Abacus’ Scattered Response Failed To Refute Any Of Our Allegations & Contradicted Its Own Statements To The SEC. We Reveal New Evidence Of Abacus Insiders Engaging In Undisclosed Related Party Dealings And Of Carlisle Round-Tripping Policies

On June 4, we released a report detailing an egregious accounting scheme taking place at Abacus Global Management (NASDAQ: $ABL). Our 76-page report took 3 months to prepare, contained 400+ citations, and involved in-depth interviews with dozens of industry experts, including multiple former Abacus employees.

Abacus management was ostensibly able to read the report, investigate our claims, and determine that it was false in a matter of just ~9 hours – while threatening us with legal action.

Numerous sell-side analysts exhibited the same ability to digest and dismiss our entire report in a matter of hours. This includes B. Riley, Piper Sandler, TD Cowen, and Northland – all of which have banking relationships with Abacus, earning millions of dollars in fees.[1]

Piper Sandler led Abacus' first senior notes deal in November 2023 and continues to rate the stock "overweight" with a $12 price target. B. Riley Securities co-managed Abacus' June 2024 share follow-on offering and continues to maintain a "buy" rating with a $15 price target. TD Securities acted as a joint book-runner on Abacus' June 2024 share follow-on offering and maintains a "buy" rating with a $14 price target. Northland participated as a co-manager on Abacus’ November 2024 12.5 million share follow-on offering and maintains an “outperform” rating with a $13.50 price target. Analyst ratings retrieved via Bloomberg. ↩︎

We stand by our report.

2 days ago, Abacus released a more detailed response. Critically, Abacus did not refute the core allegation of our report, which is that Lapetus’ life expectancy data is consistently and significantly shorter than that of other providers.

Instead, Abacus’ response was a poorly constructed attempt at shareholder misdirection that contained numerous disprovable statements, including contradictions of its earlier claims to the SEC.

We remain short and reaffirm our opinion that Abacus is systematically overvaluing its assets through practices that mirror past life settlements blowups, including GWG Holdings and Mutual Benefits Corporation.

Further, we also include new information that has come to light since our report. This includes evidence of Abacus management engaging in undisclosed related party dealings with National Insurance Brokerage (“NIB”), a formerly private entity controlled by ABL management.

After we published our report, a whistleblower provided us evidence that Carlisle has used third parties to transfer life settlements from one fund to another in what appears to be a related party transaction using third-party vehicles as cover to justify its asset values.

Rather Than Stand Behind Its Use Of Lapetus, Abacus Has Bizarrely Claimed That It Does Not Use Life Expectancy Data To Value Its Portfolio, Instead Relying On A “Mark-To-Market” Method That Relies On “Actual Market Results”

This Claim Directly Contradicts Numerous Statements Made To The SEC In Abacus’ Annual Report, Including That For Policies Carried At “Fair Value,” The Valuation Is Based On “Level 3 Inputs,” Including “Life Expectancies And Cash Flow Discount Rates”

Abacus claimed in its response that it uses life expectancy data when acquiring policies, but that this data is somehow irrelevant when valuing its policies at the portfolio level, where they instead use a “market-based” approach.[1]

Consider if there is any difference between buying a bond and expecting to hold it to maturity or to trade it— the valuation of the bond would not change depending on the “approach.” ↩︎

“When acquiring policies from consumers, Abacus uses life expectancy estimates to ensure fair pricing … But once policies enter Abacus's trading portfolio, the company shifts to a market-based valuation system that prioritizes actual market results.”

Abacus claimed that the “calculation of fair value for purposes of balance sheet valuation results from data that we observe in the market for life settlement policies.”

These statements directly contradict Abacus’ publicly declared valuation methodology, as detailed in its latest annual report, which is based on discounted cash flow models where the key inputs are life expectancies and discount rates.

