Collective Mining’s Response Attempts To Justify Drilling On Untitled Land, Misinterprets Colombian Law, And Contradicts Numerous Industry Experts, Including Current & Former ANM Officials

Former ANM Official: “If Somebody Is Doing That… It Is Considered Illegal Mining, And You Need To Report This To The ANM”

On August 6, we released a report uncovering evidence of aggressive and unlawful exploration across an untitled corridor of land at Collective’s flagship mining target, called Apollo.

The day after our report, Collective published a response claiming that all of the work at its Apollo Target has been conducted “lawfully” as the company assesses the “technical and environmental feasibility” of the project.

Collective claimed that much of the land in question, specifically the incomplete cells intersected by its titles, will “eventually” be integrated into its titles— seemingly implying that, even if true, this somehow allows for ongoing exploration activities in these areas.

Furthermore, Collective has attempted to justify its drilling in the untitled corridor by citing various articles of the Colombian Mining Code, which the company claims allow exploration activities as long as those activities are focused on assessing technical requirements for a deposit.

We disagree and stand behind our research. As part of our due diligence, we spoke to multiple experts about Collective’s claims, including current and former National Mining Agency (ANM) officials, executives from other Colombian mining companies, and a top mining law firm in Colombia.

In Collective’s response to our report, its President, Omar Ossma trumpeted his own credentials:

“As a Colombian national and lawyer with more than 20 years of experience in the mining and energy industry, I take great pride in ensuring that our Company operates with full respect for Colombian law, institutions and communities.”

We detail Ossma’s involvement as legal counsel at mining company, Eco Oro, in a situation that has parallels to Collective’s issues today.

Our Report Shows That Much Of The Apollo Target Drilling Activities Have Been Carried Out On Untitled Land Between Two Of Collective’s Mining Titles

Collective’s Response Does Not Refute This Core Allegation, But Instead Diverts Investors’ Attention To The Presence Of Incomplete Cells In The Corridor, Which The Company Claims Will “Eventually” Be Integrated Into Their Titles, Per Unnamed Authorities

Reality Check: Collective’s Drilling On The Apollo Target Within The Corridor Is Also Being Carried Out In Complete Cells That Are Under Application For A Concession Contract— Not A “Valid And In Good Standing” Title, According To The ANM Title Database

