russia, According To Its Website

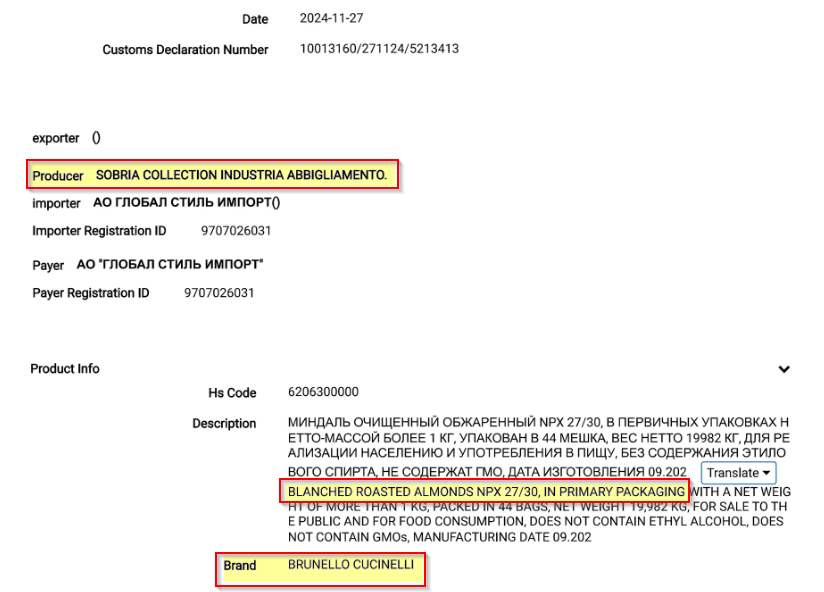

In another case, an Iranian hydroponics and agricultural company called Aras Tarla Amin appears to have facilitated significant trade in Cucinelli branded products to Russia. The company says that it has the “necessary infrastructure” to export to Russia, according to its website.

Despite its agricultural focus, from July to September 2024, there were 113 export transactions between Aras Tarla and a Russian supply chain company Multitranslogistik that describe the shipped goods as “Brunello Cucinelli” branded, per Tradesparq data. Multitranslogistik is the same company importing shipments from Suspect Distributor #3.[1]

In total, the Iranian agricultural company has shipped an estimated $4.4 million of Brunello Cucinelli branded products to Russia. The item descriptions in Russian include women’s outerwear, dresses and blazers, per Tradesparq.

The average unit price of these shipments is $1,053, per data gathered from the bills of lading (BOLs) for the shipments, far in excess of the maximum €300 limit for luxury items exports from Europe.[1]

Some trade records did not specify a quantity so we removed these from the data set for the average unit price calculation. ↩︎

Many of these shipments disclosed the loading place as “Orsha” in Belarus, another country that has been under sanctions by the EU for luxury goods since June 2024.

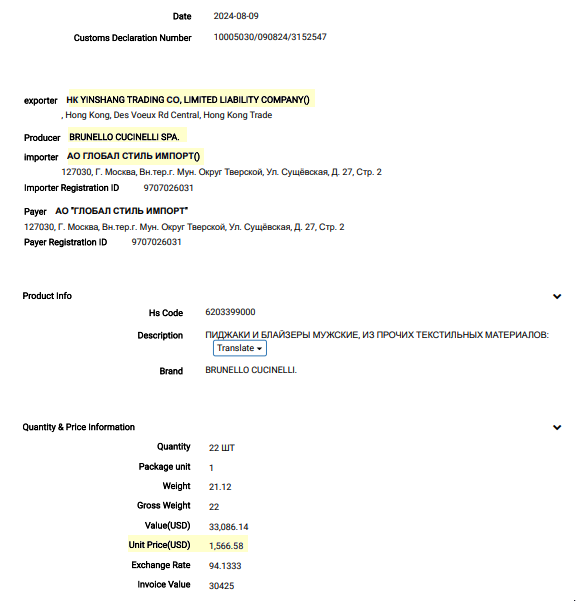

Suspect Distributor #5: From August To October 2024, A Hong Kong Entity Called “Yinshang Trading” Shipped 20,000 Kilograms Of Brunello Cucinelli Branded Items To A Russian Importer In Moscow, Per Trade Data

Yinshang’s Parent Company Shared An Office With An Entity That Has Been Sanctioned By The U.S. Government For Supplying Sensitive Electronics To Russia

Another suspect entity that began exporting Brunello Cucinelli branded products to Russia in August 2024 is Hong Kong-based Yinshang Trading Co..