“The Company’s valuation of life settlements is considered to be Level 3. The Company’s valuation model incorporates significant inputs that are not observable and reflect our assumptions about what factors market participants would use in pricing life settlement policies.” [Pg. 80]

“For policies carried at fair value, the valuation based on Level 3 inputs that reflect our assumptions about what factors market participants would use in pricing the asset or liability, such as life expectancies and cash flow discount rates. The inputs are developed based on the best available information, including our own data. The valuation model is based on a discounted cash flow analysis and is sensitive to changes in the discount rate used.” [Pg. 105]

“The valuation of life insurance policies involves inherent uncertainty (including, without limitation, the life expectancies of insureds and future increases in premium costs to keep the policies in force). The Company utilizes a multitude of inputs to determine the fair value of the policies it holds, which may include life expectancy reports generated by a company in which the Company holds a minority ownership interest.” [Pgs. 14-15]

Abacus’ most recent annual report states that policy valuations and returns will vary based on life expectancy data, not market transactions.

“The valuation of the life insurance policies will vary depending on the dates of the related mortality estimates and the medical underwriting firms that provide the supporting information.” [Pg. 15]

“The returns of the Company’s hold portfolio is almost entirely dependent upon how accurate the actual longevity of an insured is as compared to the Company’s expectation for that insured.” [Pg. 15]

Similarly, the registration statement for Abacus’s new ABL Growth & Longevity Fund clearly discloses the use of Lapetus as the primary life expectancy provider, claiming Lapetus provides the “most conservative” (i.e. longest) life expectancies.

The fund explicitly states that it uses Lapetus for post-acquisition policy valuation, rather than solely using Lapetus LEs to determine policy acquisition price, as Abacus claims it does for its own portfolio. We find it bizarre that Abacus would choose to adopt one valuation method for a fund it manages and another for its own balance sheet.

Notwithstanding this apparent contradiction, Abacus’ newly proclaimed valuation methodology for its own balance sheet is absurd on its face.

During 2024, there were 3,181 secondary market life settlement transactions of which Abacus comprised 20%,per The Deal. Even if it were possible to obtain the data from other transactions, it is highly unlikely that Abacus could find exact comparable transactions to determine pricing for each of the 700+ policies it owns.[1]

Supposing Abacus attempted to value its portfolio based on market comparables, it would still need life expectancy estimates to compare like-for-like policies, and if those estimates are understated, then those comparables would be unreliable.

We think this claim is a poor attempt to confuse and misdirect shareholders.

Abacus Claims That “Independent Actuarial Firm” Lewis & Ellis Validated Its Portfolio Valuation

Critically, Abacus Did Not Disclose What Life Expectancy Or Discount Rate Inputs Were Used By Lewis & Ellis, And Whether These Key Inputs Were Provided By Abacus Or Independently Obtained By Lewis & Ellis

In its rebuttal, Abacus said it engaged Lewis and Ellis, a third-party actuarial firm, “to review the entire policy balance sheet as stated in our Q1 2025 10-Q filing (over 700 policies), removing all Lapetus life expectancy estimates from the analysis.”

Abacus noted that Lewis and Ellis used 4 inputs to produce valuations: premium streams, life expectancies (not including Lapetus Solutions), face values of policies and discount rates.

Abacus failed to mention which life expectancy providers supplied the data for this analysis, what specific discount rates were used, or if these key inputs were provided by Abacus or independently obtained by Lewis and Ellis.

We find it highly unlikely that Lewis and Ellis was able to procure independent LE reports that perfectly aligned with Lapetus data, resulting in a virtually identical portfolio valuation.

The fact that Abacus was unable to share even these basic details of its “independent” study is telling and, in our opinion, renders the entire exercise meaningless to shareholders.

In May 2025, An Unrelated Life Settlements Fund Was Accused Of Inflating Asset Values By Manipulating Discount Rates, “Purposefully” Failing To Update Life Expectancies, And Operating With “Numerous Conflicting Interests”

The Fund Utilized Lewis & Ellis For Valuation, Which Was Named As A Defendant And Admitted During Litigation That It Relied On Inputs Provided By The Fund Itself

Lewis & Ellis Partner: “For The Most Part, In My Valuation Of Funds, I Use The Discount Rate That Is Provided To Me By The Fund Manager”