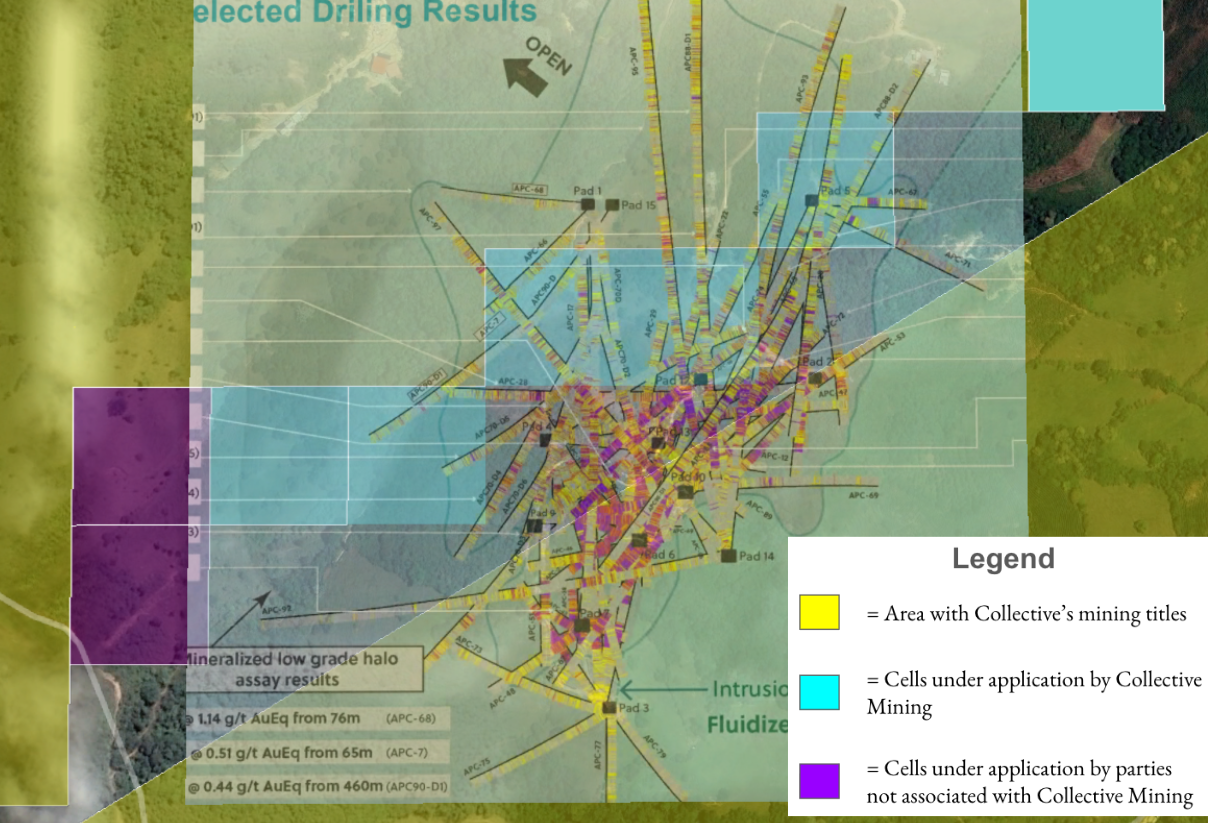

In our report, we showed how Collective appeared to be drilling in an untitled corridor between Collective’s mining titles LH0071-17 And HI8-15231 within the Apollo Target.

Collective’s response does not refute this core allegation.

Instead, the company tried to divert investor attention by saying that incomplete cells “exist between two of the company's mining titles within the Apollo system.”

The company also claimed that they had received a written confirmation from unnamed authorities that “the incomplete cells will be incorporated into the title once the Colombian mining cadaster’s software is updated.”

Collective could have simply told investors it had mining concessions in those cells - it did not.

What Collective failed to mention is that, while the corridor between the two mining titles within the Apollo System does contain incomplete cells, it is mostly composed of complete cells that are under application for a concession contract, according to the ANM’s title database. [1]

As we showed in our report, the company has drilled for minerals in those cells and even installed drill pads in some of them, as shown below.

Drilling in cells that are under application is not permitted, as explained by a top law firm in Colombia:

“In Colombia, the right to explore and exploit state-owned mines can only be established, declared, and proven through the signing of duly granted and registered mining concession contracts in the National Mining Registry (“RMN”) …

While concession contract applications are under evaluation, they do not confer the right to be granted a concession contract for the requested area. They only provide the applicant with a right of priority to obtain the concession for the proposed area if the corresponding legal requirements are met.”

Put in plain and simple English, an application is not a validly granted mining title.

We also spoke to legal counsel and mining lawyer at an international firm in Colombia, specifically referring to the image above, who told us:

"That's completely a breach of law [drilling in the cells in blue above] ... I can see Pad 5, for example, Pad 12 is also in the blue. Yeah. Those areas can't be drilled."

Our Report Shows How Collective Has Installed Multiple Drill Pads Outside Of Its Title Areas

Collective’s Response Claims That “Locating Drilling Platforms Or Performing Drilling Activities Outside Of The Mining Titles Boundaries Is Fully Permissible … If The Intent Is To Comply With Technical Requirements”

Reality Check: Drilling And Exploration To Determine The Presence Of Minerals Or Natural Resources, As Collective Has Done, Does Not Qualify As A Technical Requirement, According To Multiple Legal Experts, Including Former And Current ANM Officials

As we showed in our report, Collective has installed drill pads in the corridor between the two mining titles at its Apollo target, including in complete cells that are currently under application.

