Abacus Global Management: This $740 Million SPAC Is Yet Another Life Settlements Accounting Scheme Manufacturing Fake Revenue By Systematically Underestimating When People Will Die

Background

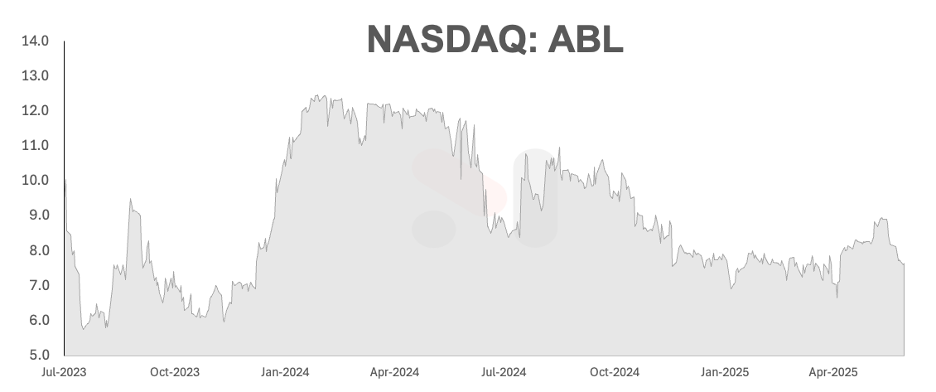

- Abacus Global Management (NASDAQ: ABL) is a $740 million market cap alternative asset manager primarily focused on buying and selling life insurance policies (“life settlements”).

- The company was founded in 2004 by Todd “Sean” McNealy, Matthew Ganovksy and Kevin “Scott” Kirby. It went public in July 2023 through a SPAC deal sponsored by Terry Pegula, the owner of the Buffalo Bills and Buffalo Sabres.

- An estimated 25% of Americans have seen Abacus’ commercials on networks like Fox and CNN, where CEO Jay Jackson states: “Did you know that your life insurance policy is an asset that you can sell? … for almost 20 years, we’ve been purchasing life insurance policies from seniors just like you.”

- As part of our 3-month investigation into Abacus, we conducted an extensive review of litigation filings and corporate records, and interviewed 33 life settlements experts, including Abacus competitors, industry brokers, fund managers, and several former Abacus employees.

- Our investigation uncovered that Abacus’ “too good to be true” returns, which drive Abacus’ revenues, are primarily manufactured by the systematic overvaluation of its assets through an opaque “mark to model” accounting scheme that closely mirrors past blow-ups in the life settlements industry.

Abacus’ “Too Good To Be True” Returns

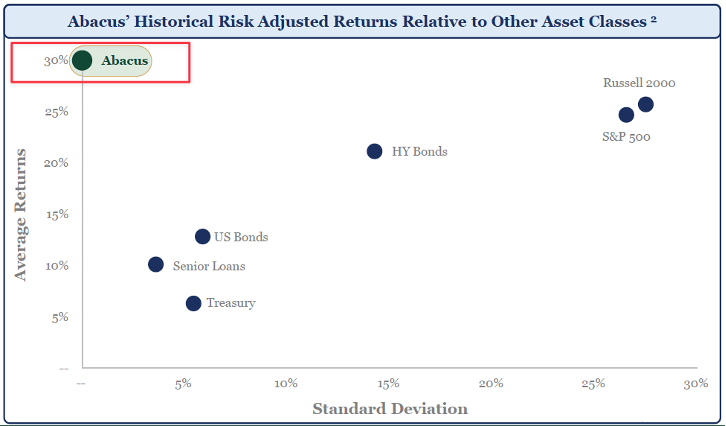

- Abacus boasts 30% returns with little to no risk, per investor presentations. Average industry returns in the space, however, hover around 12%, per trade publications and multiple experts we interviewed.

- One industry veteran told us 20% returns are virtually unheard of: “if anybody's talking about 20% IRR, I tell them to go pound sand because they're not going to deliver 20% IRR. I call BS on that.”

- One theory for Abacus’ drastic outperformance might be that it buys life insurance policies at below market prices, allowing it to generate superior returns from a lower cost basis. Yet, Abacus openly advertises that it pays 32% more for policies than its largest competitor.

- Just days before Abacus completed its SPAC deal, it quietly disclosed a change to its valuation methodology that allows it to revalue its portfolio periodically and book any increases in value as unrealized gains, or non-cash revenue, according to its financial statements.

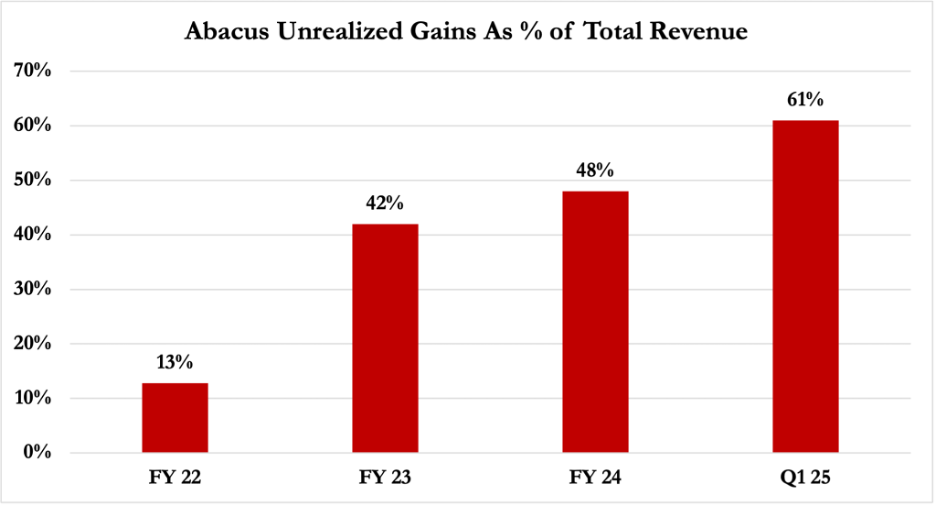

- Since making the change, a sizable and increasing amount of Abacus’ revenue is non-cash, generated from unrealized gains related to fair value markups. In 2022, just 13% of revenue was tied to unrealized gains. By Q1 2025, unrealized gains from claimed increases to “fair value” skyrocketed to 61% of total revenue.

Abacus’ Accounting Scheme With Its Intimately-Linked Vendor, Lapetus Solutions

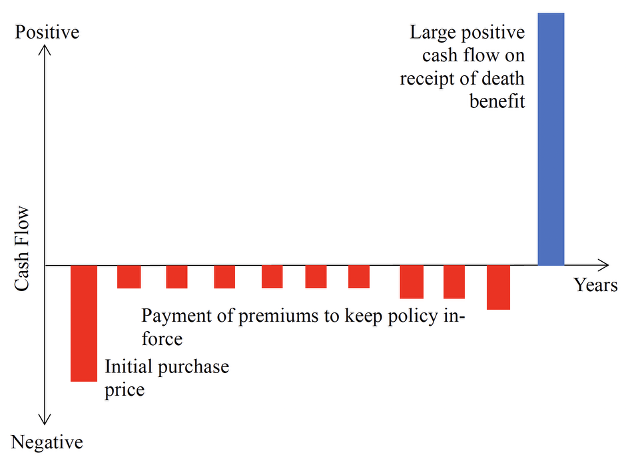

- To determine the fair value of a life settlement policy, the single most important input is how long the insured individual is going to live. If an insured individual lives longer than initially estimated, an investor will have to wait longer to receive the “death benefit” while bearing the unplanned additional costs, i.e., premiums, of maintaining the policy.

- Historically, some life settlement funds have intentionally underestimated the life expectancy of insured individuals tied to their assets. On paper, this results in an increase to the net present value of the policy due to the acceleration of the “death benefit” and the minimization of costs (premiums).

- Such misuse of life expectancy estimates has been at the center of blow-ups in the life settlement industry, including two public companies: Life Partners Holdings and GWG Holdings, which went bankrupt in 2015 and 2018, respectively.

- A former Abacus employee told us about the “curse of the life settlements” industry: “I don't know if anyone has mentioned the curse of the life settlement industry to you, but there's a running joke that every life settlement company that goes public ends up getting caught up in some sort of financial scheme. I think GWG was the last one to kind of fall under that curse.”

- To mitigate the risk of inaccurate life expectancy estimates, life settlements investors rely on life expectancy reports, or “LEs,” from third-party vendors to estimate life expectancy.

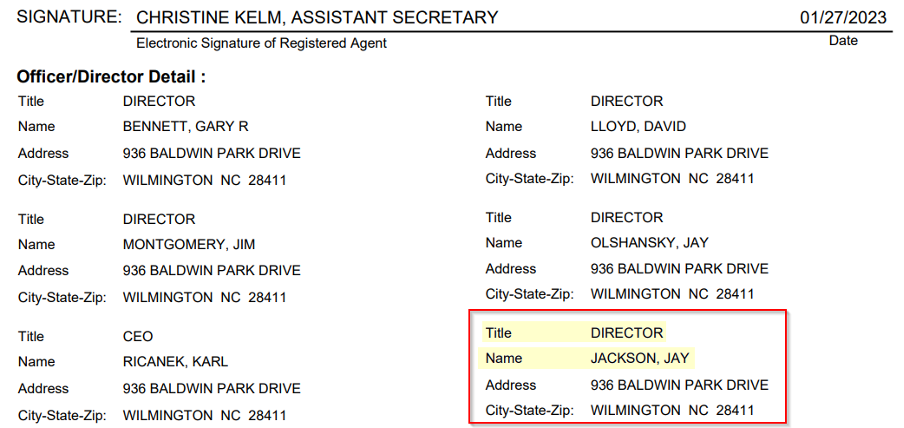

- Abacus has a relationship with an “AI” powered life expectancy report provider called Lapetus Solutions (“Lapetus”), which was founded in 2015. Abacus CEO Jay Jackson was previously a director of Lapetus and co-authored a book with Lapetus’ co-founder, while Abacus director Mary Beth Schulte was previously Lapetus’ CFO. Further, Abacus has a $1 million investment in Lapetus.

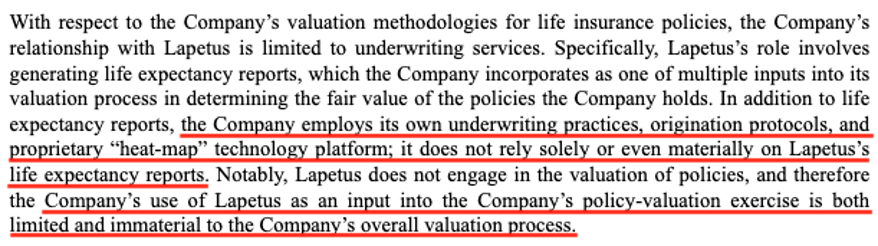

- Despite the intimate relationship, Abacus did not mention Lapetus once in its 2024 annual report. When the SEC inquired directly about the nature of the relationship, Abacus claimed it does not rely “solely or even materially” on Lapetus for the “valuation of its life insurance policies,” stating that Lapetus LEs are “limited and immaterial” to its overall valuation process.

- Former Abacus employees disagreed, with one saying, “I'm genuinely shocked to hear that. They built Lapetus LEs into the pricing tool, the proprietary pricing tool that Abacus made. So I'm floored that they would say that it has no material bearing on that. That's crazy … It's, to my knowledge, completely false. They were very reliant on Lapetus.”

- Another told us, “[Abacus] would just take what Lapetus says and buy based on just that. They would not gather the other life expectancy info.”

- Numerous industry experts and participants corroborated that Abacus is Lapetus’ largest customer, that the two companies have a “strong partnership,” and that “most, if not all of these [Abacus] policies, come with Lapetus LEs.”

- As proof of this partnership, Abacus is currently launching a fund in the U.S., for which it has disclosed that it had chosen “Lapetus Solutions as its primary life expectancy provider,” according to the fund registration statement.

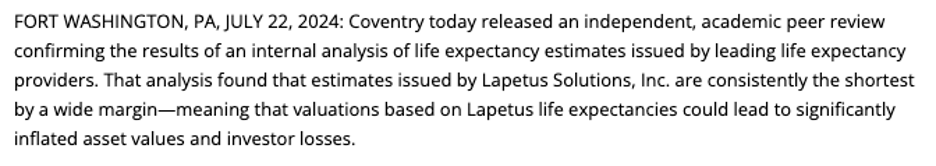

- In 2024 and 2025, Abacus’ largest competitor, Coventry, put out a series of press releases evidencing allegedly flawed underwriting from Lapetus. Coventry analyzed 4,378 LEs from Lapetus and determined that its estimates were, on average, 31 months shorter than the “next shortest” LE providers.