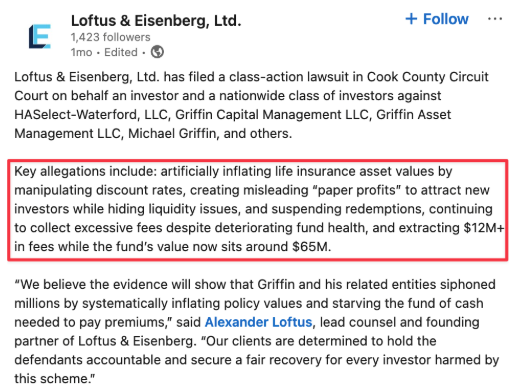

Last month, shareholders sued a life settlement fund called Waterford and its manager, Griffin Capital Management, for inflating asset values by manipulating key inputs such as discount rates and life expectancies.

While the suit was unrelated to Abacus, the fund used the same valuation firm, Lewis & Ellis, which was named as a defendant in the case.

During litigation, a Lewis & Ellis partner admitted that he relied on inputs from the fund itself for its valuation exercise, rather than obtaining independent data.

Lewis & Ellis Also Acted As An “Independent Actuarial Valuation Agent” For Carlisle’s Flagship Fund, According To The Fund’s 2020 Placement Memorandum

As Mentioned In Our Report, The Fund Gated Redemptions In 2020 And Its NAV Subsequently Plummeted By 44%, Despite The Presence Of Lewis & Ellis, And Carlisle Saying That It Was “Confident That The Fair Market Valuation Methodology Is Accurate”

Carlisle's flagship fund, Luxembourg Life Fund — Long Term Growth Fund, also used Lewis & Ellis as an independent actuarial valuation agent.

Since 2009, Lewis & Ellis was responsible for carrying out “proper and independent valuation of the Fund’s assets” and it provided “external valuation services in relation to the assets of the Fund,” according to a 2020 placement memorandum.

As mentioned in our report, the fund was gated at the end of 2020, when Carlisle told investors that it was “confident that the fair market valuation methodology is accurate” and that the fund portfolio “remains robust.” [Pgs. 1, 2]

Since halting investor redemptions, the fund has lost 44% of its value, according to Bloomberg.

In summary, we view Abacus’ use of Lewis & Ellis as worthless reassurance and a distraction from the still-unrefuted allegations raised in our report.

Another Key Claim From Abacus To Explain Its Industry-Leading Returns Is That It Targets A Balance Sheet Turn Of 2x Annually, A Claim That Has Been Constantly Repeated By Sell-Side Analysts

Abacus’ SEC Disclosures Indicate A 20.2% Average Turnover For The Last 4 Reported Quarters, Implying A Much Longer Average Holding Period Of At Least 1.3 Years, Double The Length Of What Abacus Appears To Be Targeting

On its Q4 2024 earnings call, Abacus told investors that for its policies on its balance sheet, it is “targeting 2 turns per year on average” and that policies’ “average time on the balance sheet historically has been anywhere between 4 to 6 months.”

In Abacus’ response to our report, it again claimed that it has high portfolio turnover and an active trading strategy, targeting a “balance sheet turn of ~2x annually.”

Sell side analysts also appear to regurgitate these figures, with Northland Securities’ analyst highlighting that Abacus “flips/turns the life insurance book of policies roughly every 6 months.”

The claim has been a key aspect of Abacus’ story since its SPAC deal, when it initially claimed an even faster portfolio turnover of 3.6x annually.

“Our traded portfolio returns are driven by (i) the spread we generate by selling policies to third-party institutional investors and (ii) our ability to quickly recycle capital. Our trade spreads average 20% and we have historically recycled capital 3.6 times per year.”

While Abacus’ turnover was higher at the time of its SPAC deal, a review of its SEC disclosures related to the buying and selling of policies shows that its quarterly turnover has likely averaged 20.2% over the last 4 reported quarters, implying a holding period of over 1.3 years, double Abacus’ target.[1]

The estimate of the turnover ratio was calculated by taking the fair value of matured or sold policies and dividing by the fair value of life settlement policies at the start of the period. If anything, this calculation might over-estimate policy turnover as some maturities are also included.