Relying on Article 58 and 166 of the Colombian Mining code, Collective argues that “performing drilling activities outside of the mining title boundaries is fully permissible under Colombian law” when done for “technical requirements.” Yet our interviews with multiple legal experts, including former and current ANM officials, indicate the opposite is true.

We asked legal counsel at a local mining firm whether drilling on untitled land was permissible under technical justifications in Article 58:

“No, because, in this case … what the Article 58 says is that you can establish services, equipment and works, but it doesn't say that you can do exploration outside. Because the law is very clear for you to start an exploration program, you need a signed contract. You need a signed contract with the National Mining Agency.”

To further confirm that Articles 58 and 166 do not allow for drilling or exploration outside a mining title, we conducted an in-depth interview with a former ANM official and lawyer from Colombia, who told us:.

“[On Article 58] Exactly. If somebody is doing that [exploring or drilling] just right now, it is considered illegal mining, and you need to report this to the ANM.”

“[On Article 166] Exactly it's not for drilling, it's not for exploitation, exploration. It's just in case you need to organize this area for your help.”

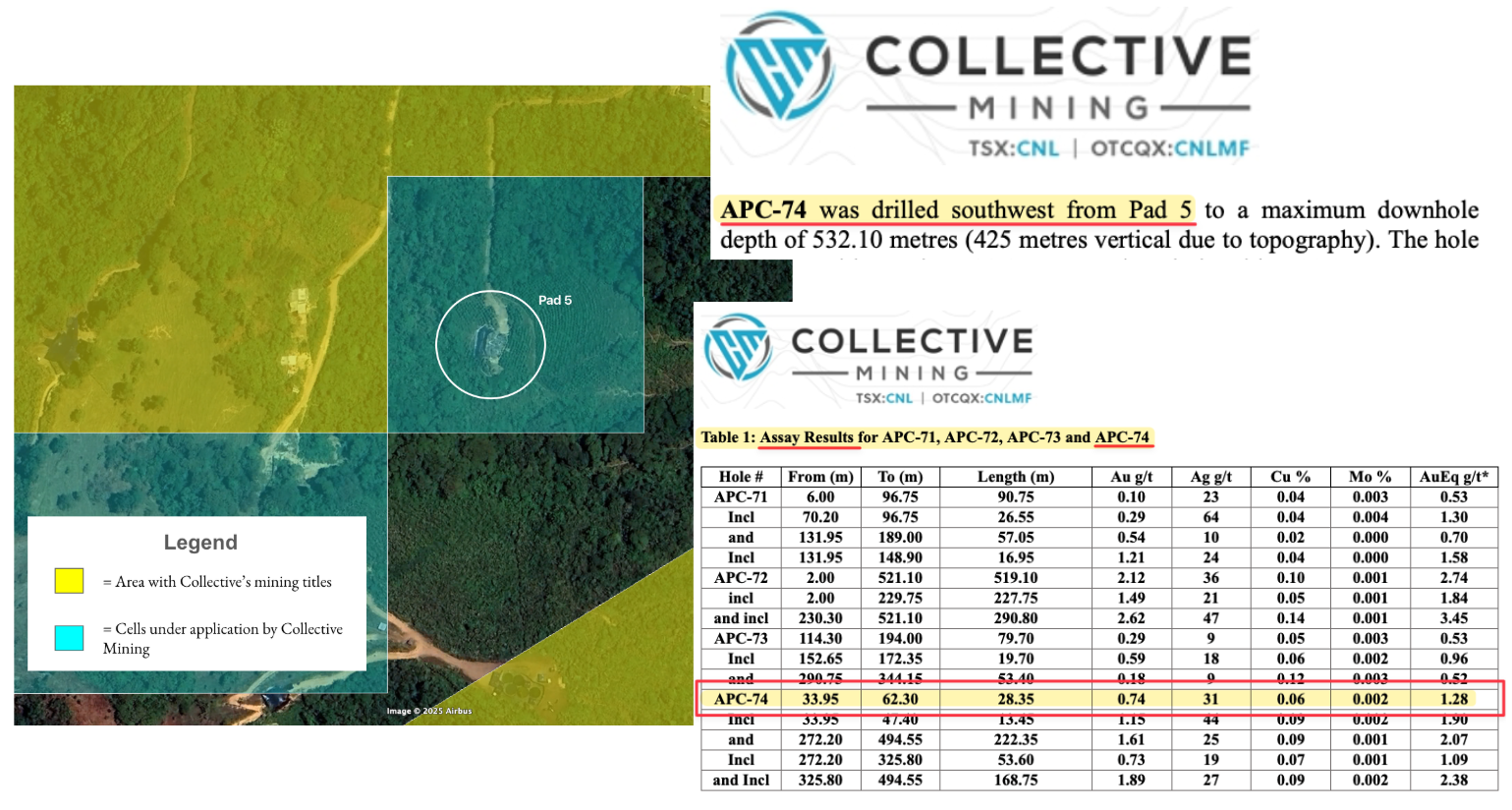

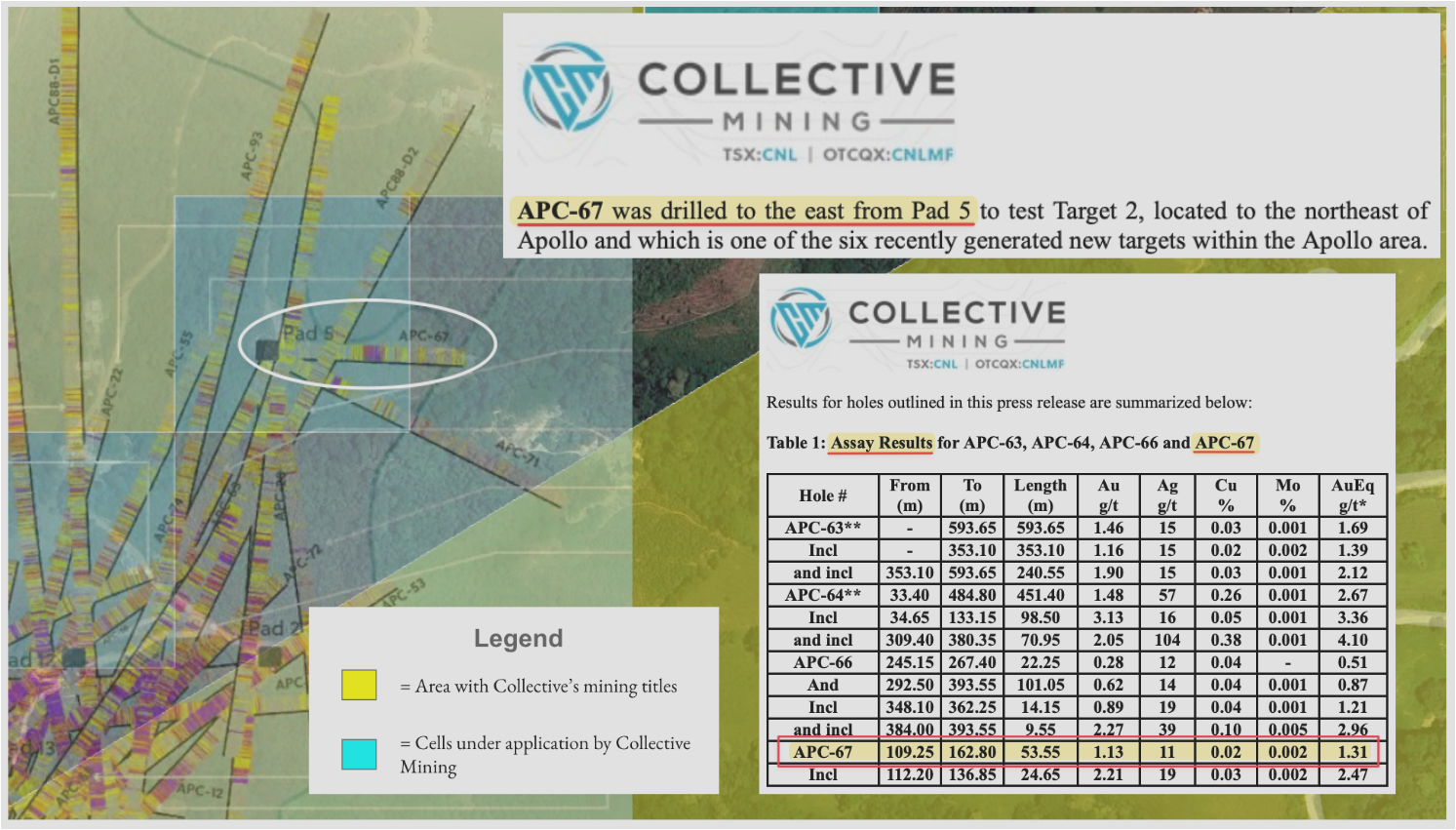

Collective regularly announces “assay results” from Apollo drill holes as well as new discoveries, drilled from pads located in the corridor between the two titles within the Apollo target. This indicates that the company is conducting drilling activities to capitalize on mineral resources rather than carry out technical studies.

For example, Pad 5 is located in a cell that is currently untitled and is under application. In a series of press releases in late 2023, Collective announced assay results from a hole drill from Pad 5. [2]

To argue that “technical requirements” could give the green light to carry out full scale exploration activities from pads outside its permitted mining title boundary is, in our view, absurd and would undermine the mining title system.

Collective’s President, Omar Ossma, Responded To Our Report By Reminding Investors That He Is A Lawyer With More Than 20 Years Of Experience Who Ensures That “The Company Operates With Full Respect For Colombian Law”

From 2010 To 2012, However, Ossma Acted As Legal Counsel Of A Colombian Miner Called Eco Oro, During Which Time The Company Falsely Stated That Its Environmental Management Plan Was Previously Approved