From August to October 2024, Yinshang facilitated 416 transactions whereby it exported approximately 20,000 kilograms of Cucinelli branded products, with a declared value of ~$16 million, to a Russian importer in Moscow, per Tradesparq records.

The exports include casual footwear, women’s blazers and jackets, and more, with an average unit price of $1,049, far exceeding the EU’s €300 threshold and prohibition for luxury goods to Russia.

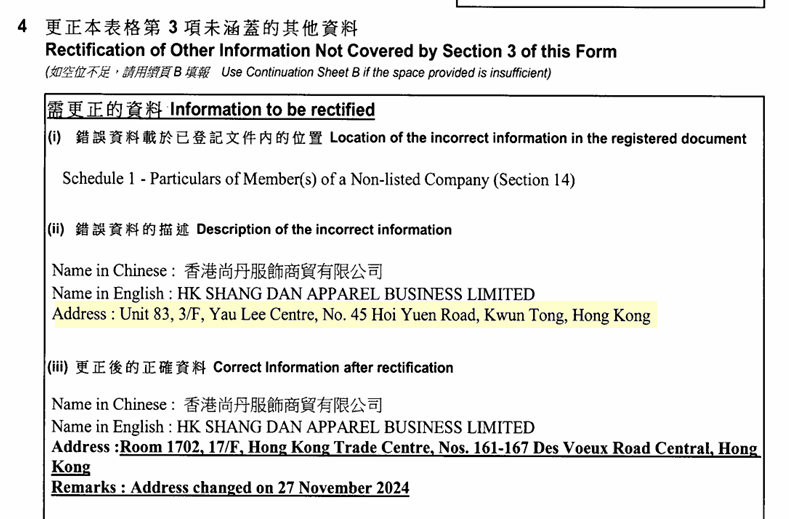

Yinshang’s parent company is called HK Shang Dang Apparel Business, per its annual return. The company disclosed that its parent was located at Unit 83, 3/F, Yau Lee Centre in Hong Kong, during the period of the Brunello Cucinelli shipments.[1]

HK Yinshang changed the address on its annual return for HK Shang Dang by way of a correction. This address was changed on November 27, 2024 per the filing. ↩︎

Yinshang’s parent company shared the exact same address, including the unit number, as “ACE Era Co Limited,” which was placed under US Sanctions on August 23, 2024, for shipping sensitive electronics to Russia, per a U.S. government press release.[1]

ACE Era also shares the same company secretary as HK Shan Dan per annual filings. In 2023, the entity acting at the company secretary, RJ Intl was reprimanded by HK authorities for failure “to put in place adequate and proper anti-money laundering and counter-terrorist financing policies”, per the Hong Kong company registry. ↩︎

Part IV: Bloated Inventory, Aggressive Discounting, And Cucinelli Clothing At TJ Maxx

Cucinelli’s decision to expand its Russian operations while many of its peers exited the market entirely may be an attempt to mask more fundamental problems within the company, namely slowing growth and bloated inventory.

For any clothing company, managing inventory is a critical task to achieve and sustain profitability. We found several signs that Cucinelli’s is struggling to keep healthy levels of inventory.

Cucinelli States That Its Inventory Levels Are “Healthy In Relation To Our Collection Offering,” But Reports Significantly Higher Inventory Than Nearly All Luxury Competitors

Inventory Days Stood At 415 Days In 2024, Meaning The Company Takes In Excess Of A Year To Sell The Inventory It Holds

In the luxury goods market, the perception of exclusivity is paramount, leading brands to carefully manage production, track where their inventory is being sold, and determine if it is being overly discounted in a way that could harm brand value.

Significant and unexplained inventory build-up is often a red flag at fashion retailers, as it can be a harbinger of sales issues, aging stock can become obsolete, and product can wind up being sold at steep discounts or through platforms that do not align with luxury brand values.