For example, at the beginning of Q1 2025 Abacus reported a portfolio of life settlement policies carried at fair value worth $370.3 million. During Q1 2025 Abacus reported $56.8 million of matured/sold policies. This results in a turnover of 15.34% during that quarter. ↩︎

We believe that Abacus’ claimed target of 2x annual turnover is not borne out by its numbers and an indication that Abacus is becoming increasingly stuck with hard-to-sell, overvalued policies.

ABL Key Claim: “Abacus Has Been Buying And Selling Life Insurance Policies For Over Two Decades … Our Returns And Valuation Are Audited, And Consistent With A 20-Year Track Record Of Generating Positive Revenue”

Reality: Abacus Only Started To Invest In Life Settlements Policies In 2021

In its initial response to our report, Abacus has repeatedly referenced its 20-year track record of buying and selling life insurance policies and “generating positive revenue.”

This is a claim that has been central to Abacus’ investment thesis, as evidenced by an April 2025 interview where CEO Jay Jackson stated that Abacus has “20 consecutive years of positive net income.”

This claim was again repeated by sell-side analysts like Northland Securities, which wrote the day after our report that “losses would also show up very quickly over 20-year history.”

These analysts have failed to read Abacus’ own SEC filings, which state that the company has spent most of its existence originating policies for third party buyers. In fact, its first purchase for its own balance sheet occurred in June 2021, only 4 years ago.[1]

Originally, Abacus operated through 2 principal subsidiaries, Abacus Settlements, LLC and Longevity Market Assets, LLC (“LMA”). Through Abacus Settlements, the company generated revenue through the “origination” of life settlements, taking 2% of the transaction as a fee, per the company’s financial statements. (1, 2) LMA provided portfolio servicing for investors, per Abacus’ 10-K. ↩︎

We stand by our original opinion that Abacus’ seemingly impressive “adjusted EBITDA” profitability is driven by unrealized, non-cash gains created from valuation mark-ups from shoddy life expectancy data.

In other words, Abacus’ 20-year track record of profitably buying and selling policies appears to be nothing short of a myth.

Abacus Says It Sold 226 Policies For $141.4 Million In Q2 2025, But Does Not Clarify If These Were Sold To Entities That Abacus Controls, Including Carlisle And Abacus’ Other Funds, Which Raised ~$123 Million The Previous Quarter

In Abacus’ response, it stated that it sold 226 policies for $141.4 million between the start of Q2 and June 2, 2025 – ostensibly validating the claimed fair value of its portfolio.

However, Abacus did not disclose what percentage of these policies were sold to entities that Abacus controls, such as its managed funds or Carlisle’s various funds.

An industry expert told us that they were unaware of any buyers with that level of capital who they believed would buy from Abacus due to its reliance on Lapetus, and stated that the most likely buyer would be Abacus’ affiliated funds.

Since March 31, 2025, 4 funds controlled by Abacus have collectively raised $124.3 million, according to the Form Ds filed by these entities. On its Q1 2025 earnings call, Abacus said it took them 2 weeks to raise this amount.[1]

The 4 funds are managed by LMA Series, LLC, a subsidiary of Abacus. Abacus Premier Income Fixed, LP sold $92.4 million of equity securities, according to May 9, 2025 Form D. Abacus Premier Income Plus, LP sold $27 million of equity securities, according to a May 8, 2025 Form D. Abacus Enhanced Income Plus, LP sold $1.5 million of equity securities, according to a May 13, 2025 Form D. Abacus Enhanced Income Fixed, LP sold $3.4 million of equity securities, according to a May 8, 2025 Form D. ↩︎

These funds are currently being pitched by Stifel, per a marketing document we obtained.

Stifel states that Abacus is responsible for releasing collateral (policies) into the fund. [Pg. 11] It is unclear, however, whether Abacus is sourcing the policies for these funds from third-party sellers, or selling directly from its own balance sheet.

In its marketing, Stifel describes the funds as having “very low risk of loss of principal and stated return” due to “imminent” death benefits. [Pg. 10]

We believe Abacus should disclose whether the market transactions they refer to occurred between related parties.