Ossma Knew That The Eco Oro’s Environmental Management Plan Was Not Approved, Later Arguing That The Company Had Been Operating Based On “Tacit Approval,” According To Internal Emails Disclosed In An Arbitration Process

As part of its response to our report, Collective’s President Omar Ossma stated:

“As a Colombian national and lawyer with more than 20 years of experience in the mining and energy industry, I take great pride in ensuring that our Company operates with full respect for Colombian law, institutions and communities.”

While we do not take issue with his time spent in the industry or his “great pride” in keeping the company compliant, we would remind investors of Ossma’s past at Eco Oro, a public Canadian mining company, also active in Colombia. [3]

From August 2010 to August 2012, Ossma acted as legal counsel of Eco Oro, a Canadian company developing a mining project in Colombia, per his LinkedIn profile.

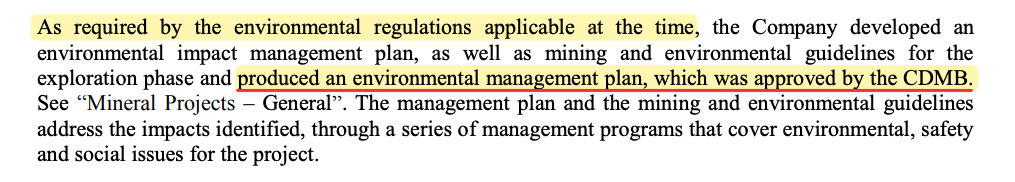

As of December 31, 2011, Eco Oro told investors that it had “produced an environmental management plan, which was approved by the CDMB,” according to the 2011 annual information form. [Pg. 9]

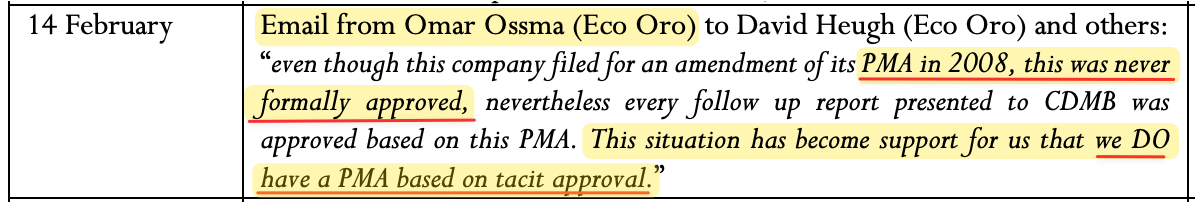

In February 2012, however, Ossma acknowledged that the Eco Oro’s environmental management plan was “never formally approved."