- This resulted in an alarmingly low Actual to Expected ratio (“A/E”) of just 31% – a measure of the accuracy of life expectancy estimates where a perfect score would be 100%.

- Coventry’s study was peer reviewed by Professor Daniel Bauer, a highly respected academic in the life settlements industry. An industry expert told us that Professor Bauer had “been studying this industry as an academic actuary for many years. I know him. He's very smart. And if his analysis says that that's the number, I can assure you the math is correct.”

- At a 2024 industry conference, Coventry’s chairman stated that Lapetus LE data results in overstated asset values: “Using Lapetus, instead of the next shortest life expectancies, the average at 12% [discount rate], we’d get an increased fair market value of over 60% more … that fair market value is grossly overstated.”

- Coventry’s chairman then compared the use of Lapetus’ short LEs to the collapse of Mutual Benefits Corporation, which was described by media reports as one of the “great frauds in history” after the SEC stated that “fraudulent life expectancy figures” were used to overvalue its portfolio.

- Coventry filed a petition with the state of Florida for the release of Lapetus’ audited A/E ratio. Lapetus is countersuing to keep the information hidden from the public.

- An industry expert told us Professor Bauer “calculated an A/E ratio of 31% for Lapetus, and that would totally blow them [Lapetus] out of the water. If they would ever release that figure officially, they'd be done.”

- Former Abacus employees confirmed to us that Lapetus LEs are generally significantly shorter than other LE providers. One former employee told us: “Lapetus tends to be the odd man out where they were, you know, 5, 6, 7, 8 years shorter than everybody else, which is I think why they kind of raised some eyebrows.”

- Another industry expert warned: “If anyone tells you that you should be buying off a Lapetus LE, lose their phone number, block their emails and run a million miles away…It's bullshit. It is terrible, terrible advice. They [Lapetus] are the shortest in the market.”

- Abacus’ reliance on Lapetus to value its portfolio presents a material risk to the $446 million in claimed life settlements on its books as of Q1 2025. If Coventry’s and Professor Bauer’s estimates are correct, we estimate that Abacus’ portfolio could be overvalued by at least 35%.

- An industry expert familiar with LE estimates corroborated this risk, telling us: “The indicative value on a Lapetus LE is 50% higher than with the other LE providers. … [Abacus] had $100 million in policies that were probably worth about $60 million.”

- Based on numerous interviews with industry experts and participants, we learned that life settlement funds were already wary of buying policies valued on Lapetus LE reports prior to Coventry’s allegations, which have only heightened their concerns.

- One industry expert told us: “For that conference, where that presentation with Coventry and Lapetus … the knee jerk reaction from a lot of the investors and funds that I work with … their reaction was, ‘I’m not going to, you know what, I think I need a time out, don’t send me any cases with Lapetus on them right now’… that was an outcome.”

- A former Abacus employee told us: “So, we had plenty of funds who said they would not buy off of Lapetus. At all. They wouldn't look at it. They wouldn't consider it, because it was just so wildly off.”

- An employee at a competing provider of life expectancy data told us Lapetus is jokingly referred to as “laugh-at-us” in the industry due to how unreliable its data is. They told us: “And this is public information because [Lapetus’] life expectancies are so much shorter, that a lot of the institutional investors will not accept [their] work product.”

Discount Rate Manipulation

- In addition to understating LEs, notorious life settlements frauds such as GWG Holdings have historically manufactured non-cash gains by continuously lowering the discount rates used in their discounted cash flow valuation models.

- An industry expert explained: “The big thing that you saw with GWG … they weren’t getting the performance they were needing. So they were just marking the discount rate further and further down… And you knew they were screwed at that point in time. So, there are things that they can do, and you see this in the guys that are public, it's easy to see when they're pulling strings one way or the other, and if they're struggling or if they're not struggling.”

- With more scrutiny on its understated LEs, Abacus has resorted to slashing its discount rate to generate more non-cash gains. In Q1 2025, CEO Jackson boasted about Abacus’ “record quarter,” citing the more than doubling of adjusted EBITDA year-over-year to $24.5 million.

- Jackson failed to mention, however, that during the same quarter, Abacus lowered its discount rate from 20% to 18%, generating ~$28.4 million in unrealized gains. Without this paper gain, EBITDA would have been negative.

Carlisle Asset Management

- In July 2024, Abacus announced it would acquire Carlisle Asset Management, a $2 billion AUM investment manager focused on life settlements led by CEO and founder Jose Garcia. The acquisition seemed transformational given Abacus’ willingness to pour 78% of its equity into the transaction.

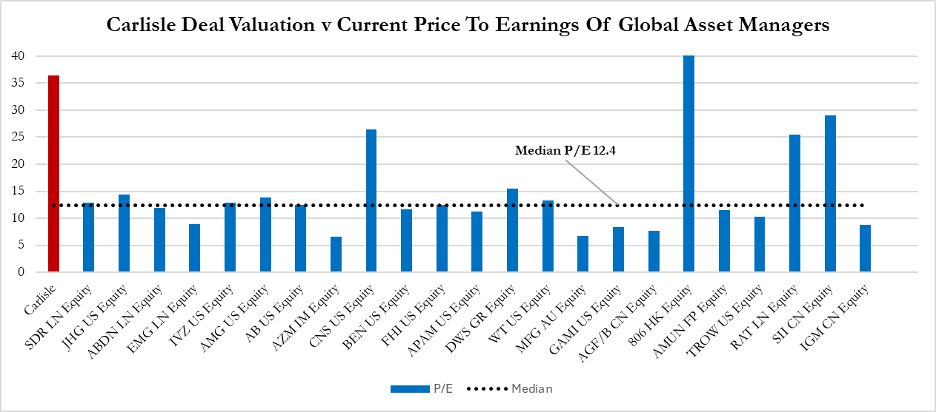

- Abacus ended up paying 36 times earnings, nearly triple the valuation of global asset management peers, for a business with declining profitability and significant undisclosed litigation risk.

- Abacus’ co-founders have known Carlisle CEO Garcia for over 20 years, dating back to his time with Vespers LLC, a US-based life settlements broker, according to Garcia

- Garcia was terminated from Vespers in 2005 based on a slew of allegations, including the abuse of cocaine or similar drugs while at work and spending at least $200,000 of company funds on personal expenses, including exotic dancers and prostitutes, according to a counterclaim filed by Vespers against Garcia

- Abacus CEO Jackson described the Carlisle team and Garcia as a “great culture fit,” insisting that the firm’s track record was “unmatched” and the “strongest and most enduring” in the industry.

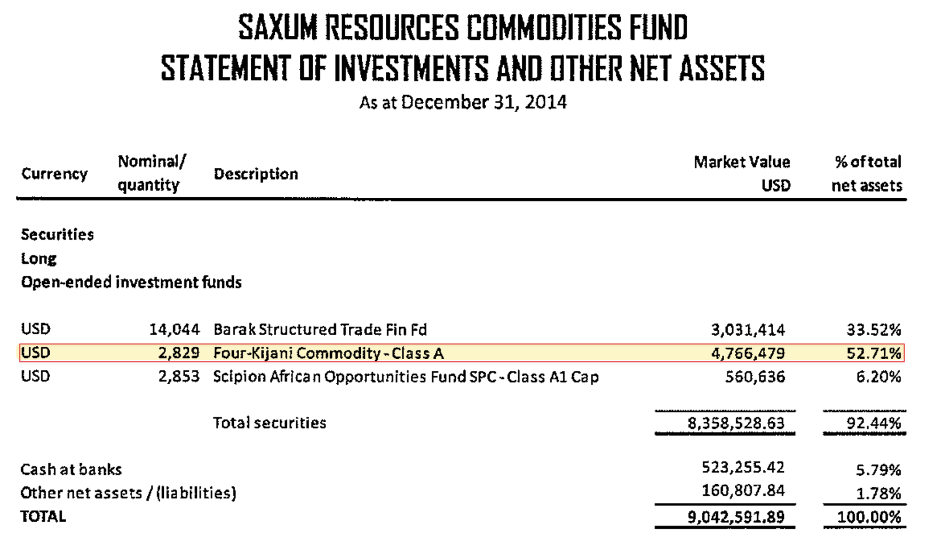

- Garcia and Carlisle have a 20-year track record of blowing up investment funds and incinerating investor cash while raking in exorbitant fees. Notably, several of these blowups related to the overvaluation of fund assets by, among other things, the use of “fraudulent” life expectancy data. These blowups include Life Trade Partners, Fortress International Fund, The Global Forestry Growth Fund and Saxum Resources Commodities Fund.

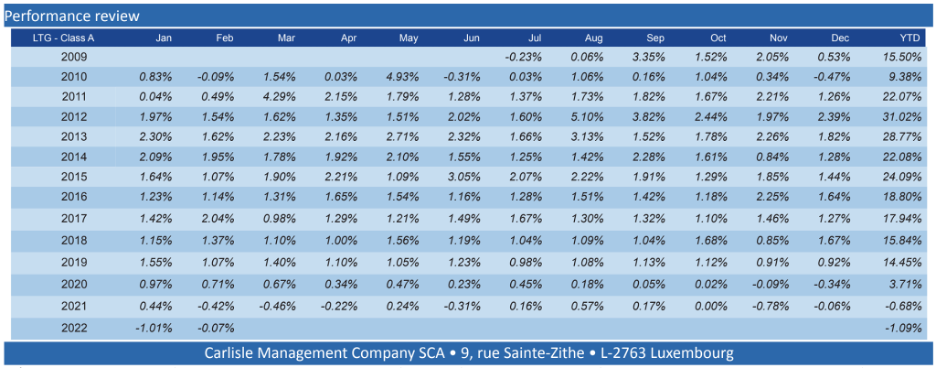

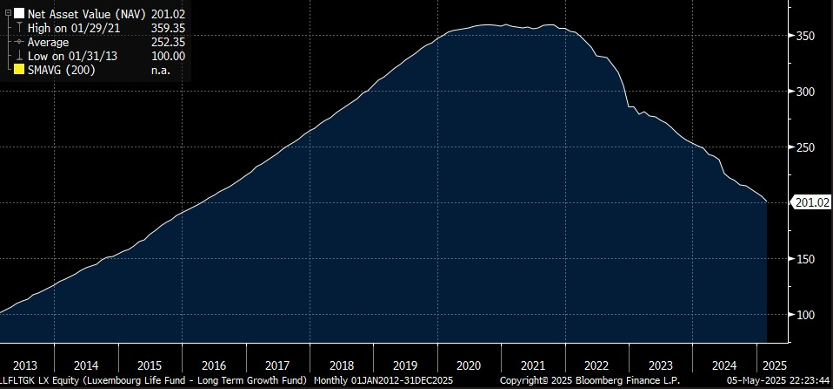

- Carlisle’s $2-billion flagship life settlements fund reported ~20% returns for nearly a decade, without posting a down month, until 2020 – when investor redemption requests were suddenly halted. Carlisle assured investors that their “fair market valuation methodology” was accurate. Since then the fund has declined in value every year – now down 44% from its peak.

- An industry expert told us: “They [Carlisle] inflated the value of the assets in order to show a fantastic [performance] curve. They attracted hundreds of millions of [dollars in] assets. They took enormous amounts of performance fees and management fees. It's all inflated. It's all [a] cheat.”

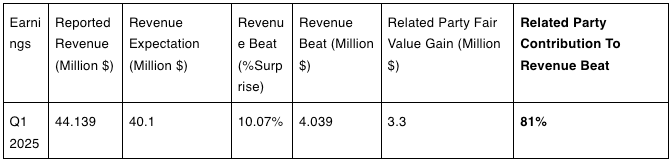

- We believe that Abacus bought Carlisle out of necessity. It needed a way to offload the overvalued policies on its books to a willing buyer, and Abacus found that in Garcia and Carlisle. Within days of acquiring Carlisle, Abacus realized a 45% gain on policies offloaded to Carlisle, according to Abacus financial statements. This gain contributed 81% of Abacus’ top line earnings beat.

- Compounding the problems of Lapetus estimates, it appears that Carlisle is also using Lapetus to value its policies and has offered big blocks of policies to the market. A fund manager told us: “Abacus have sent us big blocks of policies for sale from out of the Carlisle portfolio, all with Lapetus on them… we’ve still not bought a single policy from the Carlisle portfolio, to my knowledge, since they suspended [redemptions] back in 2020. Because we just can’t get comfortable.”