Cucinelli’s annual report strongly reinforces this reality:

“In this market, the perception of exclusivity is a key element … ‘Safeguarding the brand’ means preserving its allure through discreet communication that is consistent with the company’s identifying values; it also means careful selection of prime sales locations, paying constant attention to curating the company’s spaces and digital presence, in accordance with the essential principles of sobriety that set us apart.

Today we are seeing a growing demand for high-end products in numerous sectors; in this context, the strategy of avoiding overexposure of the product and protecting the brand identity has further strengthened its allure and appeal.” [Pg. 21]

Cucinelli’s inventory has increased over the last 3 years, with inventory days growing from 311 days in 2021 to 415 days in 2024, meaning Cucinelli currently has well over a year’s worth of inventory.[1]

Implied Cost of Goods Sold (COGS) derived from Brunello Cucinelli’s “First Margin”, an analogous metric. Inventory days calculation uses end of period reported inventory. We use a standard inventory days calculation with end of period inventory/COGS. This elevated inventory continues into H1 2025. We calculate inventory days at 404 days for the 12 months to the end of June 2025. ↩︎

While Brunello Cucinelli describes its inventory as “healthy in relation to our collection offering,” its inventory appears to be far and above that of direct luxury peers.

Close “pure play” peer Zegna reports 293 inventory days in its most recent financial year and others, such as Burberry and Hermes, are much lower.

We interviewed a luxury consultant with direct experience working in the quiet luxury space. The consultant told us that Cucinelli’s inventory is “very far” from where it should be.

“Somebody like Cuccinelli, if he wants to have a business optimized, it should be between 3 to 4 months. You see how far he derives. He's very far… You should be at 120, 140, 145 [Days]. That's the golden number… It's even normally in quiet luxury. You should be at 60 days. This is the target.”

From 2014 To 2019, Cucinelli’s Financials Stated That It Does Not Make Provisions For Obsolete Inventory Because The Company Has An Efficient Process Of Selling And Disposing Of Residual Items

Five Years Later, In 2024, Cucinelli Disclosed A €99.6 Million Inventory Write-Down Provision Which “Reflects Management’s Estimate Of The Expected Loss In Value Of Materials Or Products From Past Seasons”

Since 2013, a year after its IPO, until 2019, Cucinelli did not make any provision for inventory obsolescence. From 2014 to 2019, the company claimed that its inventory management policies allowed the company to avoid recording any inventory obsolescence provisions by having an efficient process of selling and disposing of residual items for every season according to its annual reports. [1, 2, 3, 4, 5, 6, 7]

Starting in 2020, however, the company began to recognize a provision for inventory write-downs.

The initial provision was recorded under the pretext of a charitable project called “Project in Support of Mankind” which, according to a press release, would “gift mankind” the excess inventory related to the COVID-19 sales disruption. The donation (i.e. provision for inventory write-down) amounted to €30 million, according to the company.

One would expect that a company claiming that it had “an efficient process of selling and disposing of residual items for every season” would only register a provision due to unexpected events such as a pandemic. With Cucinelli, however, write-down provisions have continued to grow since 2020.[1]

In 2020, Chairman Cucinelli Argued That “You Can’t Sell This Year Fashion Next Year” Therefore Giving Clothing Away Is Superior To Discounting, Due To The “Damage Aggressive Discounting Can Do To A Brand’s Image And Reputation,” Per A 2020 Interview

Despite Chairman Cucinelli’s Arguments, We Found Thousands Of Cucinelli’s Products Being Aggressively Discounted Across Multiple 3rd Party Outlets

Luxury Fashion Expert: “It's Always A Very Bad Sign When You Are In Outlets, Because This Means That You Have Overproduced, That Your Store Cannot Anymore Absorb It, And That You Need To Write Off Your Stock. Right. Which Is A Disaster. And It Is What Is Happening To Him [Cucinelli]. And It's A Vicious Circle”

During a 2020 interview, Chairman Cucinelli reportedly explained that donating excess inventory is akin to the biblical story of “manna from heaven,” while also making for great PR.

In the interview, Cucinelli explained that selling excess inventory at a discount can be damaging for the brand and company reputation.