Ossma argued nonetheless that the company had a compliant environmental management plan based on “tacit approval,” according to an email he sent to the company’s Chief Operating Officer revealed in arbitration filings. [Pg. 414]

Eco Oro’s environmental management plan (“PMA”) was never approved, according to the same filings. [Pg. 263]

Ossma left Eco Oro in August 2012, the same month that the company’s concession was “scrapped” by the Colombian government due to environmental restrictions, causing its share price to immediately plummet by 50%, per industry publications.

In March 2016, Eco Oro initiated a dispute that led to arbitration against the Government of Colombia. The company's efforts were unsuccessful, per ABColombia, a human rights advocacy group.

Eco Oro is now virtually worthless trading at C$0.015, down over 99% since then.

Conclusion

Investors may wish to trust the claims of Collective Mining’s management team, which seem to indicate that the company has somehow discovered a way to legally drill on untitled land. It may be that management believes it has some sort of “tacit approval” for doing so. We, however, remain skeptical and view Collective’s activities as blatant disregard for Colombian law.

Collective’s response to our report does not stand up to basic scrutiny, based on numerous in-depth interviews with Colombian mining experts, including current and former officials from the country's mining regulator. The response failed to refute our core allegations and instead attempted to divert attention away from its drilling on untitled land, the potential for future environmental restrictions at its flagship project, and the existential risks that these issues pose to the company’s future.

We remain short CNL.

Disclosure: We are short shares of Collective Mining Ltd (TSX and NYSE American: CNL)

[1] Two of the complete cells in the corridor are under application by third parties, according to the ANM’s title database. This could limit Collective’s ability to fully integrate the corridor into its mining titles in the future. These are: (i) Complete cell 18N05E04D06M is under application #502175, requested by Proyecto Andino SAS since July 23, 2021. (ii) Complete cell 18N05E04D06H is under application ARE-510317, requested by Jose Alfonso Garcia Salazar, since December 4, 2024.

[2] Pad 5 is located in cell 18N05E04D02X which has been under application 502174 since July 23, 2021, per the ANM’s title database.

[3] Perhaps Ossma would be wise to fact-check press releases published by Collective more assiduously. Collective states in its response that “square cells on the ANM measure 1.24 ha (352m by 352m).” 1.24 ha is equal to 111m x 111m not 352m x 352m as verified in a 2022 ANM presentation. [Pg. 55]

Legal Disclaimer

Use of Morpheus Research LLC’s (“Morpheus Research”) research is at your own risk. In no event should Morpheus Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Morpheus Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) may have a position in the stock, bonds, derivatives, or securities covered herein and therefore stands to realize significant gains if the price of the securities move. Following publication of any report or letter, Morpheus Research intends to continue transacting in the securities covered therein and may be long, short, or neutral at any time thereafter regardless of Morpheus Research’s initial position or views. Morpheus Research’s investments are subject to its risk management guidance, which may result in the de-risking of some or all its positions at any time following publication of any report or letter depending on security-specific, market or other relevant conditions. This is neither an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Morpheus Research is neither registered as an investment advisor in the United States, nor does it have similar registration in any other jurisdiction. To the best of Morpheus Research’s ability and belief, all information contained herein is accurate and reliable and has been obtained from public sources believed to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. Conclusions expressed herein are based upon the information disclosed herein and represent the opinion of Morpheus Research. Such information is presented “as is,” without warranty of any kind – whether express or implied. Morpheus Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Morpheus Research does not undertake to update or supplement this report or any of the information contained herein.