Questionable Management Track Record

- Abacus’ co-founders have a litany of red flags in their pasts that include destroying records, involvement in bid rigging schemes, selling fraudulently procured life insurance policies, and endorsing notorious fund blow-ups.

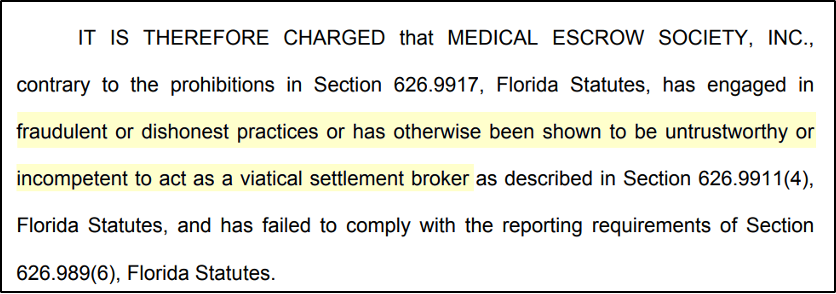

- In the late 1990s, Abacus’ co-founders Ganovsky and Kirby worked for Medical Escrow Society, a life settlements broker that was charged by Florida’s insurance regulator in 2003 for failing to disclose fraud that occurred during the time that both Abacus co-founders were at the firm.

- The company brokered policies “procured through fraud” for Mutual Benefits Corporation - a notorious life settlements company that was later described by media reports as a “$1 billion scheme to defraud 30,000 investors.”

- Medical Escrow Society had its broker license revoked in 2003. Kirby, Ganovsky, and McNealy then co-founded a new company called Advanced Settlements. Notably, Abacus has never disclosed their tenure at Advanced Settlements in SEC filings.

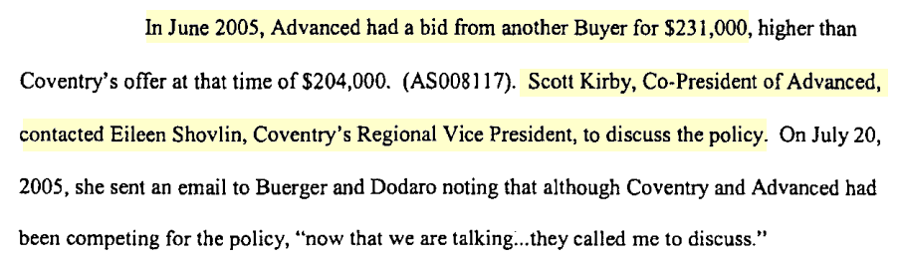

- In 2006, the New York AG fined Advanced Settlements $575,000 based on “breaches of fiduciary duty” related to Kirby accepting kickbacks in exchange for not showing his clients all of the offers for their life insurance policies. Kirby was reportedly “ousted” from a prominent industry association for his conduct.

- In 2016, Kirby, Ganovsky, and McNealy dissolved Advanced Settlements and established Abacus Settlements in Florida out of the same office, even using the same phone number which is still used by Abacus today.

- When Abacus Settlements initially applied for a life settlement providers license, the Florida state insurance regulator denied the application, saying Abacus was not “worthy of a license” due to a “lack of trustworthiness of the principals … which cannot be cured.”

- The regulator said Abacus’ principals were not “forthcoming” about their “negative history” and that they had engaged in “fraudulent or dishonest practices,” including the destruction of a significant portion of their transaction records.

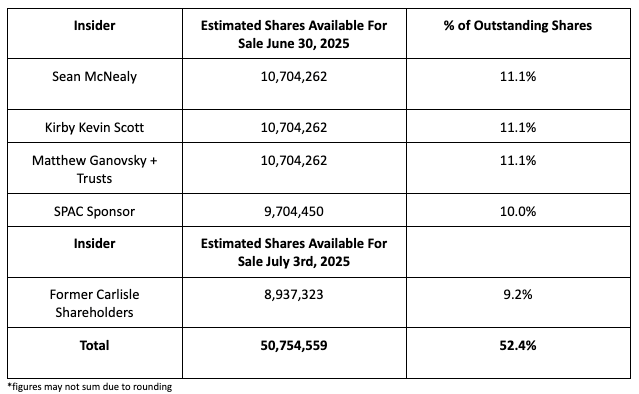

Cashing Out: How Abacus Aggressively Promotes Its Stock Ahead Of A 50.7 Million Share Lock-Up

- Pursuant to Abacus’ SPAC deal, its co-founders and other insiders hold an estimated 50 million shares that are restricted from sale due to lock-up agreements that expire in ~4 weeks.

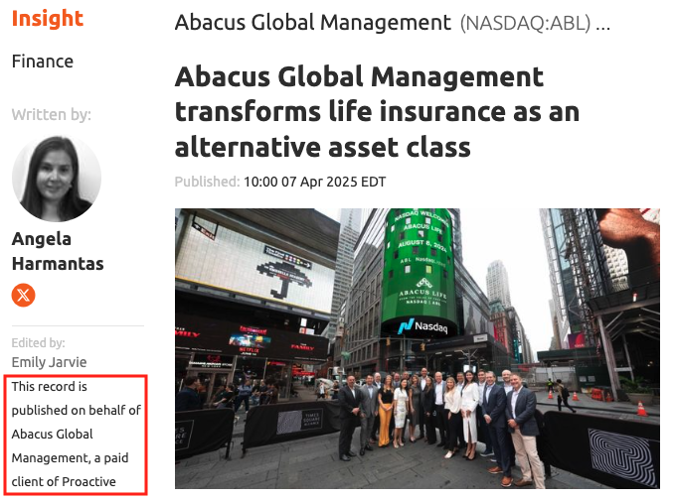

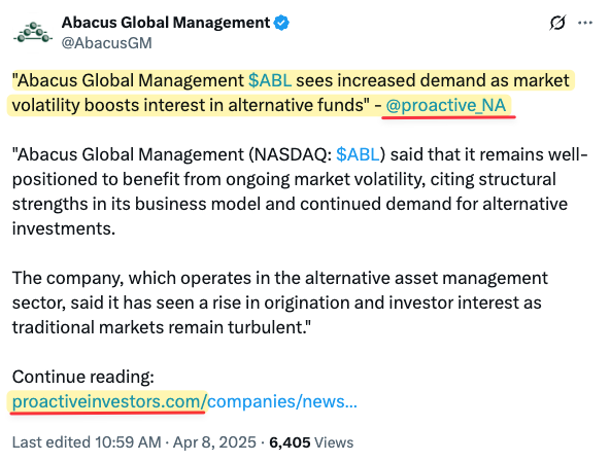

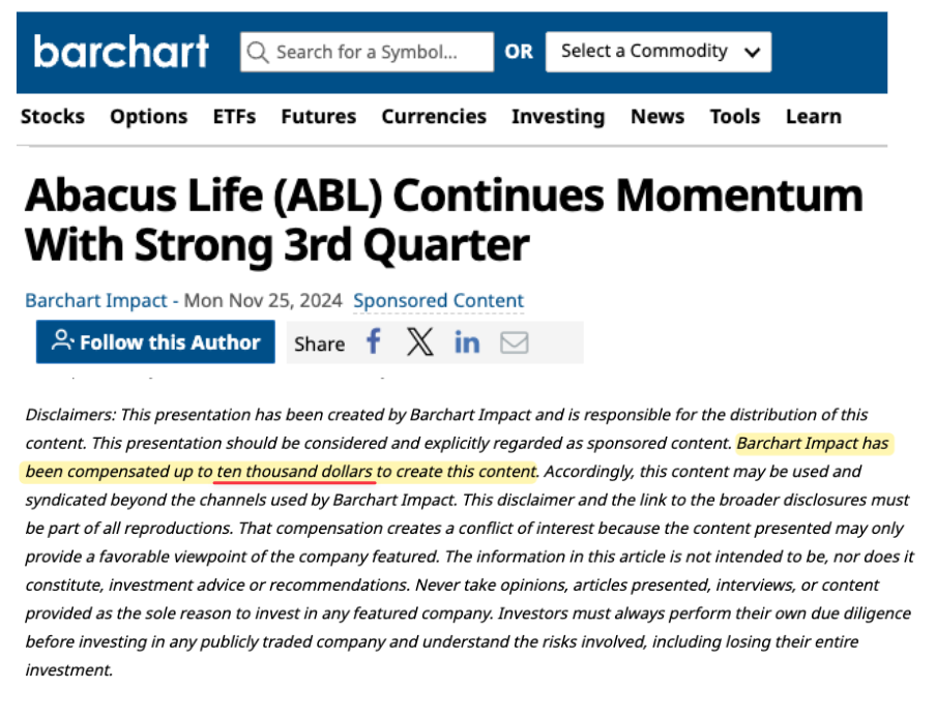

- Ahead of this lock-up expiry, Abacus has engaged in an aggressive stock promotion campaign that includes the use of paid stock promoters on social media platforms.

- Often, these efforts take the form of bullish financial articles that appear at first glance to be objective, unbiased financial analysis – but a deeper look reveals they are simply advertisements for Abacus’ stock. One example of this is Abacus being featured on Proactive Investors, a penny stock promoter that has been paid to publish a slew of bullish articles and social media content on Abacus.

Conclusion

- While Abacus touts impressive EBITDA profitability, this metric is primarily based on paper gains from manipulated life expectancies rather than real cash flow.

- What little cash Abacus does produce is primarily generated by selling overvalued policies to unsuspecting third parties, a sales channel that is increasingly at risk due to the rapidly escalating industry awareness of Abacus’ understated life expectancies and overstated valuations.

- Abacus’ actual operating cash flow in Q1 2025 was negative $61.6 million, leaving it with little ability to service its $356 million of high-interest debt, ~$117 million of which comes due in the next 9 months.

- Further, we believe Abacus faces immediate and significant write-down risk on its $446 million portfolio of life settlements policies and the $145 million in goodwill and intangibles associated with its Carlisle acquisition, as well as material litigation risk from Carlisle’s investors.

- Bulls will often point to the presence of auditors to rebut allegations of aggressive or fraudulent accounting. Abacus is audited by Grant Thornton, a second-tier firm with a history of missing accounting issues whose former UK CEO infamously said: "We are not looking for fraud ... and we are not giving a statement that the accounts are correct." Grant Thornton audited GWG Holdings, one of the most notorious accounting frauds in the history of the life settlements industry.

- For decades, investors have pinned their hopes on new life settlements ventures touting high returns, little to no risk, and a virtually unlimited addressable market. Time and time again, these “too good to be true” stories are propped up by financial engineering that enriches bad actors at the expense of investors before an inevitable collapse. We believe Abacus is no different.

Initial Disclosure: After extensive research, we believe the evidence justifies a short position in shares of Abacus Global Management, Inc. (NASDAQ: ABL). Morpheus Research holds short positions in ABL. This report represents our opinion, and we encourage all readers to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Background & Basics: A $740 Million Life Settlements Asset Manager That Went Public Through A SPAC Deal In July 2023

Abacus Global Management, Inc. (NASDAQ: ABL), is an alternative asset manager that claims to be “at the heart of the life settlement industry.” Abacus was founded in 2004 by Todd “Sean” McNealy, Matthew Ganovksy, and Kevin “Scott” Kirby.

Abacus describes its 3 founders as “innovators” who “directly contributed” to the development of the entire life settlements industry. Today, the trio remains deeply involved with Abacus, serving as managing partners and collectively holding more than 36.5% of its shares.[1]

Percentages of ownership as of April 22, 2025, per Abacus latest proxy statement. ↩︎

(Source: Abacus Website)

In 2016, Abacus appointed Jay Jackson as the company’s President and CEO. Today, he owns 10.3% of the company and is its public face, appearing on nationally syndicated advertisements that play on major channels such as Fox and CNN. [Pg. 24]

Abacus estimates that 25% of Americans have been exposed to its brand through these ads, which are just one of several channels Abacus uses to “originate” life insurance policies. [Pg. 24]

(Source: YouTube | Abacus CEO Jay Jackson in a TV commercial)

In July 2023, Abacus went public by merging with a SPAC sponsored by Terry Pegula, a fracking billionaire and owner of the Buffalo Bills and Buffalo Sabres. Today, Pegula controls 16.9% of Abacus' outstanding shares.