In Its Response, Abacus Was Notably Silent On Carlisle And Its CEO Jose Garcia, Which They Previously Touted As Having An “Unmatched” Track Record

After Our Report, We Uncovered Evidence Of Carlisle “Washing” Policies By Round-Tripping Them Through Related Parties, Which We Believe Served To Establish A Reference Transaction To Justify Carlisle’s Valuation Marks

On March 8, 2022, The Carlisle Monetization Fund Sold 6 Policies To A Related Party, Which Sold Them Back To Another Carlisle Fund ~20 Days Later At A 9% Mark-Up

During the course of our research into Carlisle, we were told by an industry expert about the “Short Term Monetization Vehicle,” a liquidation fund that Carlisle set up after it gated funds in 2020. [Pg. 3] The expert familiar with Carlisle’s funds told us:

“Whoever puts their money in the runoff fund gets fucked … So they're going to stuff all the shit in the liquidation fund and fuck all those investors.”

After we published our report, we uncovered evidence that Carlisle has used third parties to transfer life settlements from this fund to another of its funds in what appears to be a sham related party transaction using third-party vehicles as cover to justify its asset values.

On March 8, 2022, Carlisle sold 7 policies from its Short Term Monetization Fund to an entity called Daybreak LLC.[1]

One policy omitted due to Daybreak retaining that single policy instead of selling it to Life Capital. ↩︎

On March 18, 2022, Daybreak sold 6 of those policies to its affiliated business, Life Capital Group, for $4,236,785, including reimbursements for premiums – a 9% mark-up.[1]

Daybreak, LLC is a subsidiary of Whitehaven, Inc, which is located at 7924 Ivanhoe Avenue, Suite 10 and whose CEO is Brendan Francis. Francis is also an employee at Life Credit Company, which is based at the same address. The CEO of Life Credit Company is Daniel Miller, who is a current director of Life Capital, which is also located at the same address. ↩︎

On March 28, 2022, Life Capital sold the 6 policies back to another Carlisle fund at the inflated price, capturing a $350,000 spread. A document associated with the sale referred to Life Capital as the “originator” of the policies, even though they were initially sourced from Carlisle.

Notably, Life Capital is closely tied to Carlisle, servicing one of its funds and also sponsoring Jose Garcia’s racing team, Lionspeed. Life Capital’s entry into Florida in 2017 was via an acquisition which was signed by Abacus’ then General Counsel, Brady Cobb.

We believe the round-tripping of policies between Carlisle funds and Life Capital is an example of “washing” a life insurance policy or moving it between related parties to establish a market transaction that can be used to justify its valuation.

Abacus Insiders Previously Controlled A Private Brokerage Called National Insurance Brokerage (“NIB”), Which They Told The SEC Had “No Significant Contractual, Transactional, Or Affiliate Relationship” With Abacus

Reality: In A 2021 Deposition, Abacus Co-Founder Matthew Ganovsky Admitted That NIB Does Business With Abacus, And A Former Abacus Employee Confirmed That NIB Functioned As A Division Of Abacus During Their Tenure

We Believe Abacus’ Co-Founders Funneled Cash Commissions To NIB Until It Became An Issue For Abacus’ Auditors, Causing Abacus To Quietly Acquire The Business In Q1 2025 For $3 Million With Zero Mention Of The Acquisition During Its Earnings Call

When life settlement funds acquire term policies, they will typically convert those to whole life or permanent policies. Insurance companies treat these conversions as new policy sales, and pay significant commission to the brokers who handle the conversions.

Industry experts told us that these commissions vary widely, but are typically equivalent to the first year’s worth of premiums on the newly issued policies.

A former Abacus employee explained that many leading life settlement funds hold both brokers and providers licenses so that they can handle the conversion internally rather than paying commissions to outside brokers.

“A lot of the bigger companies work that way because … they can access more of the industry if you will. They can access more of the secondary market that way without having that additional broker fee from a third party broker. So some providers, if they're larger providers like that, yes, a lot of them will hold your broker licensing and your provider licensing.”