Despite Chairman Cucinelli’s awareness of the brand risks, we found thousands of Cucinelli SKUs across numerous online U.S. luxury outlets and discounters, including Yoox, The Outnet, and Saks Off.

We found nearly ~2,500 Cucinelli SKUs selling for steep discounts, sometimes as high as -87%, across these outlets at the start of September. Meanwhile, we found just 21 SKUs for close peer Loro Piana on the same platforms, or 1.5% of what we found for Cucinelli.

We interviewed a luxury consultant who knows Chairman Cucinelli personally, who explained that large volumes of discounted products being sold in outlets is a “disaster” and that this is exactly what is happening to Cucinelli.

“And it's always a very bad sign when you are in outlets, because this means that you have overproduced, that your store cannot anymore absorb it, and that you need to write off your stock. Right. Which is a disaster. And it is what is happening to him. And it's a vicious circle.”

We also interviewed a former Cucinelli executive who told us that large volumes of heavily discounted Cucinelli products are not only concerning, but they would have been unheard of 5 years ago.

“I actually was discussing this summer because I started seeing a lot of the more discounted Cucinelli. I'd say, to be honest, that's a recent concern of mine because that did not exist five years ago. That definitely didn't exist ten years ago. We would never find discounted Cuccinelli. It wasn't around. It didn't exist. It was a very controlled market. We knew where if we saw a 60% markdown, we knew where who was coming from. And we'd stopped that.”

Example Of Aggressive Discounting And Brand Dilution: Brunello Cucinelli’s Products Can Be Found In TJ Maxx, An American Discount Store Chain

“I Do Not Understand That. If I Were A Cucinelli I Would Never, Ever Put A Garment At TJ Maxx, Not Even With A Gun Pointed To Them” – Former Head Of A Quiet Luxury Brand

Throughout our interviews with dozens of industry experts, we were told how important “brand protection” is for quiet luxury brands. As one industry expert and former Loro Piana executive opined on the risks of discount stores:

“In fact, you break the magic of a brand if you do not maintain the scarcity. If. If you see it…Sorry for my English, but you fuck it. And it should not be. It should not be allowed…. You have a large part of people that are buying Cuccinelli that are not crazy rich, but they they go into those [discount] places. So they sit. And once you break the dream, I mean, you do not find a Louis Vuitton bag in any outlet.”

Brunello Cucinelli is also patently aware of the risk of overexposure, specifically discussing a strategy to prevent it in the company’s annual report. [Pg. 21]