Background: Life Settlements 101

Life settlements involve the sale of a life insurance policy to a third party investor for a lump sum, typically greater than the policy’s “cash surrender value.”[1]

Cash surrender value is the amount policyholders would receive from the insurer if they voluntarily terminated the policies. The market where participants buy from the insured person is known as the “secondary market.” The market where investors transact life settlement policies between themselves is known as the “tertiary market.” (1) ↩︎

The investor takes over premium payments and collects on the policy when the insured passes away, aiming to profit if the death benefit exceeds their total investment.[1]

In the U.S., the 1911 Supreme Court Decision in Grigsby v. Russell held that life insurance policies were personal assets that could be acquired and transferred. (1, 2) When an individual who has a terminal or chronic illness sells its life insurance policy to a third party, the transaction is known as a viatical settlement. ↩︎

These purchased policies – called life settlement policies – offer investors returns that are not correlated with broader market performance, as payouts depend solely on the insured’s lifespan. This makes them attractive for portfolio diversification.

Purchasing life settlement policies is a regulated activity in 43 U.S. states, according to the Life Insurance Settlement Association.

As part of these regulatory efforts, most states require the licensing of 2 key entities in the life settlement process: Life settlement brokers, those who help the insured sell their policies, and life settlement providers, those originating policies for other investors.

Background: How Abacus Evolved From An Originator To An Investor In The Life Settlements Space

Since Abacus incorporated its first operating entity in 2004, it has acted as a life settlement provider, originating life settlement policies on behalf of investors.[1]

In June 2021, Abacus shifted focus and began to use its capital to purchase life settlement policies with “the intent to either hold to maturity to receive the associated death claim payout or to sell to another purchaser of life settlement contracts for a gain on the sale,” according to its registration statement.[1]

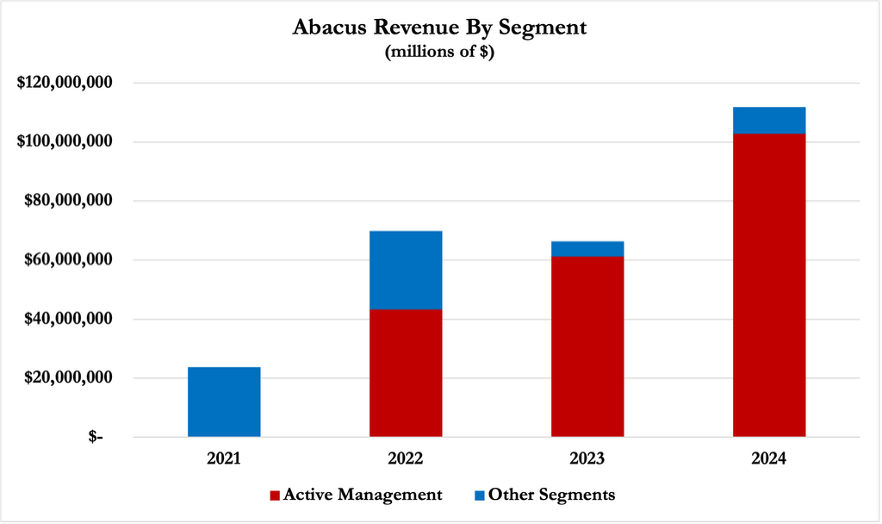

Abacus began to recognize revenues from life settlement investments under its “Active Management” segment, which has grown at a CAGR of 54% since 2022, generating $102 million in revenue in 2024.[1]

Abacus Life, Inc, resulted from a SPAC transaction in which East Resources Acquisition Company merged with Longevity Market Assets, LLC (“LMA”) and Abacus Settlements, LLC (“ASL”) and then changed its name to Abacus Life, Inc. On Abacus’ February 2024 prospectus, LMA and ASL are listed as its 2 principal operating subsidiaries. Reported revenue for 2021 and 2022 combines the total revenue of LMA and ASL, obtained from their respective financials, while reported revenue for 2023 and 2024 was obtained from Abacus Global Management’s consolidated financials. ↩︎

Bull Case: A Profitable, Vertically-Integrated Life Settlements Asset Manager Leveraging AI, Blockchain & Proprietary Data Analytics To Rapidly Scale Into A $233 Billion Addressable Market

According to Abacus, the company is in the early innings of penetrating what it claims is a $233 billion total addressable market, which CEO Jay Jackson described as an “addressable market that Google would blush over.”

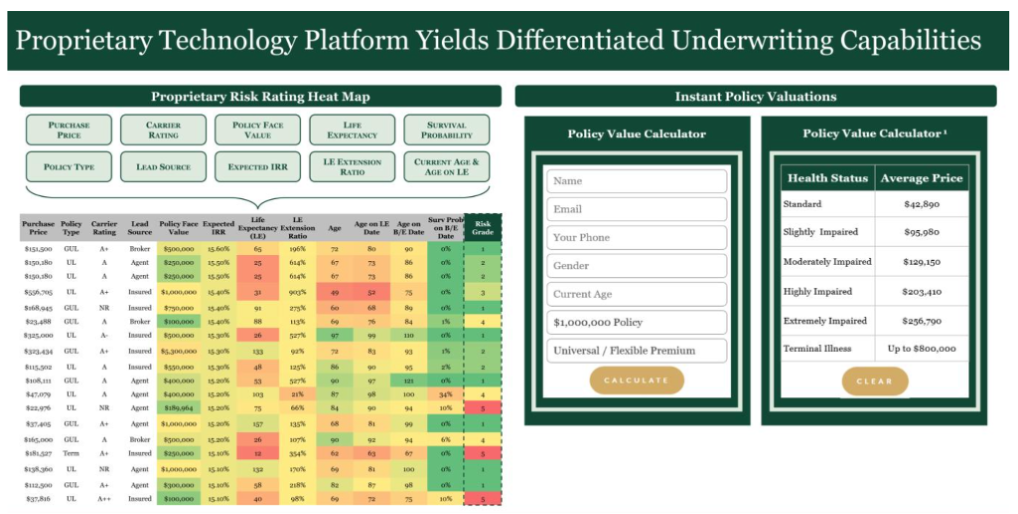

Abacus’ “proprietary technology platform” drives its “differentiated underwriting” to penetrate this market. [Pg. 20]

This tech stack includes its Risk Rating Heat Map, which determines the initial risk and viability of policies based on “large amount[s] of data [Abacus has] gathered over time,” and its Policy Value Creator, which utilizes proprietary data to “instantly value policies for both individuals and financial advisors.”

(Source: Abacus Q3 2023 Investor Presentation | Pg. 20)

Abacus also says it is making significant investments in emerging technologies, including an “AI-based platform” to price policies and assess their risk, as well as “blockchain and smart contracts” to “democratize the issuance of life insurance.”

In December 2024, Abacus completed its acquisition of Luxembourg-based Carlisle Asset Management for $145.7 million. At the time, Carlisle had $2 billion in AUM and a focus on life settlement assets.

Simultaneously, Abacus acquired another $800 million AUM asset manager called FCF Advisors, for $10.2 million.

Following those acquisitions, the company changed its name from Abacus Life to Abacus Global Management. This shift marked the transformation of Abacus as it strives to become a “leader in the alternative asset manager and wealth management space.”

Abacus' financial results over the last few reporting periods put the company in a category of its own, according to a recent interview with CEO Jackson:

“How many other companies have mid-teen year-over-year growth rates, top and bottom line? That have return on equity greater than 18%? And have an EBITDA margin … of greater than 50%? And I’ll pause just so your audience can try to think about how many companies would meet that criteria. Consider all the companies that trade on the NASDAQ, which include Microsoft…

It’s just us. We’re the only company on all of NASDAQ that can state that. So here you have a business that’s been in existence for 20 years, that is highly profitable with great margins, and has been doing it consistently for the last two decades…” [7:04]

As the sole publicly traded vertically integrated life settlements company, Abacus offers investors a unique exposure to an untapped “high-return asset class uncorrelated to market fluctuations.” [1]

Part 1: Abacus’ “Too Good To Be True” Returns Are Primarily Generated From Mark-Ups To The "Fair Value" Of Its Life Settlements Portfolio

Abacus boasts vastly higher investment returns than many leading life settlement funds and companies.

These investment returns - which are unrealized and non-cash based on “fair value” markups to Abacus’ portfolio - drive most of the company’s revenue.

Unlike marketable securities, life settlement markets are essentially opaque with no comprehensive transaction or pricing data. As a result, fair value accounting methods remain highly subjective and discretionary, providing fertile ground for manipulating the value at which an investment is carried on the books.

Abacus Boasts ~30% Returns With Little To No Purported Risk

Average Industry Returns In The Life Settlement Space Hover Around 12%, Per Multiple Experts We Interviewed And Trade Publications

One Industry Veteran Told Us 20% Returns Are Virtually Unheard Of: “If Anybody's Talking About 20% IRR, I Tell Them To Go Pound Sand Because They're Not Going To Deliver 20% IRR. I Call BS On That”

Life settlements have existed as an asset class since the 1980s, and there is a wealth of data available on industry standard returns.

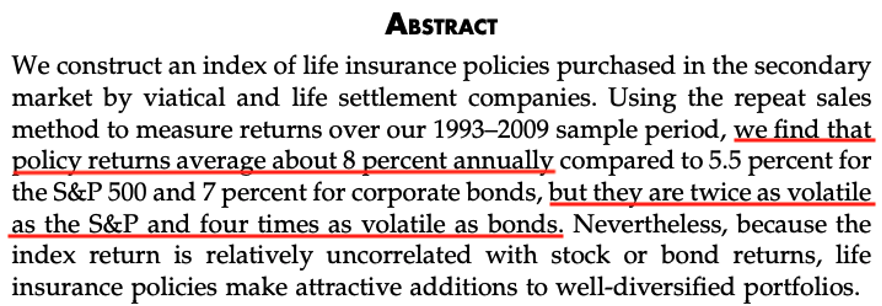

For example, a 2015 study from the Journal of Risk and Insurance tracked the performance of 17 life settlement funds between 1993 to 2009 and found an average annual return of 8% with “four times” the volatility of bonds.

More recently, a study from IFA Magazine stated that life settlements fund managers “have consistently generated high single-digit returns.”

Numerous industry experts corroborated these claims. We asked a veteran fund manager who told us that average industry returns are approximately 12-13% before fees.

“[On returns] It's probably at around 12 to 13 [%] if you use realistic assumptions ... Gross before fees.”

One life settlement expert told us that average returns hover in the 9-12% range, and that they would call “BS” on anyone claiming to deliver a 20% IRR.

“I think it's very safe to say they're going to fall right in that 9 to 12% [return] range. That's going to be your very common right down the middle investor range.”

“If anybody's talking about 20% IRR, I tell them to go pound sand because they're not going to deliver 20% IRR. I call BS on that.”

We asked the veteran fund manager about whether or not it would be realistic for a life settlement fund to buy policies on a 20% IRR. He told us:

“That's all window dressing to tempt you in as an investor.”

In August 2022, Abacus initially claimed that its portfolio of life settlement policies generated 30% average annual returns with zero standard deviation, a proxy for risk in financial analysis. [Slide 10]

To put that into perspective, even 3 month U.S. treasury bills – the "risk-free" standard – show a standard deviation of over 5%, per Abacus’ own data. By contrast, large-cap equities show a standard deviation in excess of 25%, per the same source. [Slide 10]

For the reasons mentioned in this report, we believe that Abacus’ claim of generating 30% returns with 0% standard deviation is simply absurd.

Two years later, in Abacus’ November 2024 investor presentation, the company repeated its ~30% average annual return claim, this time showing a low standard deviation, only slightly higher than that of U.S. treasury bills, per Abacus’ own data. [Slide 15]

Abacus’ Drastic Outperformance Would Imply It Buys Life Insurance Policies At Below-Market Prices, Allowing It To Generate Superior Returns From A Lower Cost Basis

Reality Check: Abacus Openly Advertises That It Pays 32% More For Policies Than Its Largest Competitor

Abacus Discloses That Its Average Acquisition Price Is 23.3% Of The Face Value Of The Policy – The 2nd Highest Rate Of 10 Direct Competitors We Checked

A possible theory for Abacus’ unparalleled outperformance in a decades-old asset class might be that Abacus has a lower cost basis for policies.

Yet industry experts, including former Abacus employees, told us that finding these bargain deals is extremely unlikely due to the ruthlessly competitive nature of the industry, saying, "[the] secondary market is very competitive and you have to have the speed, like... 'let's have the max and let's bid up to it' and you can [still] lose."

A former Abacus employee echoed this sentiment, telling us:

“I’d say that, you know, those assets that accrete value are pretty, pretty competitive at this point.”

Rather than buying at the basement-level bargain prices that would allow for superior returns in years ahead, Abacus appears to be overpaying to take market share, making its claimed outperformance even more of an anomaly.