Since its inception in 2003, Abacus’ 3 co-founders have controlled a private entity called National Insurance Brokerage (“NIB”). NIB is based out of the same address as Abacus.[1]

In November 2024, the SEC asked Abacus about its relationship with NIB, and Abacus responded by stating that NIB is an “independent” brokerage owned by Abacus’ co-founders that “assists in the conversion of term life insurance policies to permanent insurance policies.”

Abacus claimed that it had not engaged in any transactions with NIB and that the two companies operated wholly independently from one another.

“The Company respectfully acknowledges the Staff’s comment and advises that it has no significant contractual, transactional, or affiliate relationship with National Insurance Brokerage, LLC (“NIB”). While Scott Kirby, Matthew Ganovsky, and Sean McNealy serve as officers of NIB, NIB operates entirely independently of the Company. NIB is neither a consolidated subsidiary nor an affiliate of the Company.”

“Notwithstanding the ownership interests of certain executive officers and directors that may render NIB a related person under Item 404, the Company has not engaged in any transactions with NIB.”

Testimony from former employees and litigation records indicate that NIB was operated as a division of Abacus, enabling insiders to funnel lucrative cash commissions for term commissions to themselves while burdening Abacus shareholders with the cost of premiums on the same policies.

In a 2021 court deposition, Abacus co-founder Matthew Ganovsky was questioned about his role at NIB and whether it had done business with Abacus, to which he replied “yes.” [Pgs. 11-12]

Further, a former Abacus employee explained that NIB functioned as a division of Abacus that was kept separate legally for “accounting” purposes.

“Yeah, so Abacus also, or the agent of record I should say, who does that conversion, you do have the premium compensation along with that. So, just like if it was a new sale of a new insurance policy, the agent would get a commission. It's usually about 100% of the first year premium. So it was essentially another way for life insurance providers to kind of make the cost make sense because they knew that whatever they paid in the first year premium, they were essentially getting back as commission.”

“So instead of putting Sean McNealy's name as the agent of record [for the conversion], to my understanding, they were kind of using [NIB] to kind of work on some of those term conversions and things like that.”

The explanation from the former employee implies that when Abacus wanted to acquire a term policy, it would first have NIB assist with a conversion, which would result in the commissions flowing to NIB.

We believe this setup was likely problematic for Abacus’ auditors, leading Abacus to quietly acquire NIB for $3 million in April 2025. Notably, CEO Jay Jackson, who was not listed as an owner of NIB previously, received 25% of the pay-out, while the rest was split between Abacus’ co-founders, according to Abacus’ latest 10-Q.

We find it odd that Abacus did not discuss or mention NIB’s acquisition during its Q1 2025 earnings call, which occurred after the acquisition was closed.

Abacus’ relationship with NIB and eventual acquisition of the brokerage bears all the hallmarks of an undisclosed related party transaction that enrichs insiders at the expense of shareholders.

Disclosure: We are short shares of Abacus Global Management, Inc (NASDAQ: ABL)

Legal Disclaimer

Use of Morpheus Research LLC’s (“Morpheus Research”) research is at your own risk. In no event should Morpheus Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Morpheus Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) may have a position in the stock, bonds, derivatives, or securities covered herein and therefore stands to realize significant gains if the price of the securities move. Following publication of any report or letter, Morpheus Research intends to continue transacting in the securities covered therein and may be long, short, or neutral at any time thereafter regardless of Morpheus Research’s initial position or views. Morpheus Research’s investments are subject to its risk management guidance, which may result in the de-risking of some or all its positions at any time following publication of any report or letter depending on security-specific, market or other relevant conditions. This is neither an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Morpheus Research is neither registered as an investment advisor in the United States, nor does it have similar registration in any other jurisdiction. To the best of Morpheus Research’s ability and belief, all information contained herein is accurate and reliable and has been obtained from public sources believed to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. Conclusions expressed herein are based upon the information disclosed herein and represent the opinion of Morpheus Research. Such information is presented “as is,” without warranty of any kind – whether express or implied. Morpheus Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Morpheus Research does not undertake to update or supplement this report or any of the information contained herein.