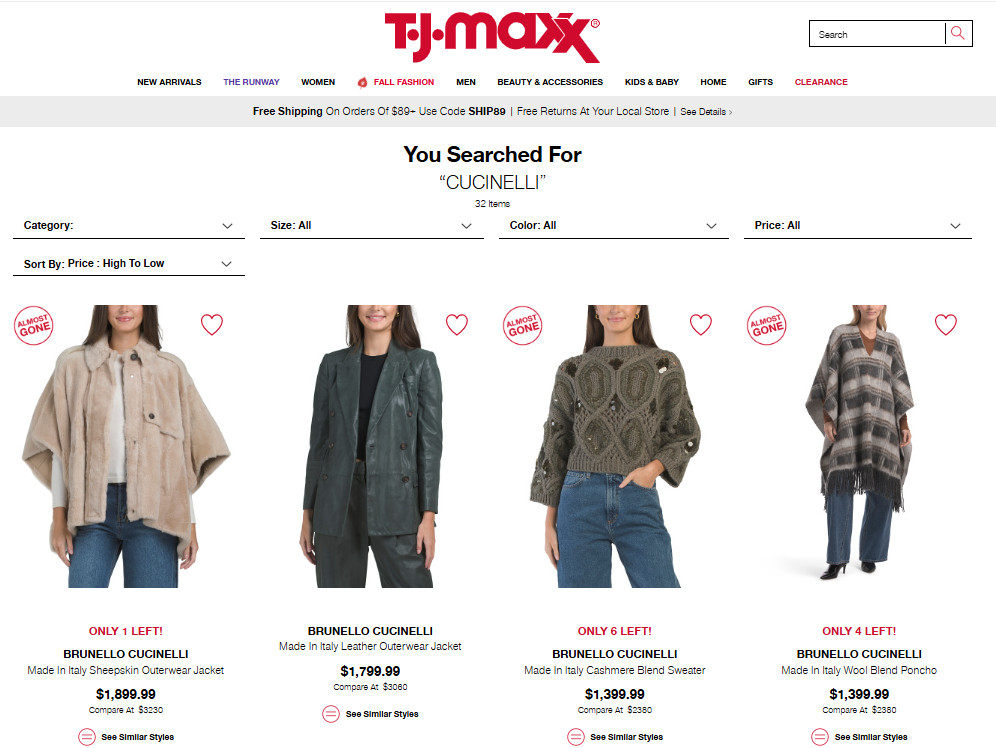

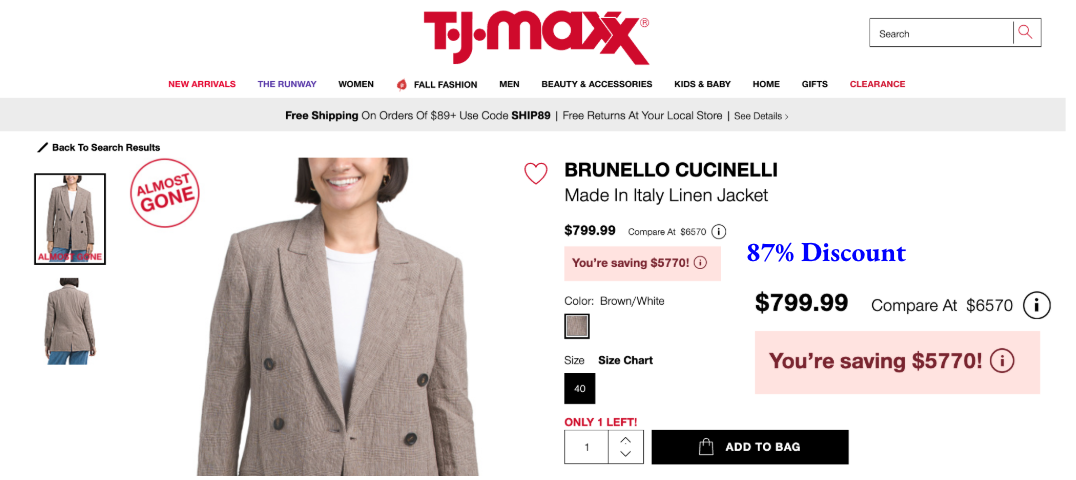

Yet, we found Brunello Cucinelli items sold in discount store TJ Maxx, an American off-price retailer, with discounts ranging from 40% - 87%.

On September 10, 2025, there were at least 32 different SKUs of Brunello Cucinelli being sold online at TJ Maxx in the US, with many appearing to have deep inventory based on availability for multiple sizes. By contrast, we found zero items from close peers Loro Piana and Zegna on the US TJ Maxx site.

For example, we found a linen jacket at TJ Maxx online store being sold at an 87% discount.

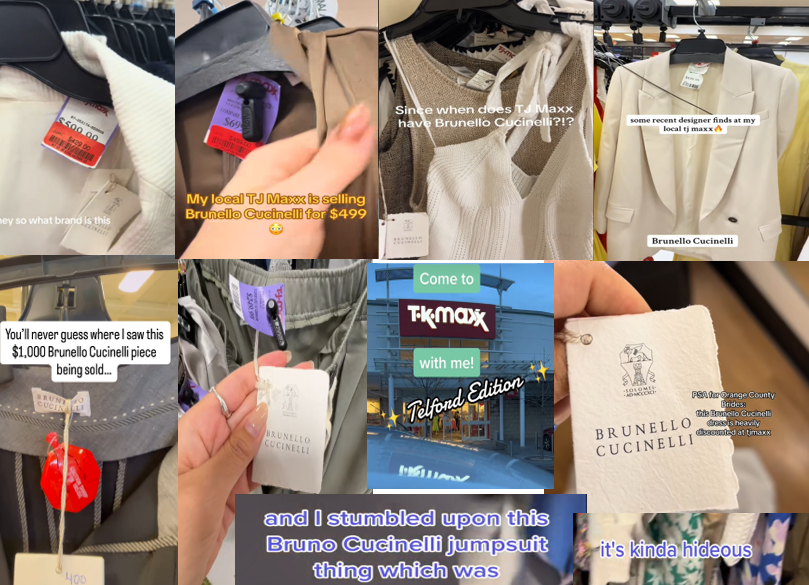

We also compiled 8 social media posts showing customers' surprise at finding the brand in TJ Maxx or T K Maxx (the UK name for the discounter).