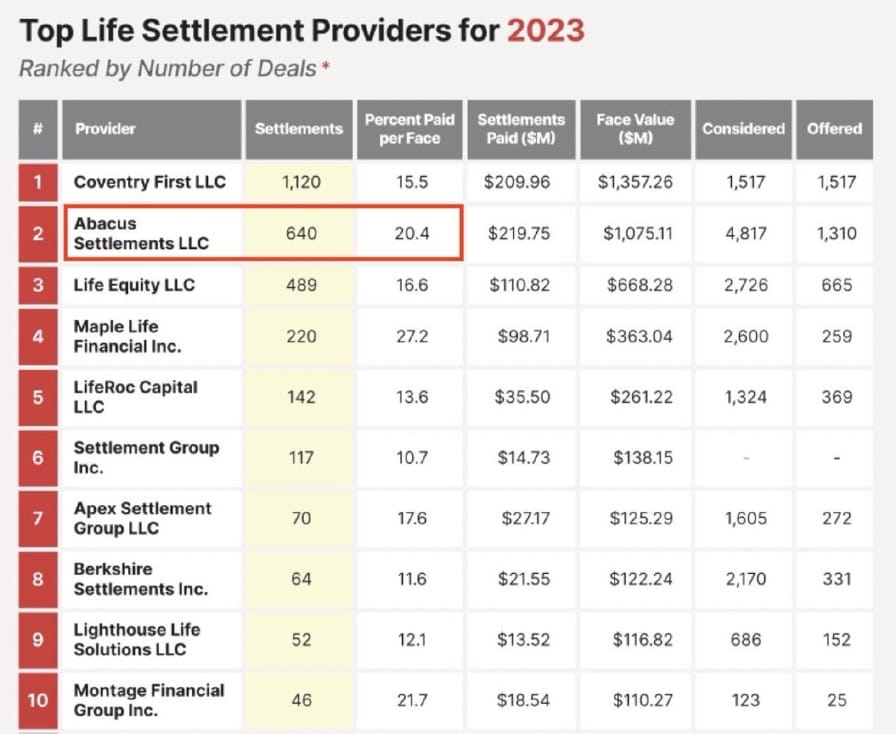

In 2023, Abacus was the second highest bidder in the life settlement markets among 10 competitors, paying 20.4% of face value for policies, according to The Deal, a financial intelligence media company.[1]

Most of The Deal articles are behind a paywall. The Deal's terms and conditions prohibit republication except for brief excerpts. ↩︎

The largest life settlement provider in the industry is Coventry, which an executive at another provider described as having clients with “pretty deep” pockets.

Despite Coventry’s access to clients with “deep pockets,” Abacus was seemingly able to outbid them in 2023, paying an average of 20.4% of face value for policies in comparison with Coventry’s average rate of 15.5% of face value, according to The Deal.

Today, Abacus’ average bid has risen to 23.3% of face value, according to its website.

A veteran fund manager corroborated that Abacus was the highest bidder in the market:

“When we sell policies, we send them to Abacus. Why do we send them to Abacus and not many other people? ... That's where we know we're going to get the highest price.”

Abacus is open about this, stating on its website that its acquisition cost is “nearly 32% higher than its closest competitor.”

In a March 2024 interview with the National Association of Insurance and Financial Advisors (“NAIFA”), Abacus co-founder and president Kirby, claimed that the company took pride in leading the industry in “the percent paid for each policy,” stating:

“One of the things that we’re probably most proud about is that every year, we lead the industry in the percent paid for each policy. It’s a number that we’re very proud of and it kind of reinforces our commitment to our customers.” [5:56]

It is unclear how Abacus generates industry-leading returns by paying significantly more for the same assets competitors are bidding on. A former Abacus employee we interviewed was also perplexed by how Abacus can pay more for policies but still generate superior returns:

“I don't know how they're [Abacus] buying as aggressive as they are and then claiming that they're worth as much as they are. That just doesn't make sense. It just doesn't add up in my mind.”

Just Days Before It Went Public, Abacus Decided To Value All The Life Settlement Policies Acquired Under A Fair Value Methodology Which Uses “Unobservable Inputs”

Under That Method, Abacus Is Able To Mark Up The Value Of Newly Acquired Policies, Booking Non-Cash Revenue In The Process

In Q1 2025, 61% Of Abacus’ Revenue Came From Unrealized Non-Cash Gains Booked From These “Fair Value” Mark-Ups

Coinciding with the completion of its SPAC deal, Abacus quietly changed its accounting methodology for valuing its life settlements portfolio. On June 30, 2023, Abacus started accounting for all newly acquired policies under the fair value method, according to its financial statements.

Under the fair value method, life settlement policies are considered Level 3, meaning that they are valued on “unobservable inputs.”

This accounting treatment allows Abacus to re-value policies periodically, and book any increases in value as non-cash revenue for the respective period, according to Abacus’ most recent annual report.

Abacus’ change to its valuation accounting has resulted in the recognition of increasingly sizable amounts of non-cash revenue from valuation markups on its held portfolio.

In 2022, prior to the accounting change, just $5.7 million, or ~13% of revenue was booked from unrealized non-cash gains. By 2024, that number skyrocketed to $53.8 million, or 48% of total revenue, increasing in Q1 2025 to 61% of total revenue, according to its financial statements.

Those non-cash valuation gains, which are calculated via Abacus’ opaque fair value method, now drive the bulk of the company’s claimed industry-leading returns.

Part 2: Abacus’ Claimed Outperformance Is The Product Of An Accounting Scheme Enabled By A Key Vendor, Lapetus Solutions

Like past blow-ups in the life settlements space, Abacus appears to be pulling two primary levers to manufacture artificial “too good to be true” returns. The first is understating life expectancies, and the second is slashing its discount rate – both of which result in significant unrealized, non-cash gains.

Background: The Fair Value Of Life Settlements Depends On Accurately Predicting Life Expectancy

Historically, Bad Actors Have Inflated Life Settlement Asset Values By Intentionally Underestimating Life Expectancy, Resulting In Understated Future Costs And Overstated Future Revenue

Life insurance policies do not generate any positive cash flow until “maturity,” or the death of the insured individual tied to the policy. To determine the net present value of a policy, life settlement investors, including Abacus, use discounted cash flow analyses that rely on life expectancy as a key input.

A head of a reinsurer, who also had experience with life settlements, told us:

“The life expectancy calculation is probably the most important part of the whole business. It just, without that being accurate the business doesn't work very well.”

The precise timing of when any given policy will “mature” is impossible to predict, but life settlement investors strive for accuracy on an average basis at the portfolio level, so as to accurately calculate the net present value of their portfolios.

If an investor underestimates the LE, they risk paying higher premiums – and for longer – than anticipated, which will result in lower-than-expected returns, or even the total loss of principal. As an industry expert told us:

“So, you're constantly having to feed something … it's ultimately a receivable, in that you’re going to get a death benefit, but you've got to feed that in order to get the death benefit…So, when your underwriting is off [too short] and you have to continue to make more premium payments, it really kind of dominos.”

For example, if an investor pays $230,000 for a $1 million life insurance policy with yearly premium payments of $30,000, predicting that the insured will pass away in 7 years, one would expect an IRR of 16.7%. If the insured passes away 10 years after that prediction, however, your IRR would be 3.0%. This shows the sensitivity of the returns to lifespan, and, therefore, the value of a life settlement policy.[1]

Historically, some funds have intentionally understated life expectancy to artificially inflate portfolio valuations.

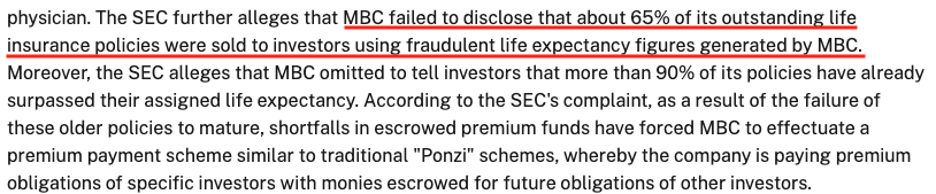

- In 2004, the SEC halted the securities offering of Mutual Benefits Corporation due to its use of “fraudulent life expectancy figures,” resulting in what the SEC described as a “premium payment scheme similar to traditional ‘Ponzi’ schemes.” Mutual Benefits was later described as one of the “great frauds in history” by MoneyWeek, a British investment magazine.

- In 2015, Life Partners filed for bankruptcy after two executives were charged with “systematically and materially underestimating the life expectancy estimates it used to price transactions,” per the SEC. Life Partners was later called “one of the biggest frauds in Texas history” in a local media report.

- In 2022, GWG Holdings filed for bankruptcy after using “unreliable mortality studies” to “underestimate the life expectancy” of the insured individuals tied to its life settlement portfolio, per a law firm representing its investors. The practice drove strong non-cash returns initially since GWG could both “understate its expected costs” (i.e. the premiums) and “overstate” the revenue it expected to collect on maturing policies.

These life settlement scams all drove “too good to be true” returns by manipulating the life expectancy of the insured individuals tied to their portfolios. In each case, the returns were unsustainable and eventually led to catastrophic losses for investors.

Background: To Accurately Predict Lifespan, Life Settlement Providers Obtain Life Expectancy Reports From Specialized Life Expectancy (“LE”) Data Vendors, Which Are Typically Independent Third-Parties

Such LE Data Providers Can Backtest Their Track Record Through “Actual To Expected” Ratios, Which Measure How Many Policies “Matured” Relative To How Many The LE Vendor Predicted Would Mature

To mitigate this risk, life settlements providers purchase “LE reports” from independent third-party vendors, known as life expectancy providers. Life settlement providers often use multiple reports from multiple vendors to try to get as accurate of an LE estimate as possible.[1]

One industry expert told us:

“If you're pricing a $5 million policy, they're not going to rely on one LE report. They're going to get two and three, and they're going to take an average of those.”

Another industry expert said that many providers and investors will not only order multiple LE reports, but they will price policies based on internal underwriting that often includes using contracted medical doctors.

“So as a way for providers and investors to protect themselves, they began to order their own life expectancies or have their own what we call internal underwriting. So they do an internal LE, right? They have doctors that they trust.

They will consider the third party life expectancies that are sent to them, but they have people that are going to ultimately give them the ultimate number that they are going to price on.”

One example of an LE provider is Fasano, a company that sells LE reports to life settlement investors who are trying to gauge how long an insured individual might live.

While no one can predict exactly when any given individual will die, LE providers like Fasano try to be right on an average basis, often measuring their accuracy at the portfolio level through an industry metric known as the “Actual to Expected” ratio, or “A to E Ratio.”

Based on a 10-year analysis of LE reports conducted in 2020, Fasano boasts a near perfect track record on an average basis. Academic research by Professor Bauer and others in 2020 found that Fasano had little evidence of systematic bias in its LE estimates. [1, 2]

Like the rest of the industry, Abacus relies on life expectancy as one of the key inputs in its “proprietary risk rating heat map” – which drives the company’s underwriting processes. As mentioned, Abacus’ valuation model relies on a discounted cash flow analysis, of which the only positive cash flow is directly linked to life expectancy.

Despite the vital importance of accurate LE estimates, Abacus discloses little about its process for calculating or sourcing LE estimates.

Abacus Has An Intimate Relationship With An “AI” Powered Life Expectancy Provider Called Lapetus Solutions, Including A $1 Million Investment In Lapetus

Industry Peers Called Abacus’ Ownership Interest In Lapetus “Illegal” Or “A Loophole,” Based On Florida Insurance Regulations That Prohibit Conflicts Of Interest

Abacus CEO Jackson Was Previously A Director Of Lapetus And Co-Authored A Book With Lapetus’ Co-Founder, While Abacus Director Mary Beth Schulte Previously Served As Lapetus’ CFO

Abacus discloses little about how it calculates life expectancy – the most critical input in the underwriting and valuation process.

In its 2023 annual report, Abacus disclosed a partnership with Lapetus called Lapetus Life Event Solutions which was designed “to build and develop current life expectancy tables.” Left undisclosed, however, was Abacus’ use of LE reports from Lapetus.

Lapetus was founded in 2015 and describes itself as “an AI-driven technology company” disrupting financial planning with its “life expectancy calculations,” per its Linkedin and website.

While Abacus disclosed a partnership with the AI startup, it failed to fully disclose the true nature of the Lapetus relationship until the SEC explicitly requested more information in a publicly-available comment letter, dated November 1, 2024.

“We also note your disclosure on page 7 of your Annual Report describing your partnership with Lapetus Solutions, Inc. ("Lapetus"). Please tell us whether Abacus or any of its officers, directors or other affiliates, have an ownership interest or credit relationship in Lapetus or its subsidiaries or other affiliates.

Please provide a detailed explanation of any relationship and disclose the extent to which you have relied upon Lapetus or any of its co-owned entities for valuation of life insurance policies …”

In response, Abacus disclosed that not only does it purchase life expectancy reports from Lapetus, but it also has a $1 million investment in the company.[1]

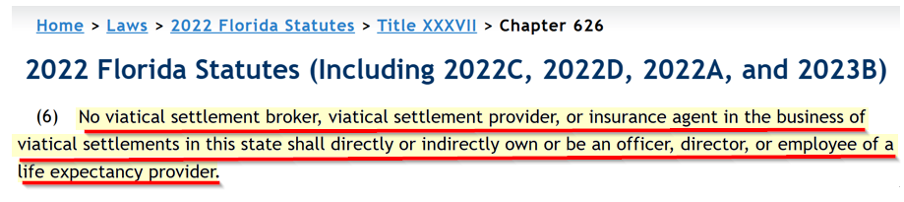

Abacus’ initial hesitancy to fully disclose the Lapetus investment may have been due to Florida’s prohibition against direct or indirect ownership of a life expectancy provider by a life settlements provider, due to the inherent conflict of interest it presents.

We asked employees at two different LE providers what they thought about a life settlements provider like Abacus investing in a LE provider like Lapetus. One told us that they believed the investment was "illegal."

“They've got a convertible preferred, you know, which is again illegal, but it's, you know, somehow happening.” — LE provider Employee 1

The other told us that the investment was some sort of "loophole."

“[Abacus is] using Lapetus. And they made an investment in Lapetus through a convertible security, which is public information. And technically, that's prohibited under the Florida statutes that govern our business. Florida is one of two states that regulates life expectancy underwriters.

But the state of Florida was contacted by all the other underwriters to say, a provider or a company that owns a provider should not invest in a life expectancy underwriting firm. But they found a loophole.” — LE provider Employee 2

Abacus’ response to the SEC also acknowledged that CEO Jackson previously held a director role with Lapetus – a fact that was previously undisclosed to shareholders.[1]

As of March 2024, Jackson was still a director of Lapetus, according to Lapetus’ 2024 annual return filed in Florida. A May 2024 amendment to its 2024 annual report, however, did not list Jackson as director of Lapetus. ↩︎

In its response to the SEC, Abacus also failed to disclose that Mary Beth Schulte, a member of its board of directors and the chair of its audit committee, also previously served as Lapetus’ CFO and may still be an investor in the company, according to The Deal.

“Sharon Schloss is the new CFO of Lapetus Solutions … Schloss replaced Beth Schulte, who took a job elsewhere. However, Schulte remains involved in Lapetus as an investor, chief scientist and co-founder Jay Olshansky said in an email.”

Schulte’s time with Lapetus is omitted from her biography in Abacus’ proxy statement.

Lastly, further solidifying the intimate connection between Lapetus and Abacus, the company states that CEO Jackson co-authored a book called “Pursuing Wealthspan” with Lapetus co-founder, Dr. Jay Olshansky, which was published in 2020.

Abacus Told The SEC That Lapetus Provided Life Expectancy Reports But That Their Use In Its Valuation Process Is “Limited And Immaterial”

Former Abacus Employee #1: “I’m Genuinely Shocked To Hear That. They Built Lapetus LEs Into The Pricing Tool … I’m Floored … It’s, To My Knowledge, Completely False. They Were Very Reliant On Lapetus”

Former Abacus Employee #2: “ … [Abacus] Would Just Take What Lapetus Says And Buy Based On Just That. They Would Not Gather The Other Life Expectancy Info”

When the SEC requested more information about Abacus’ relationship with Lapetus in November 2024, Abacus admitted that it uses Lapetus for life expectancy reports but said it does not rely “solely or even materially” on the reports, and even said that the use of Lapetus for determining the value of its policies was “immaterial to the Company’s overall valuation process.”

Contrary to Abacus’ disclosures to the SEC, multiple industry experts, including two former Abacus employees, told us that Abacus relies heavily on Lapetus LEs, which, as mentioned, serve as the primary input for determining the value of a life settlement policy. One former Abacus employee said:

“I'm genuinely shocked to hear that. They built Lapetus LEs into the pricing tool, the proprietary pricing tool that Abacus made. So I'm floored that they would say that it has no material bearing on that. That's crazy… It's, to my knowledge, completely false. They were very reliant on Lapetus.”

“I don't want to accuse them of lying. They might have changed up how they're doing things. I don't know, but when I was there, we just call them “Lappies.” It was, oh, Lappy this, Lappy that. Everything pretty much got a Lapetus report.”

A second former Abacus employee told us:

“That's what I meant by Lapetus only, meaning [Abacus] would take just what Lapetus says and buy based on just that. They would not gather the other life expectancy info… They would buy just based on that Lapetus [LE] number…”

In addition to the 2 former Abacus employees, a multitude of industry experts confirmed that Abacus is the primary buyer of Lapetus LE reports. An industry consultant with knowledge of Lapetus’ operations told us:

“It is a strong partnership [with Abacus]. And when they say they don't rely on it, that doesn't mean they don't order it for every policy they do.”

Another industry expert told us they believe Abacus was Lapetus’ largest client.

“I believe Abacus is the largest client today.”

A European fund manager, who had done detailed analyses of life settlement transactions, told us:

“Abacus is linked with Lapetus. They are working together. So we assume most, if not all of these [Abacus] policies, come with Lapetus LEs.”

A leader at a life settlements broker told us that Lapetus is Abacus’ main life expectancy provider:

“Take for instance, I said Abacus. Their main life expectancy provider is Lapetus.”

Another life settlements broker confirmed that when Abacus buys life settlements policies from brokers, they will specifically accept Lapetus LEs for valuation purposes.

“I know that Abacus, [Lapetus] was on their list that they'll accept, that they sent me just like two weeks ago.”

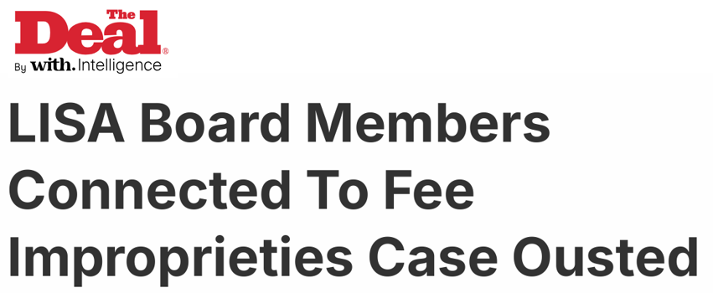

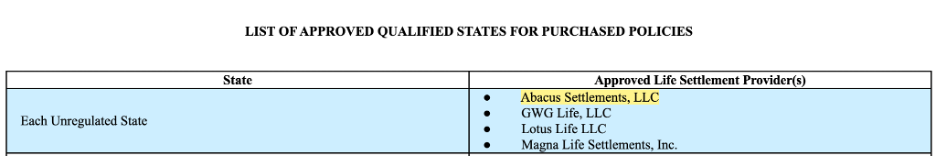

Abacus Chose Lapetus As Its “Primary Life Expectancy Provider” For A Fund It Is Launching In The U.S., According To The Fund Registration Statement

ABL Longevity Growth & Income Fund is a closed-end fund sponsored and managed by Abacus, looking to invest in life settlements.[1]

The ABL Longevity Growth & Income fund manager is ABL Wealth Advisors, LLC, according to the fund’s registration statement. ABL Wealth Advisors is a subsidiary of Abacus. ↩︎

Abacus chose Lapetus as its “primary life expectancy provider,” for the fund according to the fund registration statement.

On the fund registration statement, Abacus acknowledges that life expectancy is “one of the most critical factors for accurate valuation of a Mortality Contract.”

Unlike its own balance sheet, where Abacus claims that Lapetus life expectancy reports are “limited and immaterial” to its valuation methodology, the fund’s registration statement says that Abacus, as manager, would use Lapetus life expectancy reports as the primary source “for the valuation of fund assets.”

Check Appendix A for more details on this fund.

Abacus Claim: Lapetus Provides The “Best And Most Conservative” Life Expectancy Estimates

Reality Check: In July 2024, Coventry Released A Peer-Reviewed Study Showing That Lapetus’ Life Expectancies Were The “Shortest By A Wide Margin” And That “Valuations Based On Lapetus [LEs] Could Lead To Significantly Inflated Asset Values”

Coventry Claimed That Lapetus’ LE Estimates Were 29 Months Shorter On Average Than The Next Shortest LE Report Provider

Abacus claims that Lapetus provides “the best and most conservative information to value Mortality Contracts”, but industry experts, including Abacus’ largest competitor, disagree. In 2024 and 2025, Abacus’ largest competitor, Coventry, put out a series of press releases evidencing allegedly flawed underwriting from Lapetus.

In May 2024, Coventry published a press release stating that it had conducted an internal review of Lapetus’ life expectancy reports, which it said were “consistently and materially shorter than those issued by other [LE] providers.”

The Coventry report found that 85% of Lapetus life expectancy estimates were shorter than other LE providers. On average, Lapetus estimates were 29 months shorter when compared with other LE providers.

While the initial study did not name Abacus, an industry expert told us that Coventry’s criticisms of Lapetus were a veiled critique of Abacus’ valuation model.

“So, we’ll talk freely here … This is aimed at Abacus.”

In July 2024, Coventry published a press release stating that its earlier analysis had undergone an “independent, academic peer review” that confirmed that Lapetus’ life expectancy reports were “consistently the shortest by a wide margin – meaning the valuations based on Lapetus [LEs] could lead to significantly inflated asset values and investor losses.”

The peer review was conducted by professors Daniel Bauer and Nan Zhu, as part of a consultancy project for Coventry.

We asked industry experts about the lead author Professor Bauer’s credentials and credibility. As one employee at an LE provider told us:

“Dani’s been studying this industry as an academic actuary for many years. I know him. He's very smart. And if his analysis says that that's the number, I can assure you the math is correct. I can't tell you that there isn't some bias in there right, or some tweaking by the client. But Dani Bauer is good at what he does. He does know the business.”

A European life settlements fund manager told us: “Professor Bauer is really an honest man.”

At A December 2024 Industry Conference, Coventry’s Chairman Stated On Stage That If He Valued Coventry’s Portfolio Using Lapetus LEs, He Would Book A 60% Fair Value Gain, Which He Said Would Be “Grossly Overstated” Due To Lapetus’ Extremely Short LE Estimates

He Compared The Use Of Lapetus To Mutual Benefits Corporation, A Billion Dollar Life Settlements Fraud That Collapsed In 2004 Due To Understated Life Expectancies

At a Life Insurance Settlements Industry (“LISA”) conference in December 2024, Coventry’s Chairman, Alan Buerger and Co-Founder of Lapetus, Jay Olshansky shared the stage for a panel discussion about life expectancy reports and methodologies.

Buerger reiterated the conclusions from Coventry’s earlier studies, and said that Lapetus LEs can result in “grossly overstated” valuations for a life settlements portfolio – citing Coventry’s own portfolio as an example:

“Using Lapetus, instead of the next shortest life expectancies, the average at 12% [discount rate], we’d get an increased fair market value of over 60% more… that fair market value is grossly overstated.” (Coventry Chairman at Lisa Conference 2024)

When asked about Abacus directly, Buerger said it would not be appropriate for him to comment on a competitor, but he did predict dire consequences for anyone using Lapetus LE data to value their portfolio, stating:

“I believe $250 million dollars out there that investors have put up is dead. And I worry that it's going to be 300 [million], 400 [million], and 600 [million] and $1 billion dollars. With Mutual Benefits, it was $800 million… It's going to be awful for us. All of us. The longer it takes and the bigger it gets, the worse it will be.” (Coventry Chairman at LISA Conference 2024)

Despite Buerger’s initial coyness at not wanting to “comment on a competitor,” this statement appears to have been aimed squarely at Abacus, which he seems to have likened to Mutual Benefits Corporation, an infamous life settlements fraud that claimed $250 million of investor capital in the early 2000s.