When we asked industry experts and former Brunello Cucinelli former employees, many too were surprised to see the brand appearing in a discounter like TJ Maxx, irrespective of the route it got there.

“Oh, gosh! When I was there… we used to have scraping tools in order to scrape the market. We didn't at that time…there were no products on TJ Maxx” — former Brunello Cucinelli employee

“That's me personally I do not understand that I if I were a Cucinelli I would never, ever put a garment at TJ Maxx, not even with a gun pointed to them” — ex senior employee at Khaite, quiet luxury peer

In contrast with peers such as Loro Piana having zero items in TJ Maxx online store, Cucinelli appears to have lost control of its wholesale channel that has led its items to be aggressively discounted in bargain basements unlike it peers.

Around The Same Time Cucinelli Began Its Inventory Write-Down Provisions, Cucinelli Partnered With Undisclosed Fashion Liquidators, Specialized In The Purchase And Distribution Of End Of Season Stock To Remote Destinations Like Russia

A Former Cucinelli Employee Told Us These Entities Would Engage In “Cross Docking” In Countries Like Uzbekistan To Ship Products To Russia While Avoiding Sanctions

As part of its organizational structure, Cucinelli discloses the existence of two entities - Market Service US Inc and Logistica e Distribuzione S.R.L. - each of which is 51% owned by Cucinelli, with little to no information about the other shareholders.[1]

Logistica e Distribuzione S.R.L. was consolidated by Cucinelli in the first half of 2019, according to the company's 2019 semi-annual report. Market Service US Inc. was incorporated in January 2020. It was set up for “managing some logistics and distribution in the American market,” per Cucinelli’s 2020 Annual Report. (Pg. 82) Neither of these entities have employees, per Cucinelli’s disclosures to CDP – an independent environmental disclosure system. (Pg. 93) ↩︎

A former Cucinelli employee told us that these entities are used to sell “unsold garments” to a “network of customers that has stores around the world in the remote places of the world.”

This network also included Russia, per the former employee, who told us that after EU sanctions were implemented, one of these subsidiaries was selling items through the “Stan” countries such as Uzbekistan through a process known as cross-docking – referring to a logistics practice where products are transferred quickly between vehicles.

“They cross docking the [sanction] limitations through Uzbekistan and the “Stan” Countries. The sales in Russia were continuing of course, never stop …”

Cucinelli’s undisclosed partner in these two entities is an Italian company named Iraga Holdings S.R.L., according to Iraga’s financial statements, obtained from the Italian corporate registry.[1]

Iraga is co-owned by Gianluca Donati and Vittorio Chalon, who also appear to be associated with another entity, also owned by Iraga Holdings, called Good Fellas S.p.A., per their LinkedIn profiles. [1, 2]

Archived versions of the Good Fellas website reveal that it was in the business of liquidating “end of season” stock to jurisdictions like Russia, per its 2019 website.[1]

Furthermore, trade data confirms that Good Fellas conducts business in Russia. For example, in June 2024, Good Fellas SpA, exported to Mercury Group in Russia, according to Tradesparq.

Conclusion: Sanctions Violations And Brand Dilution From Aggressive Discounting Of Bloated Inventory Are Not Yet Factored Into Cucinelli’s Stock Price

Founder Brunello Cucinelli and his company have extolled the virtues of a new form of capitalism - more humane, more ethical - seemingly convincing the market to reward the business with a significant valuation premium to its peers despite slowing revenue growth and rising competition.

Despite this virtue signaling, Cucinelli appears to have blatantly disregarded European law by continuing to sell its ultra high-value luxury goods in Russia, a market that many of its peers have exited, whether out of respect for the law or basic ethical judgement.