It appears that understated life expectancies were a key driver of the Mutual Benefits collapse, as 90% of its cases surpassed life expectancy estimates, per the SEC’s complaint. [Pg. 13]

In February 2025, Coventry Announced A “Comprehensive New Study” From Professors Bauer And Zhu Showing That Lapetus “Significantly Understates The Actual Life Expectancies Of The Insureds”

Based On An Analysis Of 4,378 LE Reports, The Study Concluded That Lapetus Had An “Alarmingly Low 31% A/E Ratio”

Coventry Stated: “Funds And Companies Like Abacus That Rely On Lapetus To Provide [LEs] For Their Policy Valuations Could Soon Face Growing Challenges With Serious Consequences For Investors”

In February 2025, Coventry released its third and final press release on the matter, announcing that Professors Bauer and Zhu had completed a “comprehensive new study” showing that Lapetus “significantly understates the actual life expectancies of the insureds.”

In the final second study, Professors Bauer and Zhu calculated Lapetus’ A/E Ratio – one metric used to measure the accuracy of a life expectancy report provider in a given time period. In a perfect underwriting scenario, this ratio would be 100%, meaning estimated deaths were equal to actual deaths at a given point in time.

The study analyzed 4,378 LE reports from Lapetus and concluded that Lapetus’ LE methodology resulted in an “alarmingly low 31% A/E Ratio.”

“Based on Lapetus’s life expectancies, the study calculated that there should have been 648 deaths in the relevant period. However, the actual number of reported deaths was just 203, resulting in the alarmingly low 31% A/E Ratio.”

Coventry’s third and final press release stated that Abacus’ use of Lapetus could have “serious consequences for investors and the broader life settlement industry.”

In March 2025, Coventry Filed A Petition With The Florida Insurance Regulator To Release Lapetus’ Audited A/E Ratios To The Public

The Petition Stated That Lapetus LEs Are “Chronically Short” And That Lapetus Has A “Unique Relationship With Abacus” Which Uses “Lapetus As Their Preferred [LE] Provider”

An Industry Expert Told Us That If Lapetus’ A/E Ratio Is Released, It Will “Blow Them [Lapetus] Out Of The Water … They’d Be Done”

As mentioned, Coventry claims that based on its analysis of ~4,378 LE reports, Lapetus’ A/E ratio is 31%, “alarmingly low” relative to competitors like Fasano that report a figure closer to 100%.

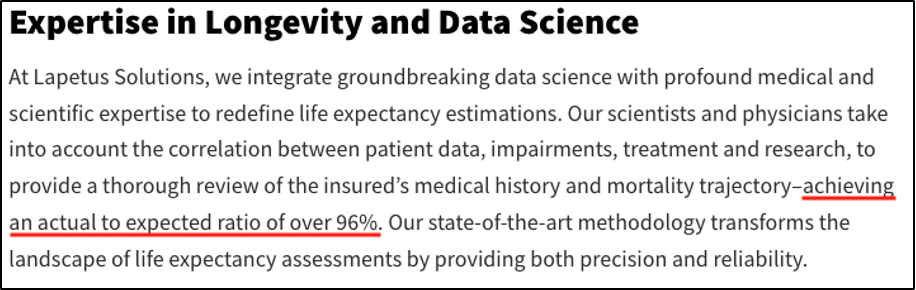

Lapetus, however, claims on its website to have an A/E ratio of 96%.

According to Florida regulations, registered life expectancy providers such as Lapetus must submit triennial audits to the state insurance regulator, including its “actual-to-expected ratio of life expectancies.”

On March 21, 2025, Coventry filed a petition in Florida courts seeking access to Lapetus’ audit of its A/E ratio. The petition states:

“The Life Expectancy provider that has distorted the entire market is LAPETUS, whose Life Expectancies have substantial influence on the market through, among other things, LAPETUS’ unique relationship with Abacus Global, a group of life settlement companies which use LAPETUS as their preferred Life Expectancy provider.” [Pg. 7]

Despite disclosing its claimed A/E ratio on its website, Lapetus promptly sued the Florida Insurance regulator to prevent disclosure of the audited ratio submitted to the state, citing confidentiality of trade secrets, per its complaint. [Pgs. 1-2]

Litigation is ongoing, with the next hearing in the case scheduled for July 14, 2025.[1]

We interviewed an expert in LE estimates, who had analyzed Coventry’s study and the work of the academics that Coventry hired, including Professor Bauer. The expert told us that if Lapetus’ actual A/E ratio is disclosed, it would “blow [Lapetus] out of the water.”

“He [Dani Bauer] calculated an A/E ratio of 31% for Lapetus, and that would totally blow them [Lapetus] out of the water. If they would ever release that figure officially, they'd be done.”

This is not Coventry’s first time calling out a competitor for the use of short life expectancies to artificially inflate returns.

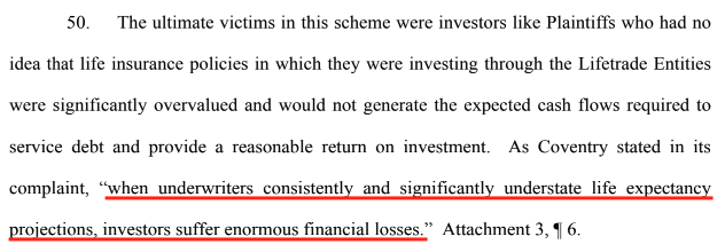

In 2004, Coventry “accurately predicted” that investors in a life settlements fund called Lifetrade would “suffer large losses” due to Lifetrade’s use of “understated life expectancy projections,” per litigation that occurred after Lifetrade’s collapse in 2012— more on Lifetrade below. [Pg. 18]

Multiple Industry Leaders We Interviewed, Including Former Abacus Employees, Said That Lapetus’ LE Estimates Are “Worryingly” Shorter Than Other LE Report Providers, And That The Company Is Referred To As “Laugh-At-Us” By Industry Peers, Leading Many Investors To No Longer Accept Lapetus Data

Former Abacus Employee #1: “Lapetus Tends To Be The Odd Man Out Where They Were, You Know, 5, 6, 7, 8 Years Shorter Than Everybody Else, Which Is I Think Why They Kind Of Raised Some Eyebrows”

Industry Expert: “If Anyone Tells You That You Should Be Buying Off A Lapetus LE, Lose Their Phone Number, Block Their Emails and Run a Million Miles Away … It's Bullshit. It Is Terrible, Terrible Advice. They [Lapetus] Are The Shortest In The Market.”

During our research, numerous industry experts we interviewed agreed that Lapetus is consistently and significantly shorter on LE data than other providers.

“Lapetus... they were worryingly short.” - Life Settlements Fund Manager

A former Abacus employee told us that Lapetus is the “odd man out” and that its LE estimates tend to be 5 to 8 years shorter than other providers.

“I would say by and large, most of these [LE] companies are coming in within a year or two of each other. So even if you average it out, it's not making a monumental difference. Lapetus tends to be the odd man out where they were, you know, 5, 6, 7, 8 years shorter than everybody else, which is I think why they kind of raised some eyebrows.”

The former employee described Lapetus’ LE reports as the “shortest” you can possibly get.

“Yeah, and that's basically Coventry's complaint against Lapetus. Lapetus was known and is still known as the shortest LE you can possibly get…”

An industry expert that regularly advises funds in the US and Europe warned us more frankly:

“If anyone tells you that you should be buying off a Lapetus LE, lose their phone number, block their emails and run a million miles away… It's bullshit. It is terrible, terrible advice. They [Lapetus] are the shortest in the market.”

The Alleged Misvaluation Of Policies Also Presents An Existential Risk To Abacus’ Ability To Generate Cash By Selling Overvalued Lapetus-Priced Policies To Third Party Investors Who Are Becoming Increasingly Aware Of The Issue

Industry Expert: “Abacus Is Out There With Lapetus Selling Vegas Flash”

Former Abacus Employee: “We Had Plenty Of Funds Who Said They Would Not Buy Off Of Lapetus … Because It Was Just So Wildly Off”

As discussed, most of Abacus’ revenue is non-cash and generated through fair value mark-ups to its “held” life settlements portfolio. Its primary source of actual cashflow is the realized gains generated from either maturing policies or the sale of policies to third party investors.

In Q1 2025, Abacus reported ~$13.8 million in net realized gains from the sale of settlements to third parties.[1]

We believe Abacus’ ability to sell policies that have been valued with Lapetus life expectancy data is rapidly diminishing in the marketplace, presenting an existential and immediate threat to the company’s ability to generate cashflow.

An industry veteran and former employee of notable industry blow-up GWG Holdings told us that Abacus’ use of Lapetus to value its policies is akin to selling “Vegas flash.”

“Abacus is publicly traded... once you go public... the quarter by quarter is driving you. You need numbers. You need growth … That’s the stuff that always blows up the life settlement guys, when they're pressured to move.... And so that pressure goes in the direction of ‘where can I find the shortest LEs?’ … Abacus is out there with Lapetus selling Vegas Flash.”

While this strategy appears to have worked for Abacus so far, the concerns about Lapetus appear to be spreading through the industry. We believe they will significantly inhibit Abacus’ ability to generate cash by selling policies that are, or are perceived to be, overvalued based on Lapetus LE data. This was confirmed to us by an industry expert, who said with respect to the presentation with Coventry and Lapetus:

“The knee jerk reaction from a lot of the investors and funds that I work with that are buying policies, after that, their reaction was, ‘I’m not going to, you know what, I think I need a time out, don’t send me any cases with Lapetus on them right now’… that was an outcome. There has been some, I would say slowdown in, you know, people accepting Lapetus.”

A former Abacus employee told us that “many” funds do not accept policies valued on Lapetus LEs. A second former Abacus employee told us that “plenty” of funds have stopped accepting policies valued with Lapetus LE reports because they are “so wildly off.”

“So, we had plenty of funds who said they would not buy off of Lapetus. At all. They wouldn't look at it. They wouldn't consider it, because it was just so wildly off.”

Our interviews with numerous industry experts confirmed that investors are increasingly hesitant to buy policies that have been valued on Lapetus LEs. An employee at an LE provider told us:

“So Lapetus is funded by a small venture group and they are perceived to be the shortest, but they are not acceptable to the entire market.”

The employee explained that Lapetus’ data is an open joke amongst industry insiders, including their use of mortality tables that are not representative of the population they are underwriting.[1]

Lapetus uses mortality tables from the Social Security Administration, according to a deleted version of its website from June 2024. Social Security tables represent the entire U.S. population. Typically, owners of life insurance policies are wealthier and have better access to healthcare, resulting in longer lifespans than the average population. ↩︎

“And it's somewhat unfair, but they call them, laugh-at-us, l-a-u-g-h, because they use population tables to calculate their LEs and we are underwriting a selected population, that is, people who were insurable at older age for large face amounts, for the most part, and we do not believe — all the other underwriters do not use population mortality tables to determine LE …

And this is public information because [Lapetus’] life expectancies are so much shorter, that a lot of the institutional investors will not accept [their] work product.”

Several other industry experts confirmed that Lapetus is increasingly unacceptable as a valuation input for life settlement funds.

“Two weeks ago, we had a portfolio on our desks, and there [was] a lot of Lapetus in there, and we basically communicated back, ‘we don't accept Lapetus.’ That's it.” - Director at Life Settlements Fund

“But Lapetus nobody actually uses. They’re very good on very old people and very bad on everything else … it’s not even short. It’s just wrong …on everything outside of the 90 plus cohort. Nobody can figure it out.” - Life Settlements Provider

“I do hear that [from market participants], you know, we don't consider Lapetus a legitimate source.” - Life Settlements Industry Consultant

Abacus’ Reliance On Lapetus Presents A Material Risk To The “Unrealized Gains” Generated From Valuation Mark-Ups On Its Held Portfolio – Presenting An Estimated Writedown Risk Of At Least 35 - 50%

Industry Expert: “The Indicative Value On A Lapetus LE Is 50% Higher Than With The Other LE Providers … [Abacus] Had $100 Million In Policies That Were Probably Worth About $60 Million”

Abacus’ reliance on Lapetus LE data to value its portfolio presents a material risk to its “held” portfolio, which could be turned “upside down” if the policies take longer to mature than anticipated, per an industry expert who said:

“Because if we find out ten years down the road that Lapetus was far, far too short and people were living three and four years longer, their [Abacus’] portfolio is going to be turned upside down.”

Abacus last disclosed a weighted average life expectancy of 66.5 months for its held portfolio of policies.[1]

The disclosure was made in its Q3 2024 investor presentation citing data as of December 2023. ↩︎

As mentioned, Professors Bauer’s and Zhu’s analysis, found that Lapetus LE were 31 months shorter than other LE providers. [Pg. 3]

Based on this data, we estimate that Abacus’ $446 million portfolio could face a write down risk of at least 35%.[1]

We assumed that the fair value is equal to the present value of the cash flows associated with the life settlement policies. Using Abacus’ previously disclosed average life expectancy, we determine a single future cash flow occurring in 66.5 months and then deferred it by an additional 31 months. We then discounted that cash flow back to present value. We used 18% as the discount rate for our calculations. ↩︎

A write down of this magnitude would represent 97% of the total revenue that Abacus generated throughout all of 2023 and 2024.

An industry expert familiar with LE estimates said that Abacus’ “book” could be overvalued by as much as 50% due to calculating valuations on Lapetus LEs versus other LE providers.

“The indicative value on a Lapetus LE is 50% higher than with the other LE providers … [Abacus] had $100 million in policies that were probably worth about $60 million.”

In Addition To Understating LEs With Lapetus Data, Abacus Has A Second Lever To Manufacture Artificial Gains That Was Infamously Used By Previous Life Settlements Blowups: Lowering The Discount Rate For Its Valuation Model

During Its Q1 2025 Earnings Call, Abacus Boasted About A “Record Quarter,” Citing Its “More Than Doubled” Adjusted EBITDA

Abacus Failed To Mention That Adjusted EBITDA Would Have Been Negative Without Changes To Its Discount Rate Which Went From 20% To 18%, Resulting In $28.4 Million In Unrealized Non-Cash Revenue

As evidenced by notorious life settlement fund blow-ups like GWG, Mutual Benefits, and Life Partners, which are detailed in Part 4, there are two primary levers to artificially inflate the fair value of a portfolio. The first, as discussed above, is understating life expectancy. The second is lowering the discount rate used to calculate the fair value of a portfolio.

During Q1 2025, Abacus quietly lowered its discount rate from 20% to 18%, triggering a “fair value” non-cash unrealized gain of approximately $28.4 million, driving all of Abacus’ unrealized gains for the period.[1]

Abacus has not disclosed the exact amount of unrealized gains due to changes in its discount rate. Nevertheless, at the end of Q1 2025, Abacus’ portfolio would have experienced a $28.4 million fair value loss by increasing its discount rate by 2%, according to a sensitivity analysis provided by the company in its financial statements. Therefore, this allows us to approximate the amount of the unrealized gains due to changes in the discount rate. ↩︎

On Abacus’ Q1 2025 earnings call, CEO Jackson described the results as a “record quarter,” citing the “more than doubling” adjusted EBITDA:

“We are pleased to kick off the New Year with a record first quarter of profitable growth while continuing to execute our strategic initiatives to scale and diversify our business. For the first quarter of 2025, we more than doubled total revenue year-over-year to $44.1 million and recorded strong adjusted earnings, more than doubling adjusted net income to $17.3 million and adjusted EBITDA to $24.5 million year-over-year.”

Jackson failed to mention, however, that 61% of Q1 2025 revenue was non-cash and driven by changing a singular input to its valuation methodology – the discount rate. In other words, without the changed discount rate, Abacus would have been loss-making.

While Abacus did not comment on the change and not a single analyst asked about it on the call, industry publication The Deal reported:

“Abacus has again revised its discount rate, measuring the value of its life settlement policies. Abacus said it used a blended average rate of 18% for policy valuations for the first quarter, compared to a 20% discount rate as of Dec. 31…

’I was surprised there was no reference or explanation to the reduction in the discount rate from 20% to 18%,’ a market player, who asked not to be named, said in an email. ‘Neither Abacus nor analysts’ questions made reference to it.”

The tactic of continuously lowering the discount rate may be a sign that Abacus has exhausted its ability to manufacture gains by using unrealistically low life expectancy rates. Instead, by continuously lowering the discount rate, it can continue to inflate revenue through non-cash, unrealized valuation gains.

This tactic was confirmed by an executive at a competing life settlements provider, who recalled that GWG engaged in the same tactic shortly before it collapsed.

“The big thing that you saw with GWG, where they were getting in trouble was that they weren't getting the performance they were needing. So they were just marking the discount rate further and further down. So, instead of it being enough starting at 11[%], it was 10.65[%], then 10.58[%].

They would mark it all the way down until they were sitting right above where their debt was. And you knew they were screwed at that point in time. So, there are things that they can do, and you see this in the guys that are public, it's easy to see when they're pulling strings one way or the other, and if they're struggling or if they're not struggling.”

Part 3 – Carlisle Asset Management: How Abacus Tapped An Old Friend With A History Of Fund Blowups And Investor Lawsuits To Help Unwind Its Overvalued Portfolio

On July 18, 2024, Abacus announced that it would acquire Carlisle Management Company SCA, which it described as a “leading Luxembourg-based investment manager in the life settlement space,” with approximately $2 billion in AUM, per a press release.

The Carlisle acquisition was a major deal for Abacus. At the time the acquisition was announced, the purchase price offered for Carlisle represented 78% of Abacus’ total equity.

Carlisle was founded by its Chief Executive Officer, Jose Garcia.[1]

It is unclear when Carlisle was founded. Garcia’s LinkedIn profile says it was founded in 2002, while he was working at Vespers, as described below. On the other hand, corporate records show that Carlisle Management Company SCA was established in January 2009. ↩︎

Fundamentals: Abacus Paid An Exorbitant 36 Times Earnings For A Business With Declining Profitability

The Carlisle acquisition was completed on December 2, 2024 at a purchase price of $145.7 million.[1]

The transaction was settled by issuing a $72.7 million note and $73 million worth of shares to the sellers. Abacus’ original press release on the Carlisle acquisition said that they would acquire Carlisle Management Company S.C.A. for “approximately $200 million.” When the transaction closed, Abacus acquired 2 entities: Carlisle Management Company S.C.A. and Carlisle Investment Group S.A.R.L. ↩︎

The final purchase price valued Carlisle at an exorbitant 36x 2024 net income, a 3x premium to global asset management peers we reviewed.

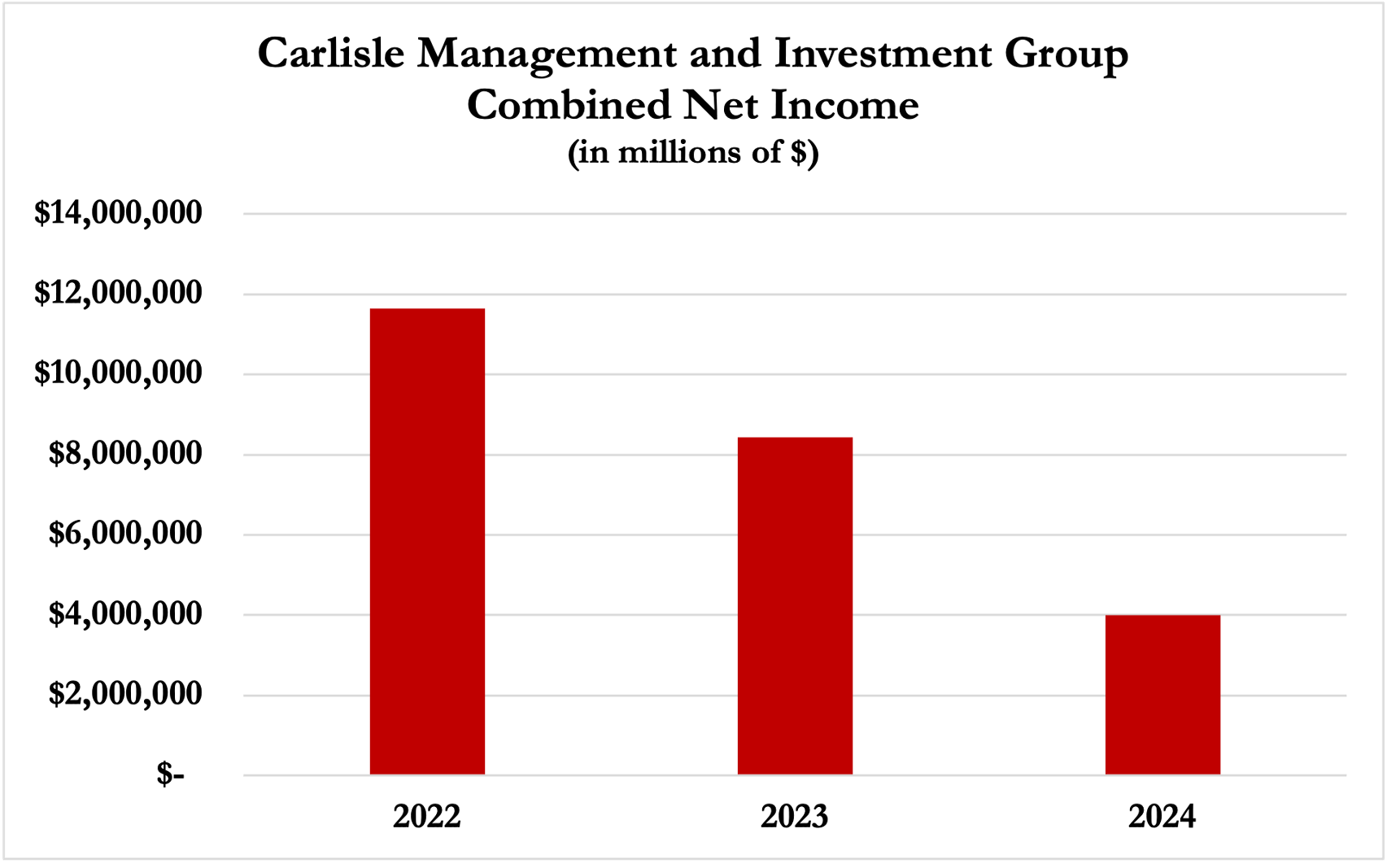

Over the last 3 years, Carlisle’s profitability has halved from $11.6 million in 2022 to $4 million in 2024, per its annual reports.[1]

Abacus Failed To Mention That Its Founders Have Known Garcia For 20 Years, Ever Since He Worked For A Life Settlement Broker Called “Vespers”

Garcia Was Fired From Vespers After He Allegedly Came To Work Under The Influence Of “Cocaine, Or A Similar Drug,” And Used $200,000 Of Company Cash For “Personal” Expenses, Including Hiring Exotic Dancers And Prostitutes

Carlisle founder Jose Garcia began his career in the life settlement industry in 2001 when he joined a life settlement broker called Vespers.[1]

He was promoted to Vice President in 2003, according to subsequent litigation between Garcia and Vespers. [Pg. 2]

In 2005, Garcia was fired based on multiple allegations, including that he “began abusing cocaine, or a similar drug, even coming to work under its influence,” according to a counterclaim filed by Vespers against Garcia in 2005. [Pg. 43]

Vespers also alleged that Garcia violated his non-compete agreement, and spent “at least” $200,000 of company cash for “personal” interests, including exotic dancers and prostitutes, for himself and his friends. [Pgs. 42, 46, 50-51]

The litigation between Garcia and Vespers reveals that Garcia’s relationship with Abacus’ founders goes back much further than the Carlisle acquisition.

According to Garcia’s deposition in his countersuit against Vespers, he was “friends” with the founders of Advanced Settlements and its owners, Kirby and Ganovsky, as early as 2005. [Pg. 62]

The allegations seem to explain why Garcia decided to omit his almost 4-year tenure at Vespers from his LinkedIn profile.

On Abacus’ Q2 2024 earnings call, CEO Jay Jackson said that Carlisle was a “a great culture fit” for Abacus.

Abacus Described Carlisle’s Track Record As A Life Settlements Fund Manager As “Unmatched” And “The Strongest And Most Enduring” In The Industry

Reality Check: Garcia And Carlisle Have A 20-Year Track Record Of Blowing Up Investment Funds And Incinerating Investor Cash While Raking In Fees

In July 2024, when Abacus announced the acquisition of Carlisle, CEO Jackson said, “Carlisle has the strongest and most enduring track record as a fund manager within the life settlement industry.”

During the company’s Q4 2024 earnings call, Jackson reiterated that Carlisle’s “track record as a fund manager within the life settlement industry is unmatched.”

Despite Jackson’s claims, our research indicates that Garcia has been a serial incinerator of investor cash during a span of over 20 years.

Fund Blowup # 1 — In 2003, Garcia Played A Key Role Selling Life Settlement Policies To The LifeTrade Funds, According To The Former Chairman Of The Fund

LifeTrade Lost All Of Investors Capital After It Acquired “Significant Overvalued” Policies With “Fraudulent” LE Evaluations, According To A Complaint Filed By The Fund’s Investors

In 2003, Garcia played a pivotal role in setting up The LifeTrade Fund B.V., an “offshore life settlement fund,” according to The Deal. Beyond helping to set up the fund, Garcia raised hundreds of millions in capital for the fund, and also helped it acquire its life settlements assets, according to The Deal.[1]